Interactive Brokers adds new Intraday VWAP study to charts on TWS platform

The study, which tracks VWAP throughout the day, has become available in the latest version of Interactive Brokers’ TWS platform.

Whereas the latest enhancements to TWS, the proprietary trading platform developed by Interactive Brokers Group, Inc. (NASDAQ:IBKR), appear to have been focused on novel tech products such as IBot, the set of improvements concerns chart studies too.

The latest (beta) version of the TWS platform sees the addition of a new Intraday Volume-Weighted Average Price (Intraday VWAP) study to the charts.

This study tracks VWAP throughout the day, and displays as a colored line linking VWAP values at varying times throughout the one-day period. By default, the line that tracks Intraday VWAP is bracketed within a high/low standard deviation range. The standard deviation is calculated for the same period as the VWAP, and the range can be adjusted by modifying the number of Standard Deviations within the settings of the Intraday VWAP.

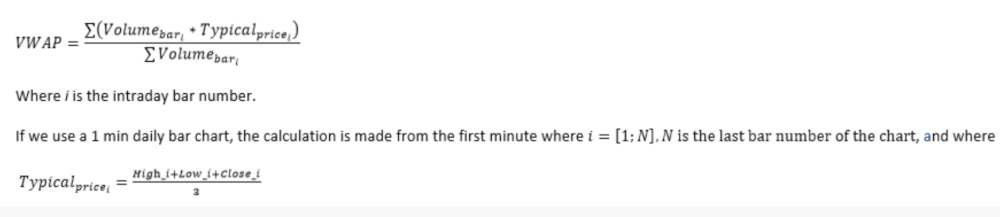

Below you can see the formula for the calculation of Intraday VWAP:

Traders can add this study from the “Volume Studies” section of “Chart Studies”. They can also display the “VWAP” bar by checking VWAP of the bar found in the “Additional Parameters and Features” section of the “Chart Parameters” page. The broker notes that the Intraday VWAP study is not drawn on charts that use the Heiken-Ashi bar type as these candles do not support volume or VWAP.

Interactive Brokers remains committed to provide traders with comprehensive information so that they can make informed decisions about their trades. The recent partnership between Interactive Brokers and TipRanks serves as a piece of proof for that commitment. Thanks to the collaboration, TWS users get access to TipRanks fundamental analysis for US stocks.

TipRanks, founded in 2012, aims to bring the general public accurate and accountable financial advice, provided by analysts, hedge fund managers, financial bloggers, and corporate insiders. The technology uses Natural Language Processing (NLP) algorithms to aggregate and analyze financial data online. TipRanks data is available on TWS through new tabs in the Analyst Ratings (Summary) and Analyst Ratings (Details) windows.