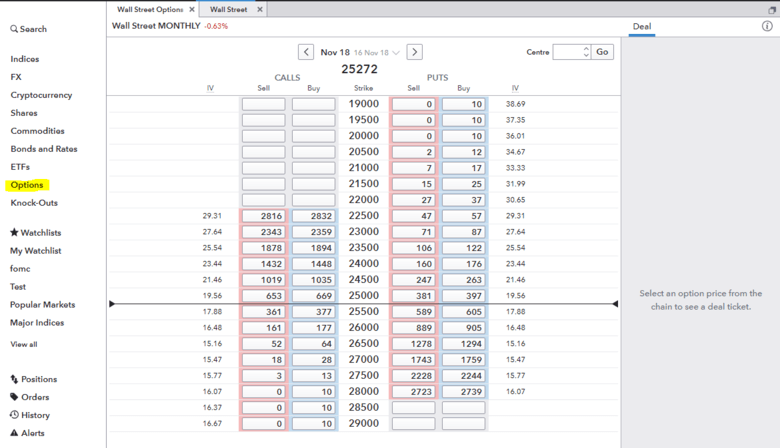

IG introduces new options trading interface on HTML5 trading platform

The novelties have been released for all UK Spread Betting and Pro-CFD users, as well as in Australia, Dubai, Singapore and South Africa.

There have been many questions by clients of IG Group Holdings plc (LON:IGG) about options trading on the new web platform. These questions have been present since the start of the rollout of the solution. The online trading giant has responded to the requests and the new options trading interface is now available on the HTML5 trading platform, as confirmed by a member of IG staff.

“We’ve at long last pushed these out to our HTML5 trading platform. This has been released for all UK Spread Betting and Pro-CFD users. This has also been released to Australia, Dubai, Singapore and South Africa and we expect to roll this out to all of Europe by the end of the week”, a notice on the IG Community forum says.

Traders are encouraged to provide any feedback – good or bad, which will be send to the options desk.

Let’s note that the options in questions are not binary options, which have been banned in the European Union, as per the latest ESMA rules.

When IG posted its results for the full year to May 31, 2018, the broker noted that it would be looking to diversify its offering to clients in line with the latest European regulators and the declining interest in cryptos.

“The interest in cryptocurrencies has now waned, and we look forward to facilitating client trading in other interesting markets this year”, IG said.

As ESMA’s product intervention measures are focused on the CFD industry, they risk creating an unlevel playing field by giving an advantage to other forms of leveraged trading products which are offered to retail clients such as futures, options, turbos and warrants, the broker warned back then. IG said it is developing new OTC leveraged derivative products that are compliant with regulations that it believes will be attractive to retail clients. The company added it will also assess the opportunity to expand further its range of financial trading products to include exchange traded futures.