Interactive Brokers adds Unbalanced Butterfly to Strategy Builder “Pick List”

The pre-defined strategies list in the Strategy Builder in the TWS platform now includes the Unbalanced Butterfly spread.

Electronic trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) has just unveiled new features on its TWS trading platform, with one of the additions having a rather poetic name – Unbalanced Butterfly.

This name, of course, stands for an option strategy that must be familiar to some traders. In contrast to a Butterfly spread where the strikes for the two “wings” are equidistant from the middle strike, the Unbalanced Butterfly has one “wing” farther out from the middle strike. For example, where a Butterfly might have strikes of $72.00/$74.00/$76.00, the unbalanced version might have strikes of $72.00/$74.00/$79.00.

In the latest (beta) version of the TWS platform, the pre-defined strategies list in the Strategy Builder includes the Unbalanced Butterfly spread.

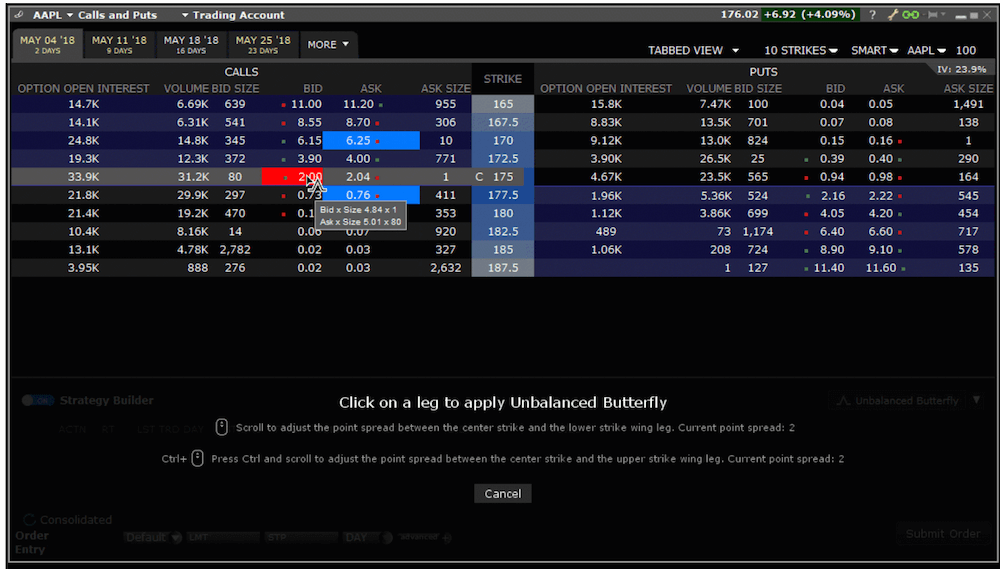

To create an Unbalanced Butterfly spread in Mosaic, traders have to select an asset in a Watchlist or Portfolio and use the right-click menu to choose Trading Tools and then Option Chains. Toggle the Strategy Builder “on” in the bottom panel and click the pick list of strategies on the right side. From the displayed list select Unbalanced Butterfly.

If traders mouse over any strike price within the Option Chain, they can see the potential spread highlighted. To modify the spread width, use the mouse scroll key, roll up to widen the spread and roll back to compress it. When traders are ready to load the spread into Strategy Builder, they should click a bid or ask price in the Call or Put section. This becomes the middle leg of the spread.

Traders can easily modify a loaded strategy or a leg of the strategy. If they mouse over one of the legs, they will see the cursor change to a grabbing hand. To change one leg, click, drag and release on the new strike. To change the entire strategy, depress the Shift key while you click and drag the whole strategy to a new set of strikes.

The Strategy Builder tool allows traders to easily build complex, multi-leg strategies from an option chain by simply clicking the Bid or Ask price of a call or put to add the leg to one’s strategy. In February this year, Interactive Brokers made this process even easier thanks to the Predefined Strategies pick list in the Strategy Builder.

When a trader selects a strategy and hovers over the price for the initial leg, TWS highlights the other legs that will be included in the strategy. One simply has to click the first leg and see the fully-editable strategy come together in the Strategy Builder.

In order to create a predefined strategy, a trader has to open an option chain (select a symbol and use the right-click menu to choose Trading Tools and then Option Chain). Toggling on the Strategy Builder tool at the bottom of the chain will result in displaying the predefined strategies. Then one has to select a strategy, and hold the cursor over the Bid or Ask price of the put or call for the first leg in the option chain. The other legs that will be included are highlighted. Clicking the price will lead to adding the highlighted legs to the Strategy Builder.

Alternatively, keeping the cursor over the price for leg 1, and using the mouse scroll button can be used to widen or narrow the spread between the strategies other legs. When ready, one can click the price to add the highlighted legs to the Strategy Builder.