IG Group’s CEO buys more shares

IG Group’s CEO June Felix has purchased 9,700 shares in the broker.

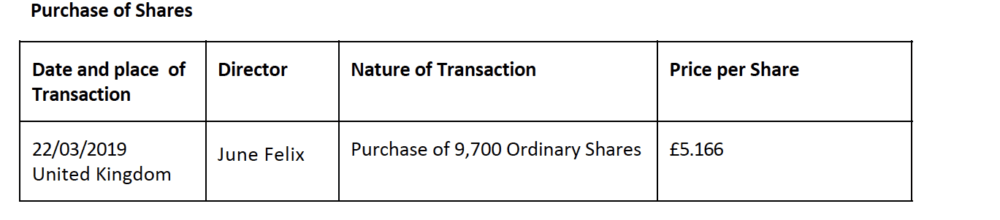

Online trading major IG Group Holdings plc (LON:IGG) today reports recent transactions in its shares by its management. IG confirms that on March 22, 2019 it was notified of a transaction carried out in respect of the company’s ordinary shares of 0.005p each by June Felix, Chief Executive Officer.

June Felix has bought 9,700 shares at a price of £5.166 each.

This is not the first time that June Felix buys IG Group’s shares since her appointment as Group CEO. On January 23, 2019, June Felix bought 17,000 ordinary shares of 0.005p each. The price of each share was £5.858, which results in an aggregated price of £99,579.38. On October 30, 2018, she also bought 17,000 shares in IG Group.

IG’s recently appointed CEO has extensive international experience and knowledge of the digital sector, as well as experience in strategy, product innovation and delivery. Before being appointed as Chief Executive Officer, she served as a Non-Executive Director at IG from September 2015 to October 2018.

Prior to becoming CEO of IG, Ms Felix was the President of Verifone Europe and Russia, with responsibility for the operation of the Verifone business throughout those territories.

She has held a variety of executive management positions at a number of large multi-national businesses. These include Citibank, where she was Managing Director of Global Healthcare, Citi Enterprise Payments and IBM Corporation, where she led their global Banking and Financial Markets business. Ms Felix was also a strategy consultant at Booz, Allen & Hamilton. She started her career at P&G in brand management marketing.