Then or now? We look at where and when professional FX traders earn the highest salaries – Op Ed

How much will traders earn in 2016? How much did they earn during the 1980s boom times? We take a close look at the salaries of FX and derivatives traders, and we don’t lament the passing of red braces, filofaxes and outlandish hair styles.

It has been widely accepted ever since the belt-and-braces days of the 1980s when pinstripe shirts and filofax-toting young upwardly mobile professionals adorned the streets of Wall Street and the Square Mile.

London and New York have maintained their top slot as global financial centers ever since joining a trading desk within a large bank became a desirable career choice for energetic young interns qualifying from two years at Goldman Sachs or Citigroup, both cities having spent several years at the top with the enviable accolade of being the world’s largest financial centers.

Today it is London, a few years ago it was New York, and prior to that, London, and so the cycle continues.

The snakeskin shoes and shoulder pads which are accouterments of a time during which vulgarity was as visual as it was aural, the opencry trading pits jam packed with under-25 year old Ferrari driving upstarts contorting their faces and shouting buy and sell commands via a gigantic hearing-aid beige Motorola cellphone stuck like superglue to each ear.

Bonuses exceeded £1 million among London’s bank desk employees and sometimes even more in the trading pits of Leadenhall Street and London Wall.

That was a lot of money in 1985 when a house that now costs £700,000 was £50,000.

Both of the financial districts of the world’s fiscal powerhouses – Wall Street and the Square Mile, are today plate glass centers of technological refinement.

Opencry shouting has given way to ultra-low latency connectivity. The ‘market trader’ origins have subsided and today’s professionals are urbane, sophisticated, often private school educated prodigies with a full understanding of how electronically delivered liquidity powers global markets from Hong Kong to New York and Singapore to London, being able to eloquently explain how to aggregate Tier 1 liquidity and provide it to prime brokerages or other banking institutions whilst minimizing risk and generating prices with millimetric precision.

The world has changed, the infrastructure and culture has changed, but have the salaries?

It is well recognized that FX traders do not consider their basic salary as the main reason for striving for good performance. The bonus is the main attraction.

Although the Ferraris, gauche suits and over-the-top hairstyles have been consigned to the history books in favor of much more somber dress codes and an interest in technology, an international business mindset and the innovation of financial markets have replaced the barrow-boy-made-good image of the 1980s, the fiscal reward is still very much there.

It is perhaps not obvious by looking around, but subtlety and sophistication has replaced the gregarious, in-yer-face nouveau riche of 30 years ago, therefore the size of one’s bank account in today’s London or New York is not gauged by how much of the sun’s light is eclipsed by giant wallets and on-display lifestyle accessories.

Intelligence, modernity and innovation have replaced decibels.

Indeed it was possible to make a £1 million annual remuneration in pre-stock market crash London. Before Black Monday, October 19, 1987, when stock markets around the world crashed, shedding a huge value in a very short time. The crash began in Hong Kong and spread west to Europe, hitting the United States after other markets had already declined by a significant margin, it was possible to rise from teenage pennilessness to extreme wealth within just one year in London.

The bleak 1990s passed, and the global towers of strength rebuilt their vast institutions.

In 2010, in New York, a first-year trader generally earned an annual base of slightly more than $64,000 with a bonus that brought total compensation to approximately $85,000.

Commodity and currency traders median wages, according to the U.S. Bureau of Labor Statistics’ 2010 survey, were $60,980 per year with a median yearly salary of $104,000 earned by the top 10%.

Firm profitability and trading volume still today makes a big difference to bonuses. Experienced traders at a major trading house can make base salaries of approximately $100,000 to $120,000, with bonuses bringing them to $150,000 to $250,000 or higher in total compensation.

Today, those figures are still quite similar for young traders, however those at directorship level, or heading specific sales teams within banks that concentrate on certain asset classes whether FX majors or other spot derivatives, are able to earn more than $600,000.

In London, the salaries are even higher.

A testimony to the technologically advanced nature of today’s institutional financial structure is that compliance officers in London are now in such demand, due to the need for not only the regulatory requirements to be fully underststood by such professionals, but because of the highly sophisticated reporting systems that companies are using, and the high-tech approach now being taken by regulators, that day rates of up to £1200 are not uncommon for medium-level compliance officers.

That is more than some traders.

In 2015, Managing Directors in London (most institutions have several Managing Directors, each responsible for their specific channel of business within the institution – this is not a CEO position and sometimes is not a board position – it is a senior level manager of a specific department) earned an average of $898,000.

That translates to £677,000 and by all accounts is substantial remuneration for a demographic that is in the 30 to 50 year old age range and still has some levels of the corporate ladder to climb. The previous year, the same level of staff received an average of only £250,000.

Interestingly, traders at some of the large institutions, including Bank of America Corporation’s London office and Citigoup’s Canary Wharf headquarters displayed considerable discourse to their employers with regard to their bonus amounts in 2015.

45% of Bank of America’s front-office traders expressed dissatisfaction with their bonus, and 42% of Credit Suisse staff were also vocal about their lack of gratitude for their bonus, despite Credit Suisse having made huge losses last year – indeed the bank’s first loss for 8 years.

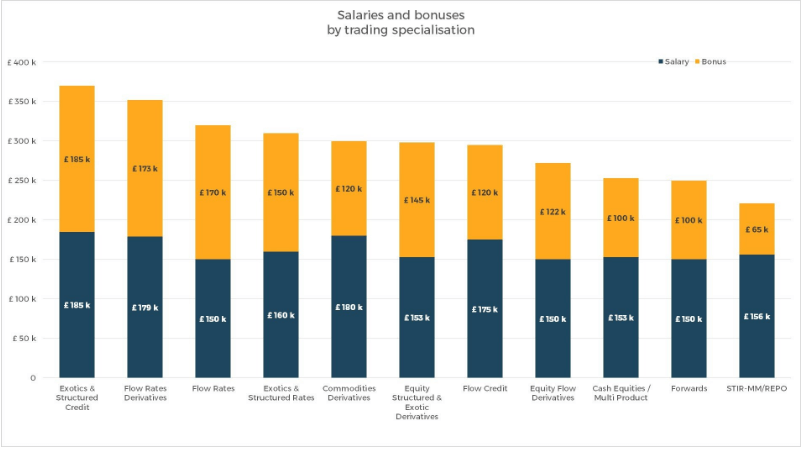

In 2016, bonuses tend to fluctuate across each trading desk, depending on the focus of the bank with regard to risk and wishing to drive certain products forward over others as well as paying traders more for dealing with more complex financial instruments.

This year, traders receive bonuses ranging from 40% (for repo traders) to 113% of their annual salary for flow rates traders.

This year, a trader in a non-directorship position, with no board membership and who works on a city desk is likely to earn an average of £221,000 in London.

Working as a non-senior executive at an institutional non-bank firm this year will usually result in a salary of between £100,000 and £150,000 for those who are skilled at maintaining strong relationships with Tier 1 banks and with liquidity takers.

Yes, the cost of living has increased tenfold since the days during which power dressing was en vogue and the Human League and Kraftwerk graced the 8-track players in the array of Jaguar XJ-S V12s driven by young men with ambition, however the actual remuneration of today is roughly the same as it was 30 years ago, and in the same vein, the financial centers of New York and London continue to have very much their own economies.

The culture has changed, too. Initiation ceremonies and boisterousness have given way to polite and detailed conversation with esteemed corporate clients over fusion cuisine in ultra-modern surroundings, the international experience of today’s professionals being a major facet when forging and maintaining multi million dollar relationships. The gentleman’s society, it seems, is here to stay.

Photograph: London’s Yuppies in 1985. Copyright Clive Limpkin