Grayscale’s crypto assets drop by $3.7 billion in single day as Bitcoin falls

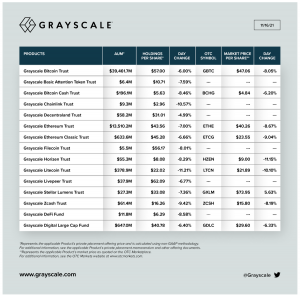

Grayscale Investments, a subsidiary of Barry Silbert’s Digital Currency Group, announced Tuesday that the firm’s total assets under management were $55.1 billion. That is $5 billion less than a week before when the New York-based crypto-fund manager held a staggering $60.8 billion in cryptocurrencies for the first time.

According to a recent Grayscale tweet, the amount of crypto assets under its management totaled $58.8 billion on Monday.

The 9% fall in Barry Silbert-affiliated crypto hedge fund’s holdings comes as Bitcoin dropped back below $60,000, a pronounced drop from the high it set earlier this month when it went over $68,000.

While nothing is certain about the recent fall in BTC prices, but it seems President Joe Biden’s new legislation could impact the tax ramifications for crypto investors.

Grayscale’s assets valuation is mostly dominated by its flagship product, Grayscale Bitcoin Trust (GBTC), which ballooned to $43 billion on November 11. The Bitcoin product now counts less than $40 billion, a massive drop caused by Bitcoin’s major correction.

At the time of writing, Bitcoin trades at $59,636 on Coinmarketcap. Additionally, the market capitalization of BTC has dropped from $1.27 trillion on November 8 to $1.13 billion at the time of this report. By comparison, Grayscale’s stock price was trading at $47.07 on Tuesday, down 8 percent today. This means the fund’s public shares had fallen more than bitcoin itself over the day.

Yet the company seems unconcerned about the recent drop. Its executives argued previously that they see any price fall a good buying opportunity and predict that the price will continue to pull higher.

Investments into the company’s Ethereum Trust hit a record $14.8 billion in total investments last week. But the ether product saw outflows of more than $1.3 billion since then.

Grayscale maintains positions in nearly 15 crypto assets. The company’s publicly-traded funds offer institutional investors the opportunity to trade crypto on the stock market, with most of the funds poured into the Grayscale Bitcoin Trust. Besides institutional investors, which accounted for 90 percent of the total investment in the third quarter, Grayscale said accredited individuals, retirement accounts and family offices increased their involvement.

The firm has filed to convert the world’s biggest Bitcoin fund into an ETF, although the Securities and Exchange Commission (SEC) has yet to greenlight any spot bitcoin exchange-traded fund to date.