Integrating Traditional Finance and Blockchain: The Role of Real World Assets in Crypto

Integration of Real World Assets (RWAs) into cryptocurrency, a key development in finance that bridges traditional assets with blockchain technology. Discover how RWAs offer a practical connection between the physical and digital worlds, enhancing the functionality, inclusiveness, and connectivity of financial systems.

The combination of Real World Assets (RWAs) with the cryptocurrency ecosystem marks a major change in the financial landscape. Initiated by fiat-backed stablecoins such as Tether (USDT) in the early 2010s, the realm of RWAs has expanded, especially with the rise of DeFi in 2020 and the subsequent market changes. Currently, RWAs cover a wide range of tangible assets including debt, credit, real estate, artwork, and collectibles, creating a concrete connection between traditional financial assets and blockchain technology.

Understanding RWAs

RWAs serve as a link between the physical and digital worlds, acting as intermediaries that bring real-world value into the decentralized space of cryptocurrencies. This integration is facilitated by the strategic use of third-party services like oracles for timely data, custodians for asset protection, and valuation experts, ensuring the authenticity and dependability of RWAs.

Significant growth in the RWA sector is evidenced by findings from CoinGecko’s RWA Report 2024:

- USD-Based Stablecoins Lead: Representing 99% of the total stablecoin market cap, underlining the important role of fiat-backed tokens in the crypto market’s stability.

- Growth in Commodity-Backed Tokens: Reaching a market cap of $1.1 billion, with gold-backed tokens such as Tether Gold (XAUT) and PAX Gold (PAXG) at the forefront.

- Increase in Tokenized Treasury Products: Showing a 641% rise in 2023, indicating a growing interest in secure, yield-generating digital assets.

- Focus on Private Credit in the Automotive Sector: Comprising 42% of all loans, showing a notable trend toward sector-specific lending in DeFi.

ONDO: A Prominent Figure in the RWA Landscape

Within the dynamic RWA landscape, ONDO stands out for its significant achievements. Achieving a new high of $0.9744, ONDO’s performance reflects a growing interest in RWAs among investors, driven by:

- Launch of BlackRock’s BUIDL Fund: Marks a notable integration of traditional finance with blockchain, increasing RWAs’ appeal and credibility.

- Strengthening through Ecosystem Partnerships: ONDO has solidified its DeFi sector position through ventures into tokenized treasury products and partnerships with blockchain platforms.

- Introduction of Ondo Global Markets: Boosts ONDO’s functionality by enabling the tokenization of traditional securities, expanding its application and appeal.

ONDO showcases the potential of decentralized governance in shaping finance’s future. As RWAs continue to attract attention, the collaboration between digital tokens and real-world assets is expected to become a fundamental element of the new financial era, with ONDO illustrating the transformative potential of RWAs in fostering a more functional, secure, and interconnected financial environment.

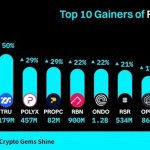

A Look at Trending RWA Tokens

The RWA token ecosystem is diverse, reflecting the broad spectrum of real-world assets being integrated into the blockchain. A review of prominent RWA tokens, including ONDO, showcases the sector’s development and appeal:

- Varied Growth and Market Caps: Tokens such as PROPS, TRU, POLYX, PROPC, RBN, RSR, OPUL, SNX, and MKR demonstrate growth and innovation in areas from digital content rewards to decentralized credit, lending, real estate tokenization, music rights, and synthetic assets, highlighting the sector’s potential.

The Impact of RWAs in Cryptocurrency

The achievement and diversity of RWA tokens signal a crucial transition in the crypto domain. By linking tangible, real-world assets with blockchain, these tokens not only present investment avenues but also enhance asset liquidity, accessibility, and democratization. From the tokenization of commodities and securities to innovative financial tools in lending and yield generation, RWAs are widening the scope of possibilities within decentralized finance.

As this sector matures, RWAs will likely be instrumental in closing the gap between traditional finance and DeFi, leading to a more resilient, stable, and varied ecosystem. The progress of tokens like ONDO and their peers showcases the crypto community’s capacity for innovation and its ability to redefine and improve the financial landscape. For those in the crypto space, the emerging RWA sector presents a new set of opportunities, merging the trustworthiness of traditional assets with the innovation and flexibility of blockchain technology.

Bitget invites enthusiasts to delve into the evolving world of RWA tokens, offering a gateway to the broad possibilities of decentralized finance.