IG releases new share dealing platform

The new web trading platform allows buying and selling of more than 10,000 shares, trusts and investment funds.

Online trading major IG has earlier today confirmed that the release of its new share dealing platform. The platform enables trading in more than 10,000 shares, trusts and investment funds.

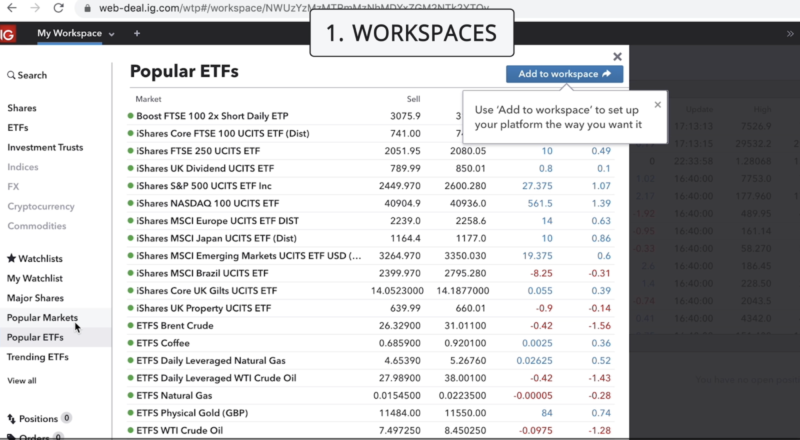

When traders first log in, they will find a new workspace. By clicking “Add to workspace”, you can add watchlists, markets, etc, thereby customizing the workspace. Traders can name the workspaces and add more workspaces at their own discretion.

Traders can browse all markets sorted by popularity from the left-hand menu. Traders can apply filters to search for stocks, ETFs, etc. A particular stock or ETF can be found by typing its name (eg., Apple) in the search bar.

Ticking the markets name will bring its chart and deal ticket on the screen. The charts are built on html5 technology. When a trader is ready to place a deal, use the deal ticket. They can choose whether to deal in quantity of shares or in value (in one’s account base currency). Traders can choose among market, limit or stop orders.

Users of the platform can use the alert tab to set alerts, so that they can be notified when a market changes a certain amount or fulfills one’s technical conditions.

To stay updated, traders can make use of the news and analysis feed available on the right side of the platform. More detailed information may be viewed by visiting the left-hand menu and selecting “News & Analysis”. This can be added to one’s workspace if a trader would like to keep it visible.

Traders can keep an eye on their balances at the top of the platform.

Let’s recall that, during the first half of FY20, IG saw its client numbers grow. The brokerage generated 96% of its net trading revenue from OTC leveraged derivatives. OTC leveraged revenue in the half was £239.5 million, in line with H1 FY19. IG served 6% more active clients in H1 FY20 which was offset by a 6% reduction in revenue per client.

ESMA region OTC leveraged active client numbers were up 4%, whereas other Core Markets OTC leveraged active client numbers grew 5%.