IG’s Daily FX applies for Forex firm, NFA member registrations

FX Publications Inc, doing business as Daily FX, has applied for registrations as a US Forex firm, Introducing Broker and NFA member.

Further to FinanceFeeds’ report about IG US LLC getting registered as Retail Foreign Exchange Dealer (RFED), and Introducing Broker, it appears that IG Group continues to build its presence in the United States.

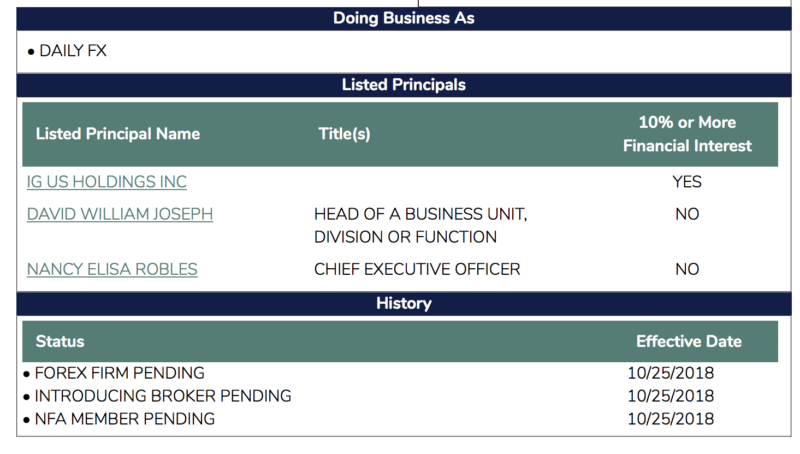

FinanceFeeds’ research has indicated that another of IG Group’s entities – Daily FX, is seeking a raft of regulatory approvals in the United States. The National Futures Association (NFA) database shows that FX Publications Inc, doing business as Daily FX, has applied for:

- Forex Firm;

- Introducing Broker;

- NFA Member.

The status of the application, effective October 25, 2018, is pending.

David William Joseph is listed as head of a business unit, whereas Nancy Elisa Robles is listed as Chief Executive Officer. IG US Holdings Inc is a principal of FX Publications Inc.

Let’s recall that, on October 15, 2018, IG US LLC was officially registered as Retail Foreign Exchange Dealer (RFED), and Introducing Broker. It has been approved as Forex Dealer Member, Forex Firm and NFA Member.

IG Group has indicated its interest in the US OTC FX market, where it believes the market is currently underserved. IG filed its licence application at the end of November 2017 to establish a new subsidiary based in Chicago. In July this year, IG said it had completed hiring for key roles. The Company said back then it expected to launch this business in the first half of FY19.

There are just a handful of retail FX brokers currently offering their services in the US retail FX market – GAIN Capital and OANDA are some examples. The exit of FXCM from the US following the regulatory action against the company in early 2017 and the settlements with the regulators have significantly changed the retail Forex landscape in the US, making it attractive for new market participants. FinanceFeeds will be keeping an eye on how the situation develops.