Interactive Brokers’ mobile app makes it easier to find a product to trade

Smart filtering with type-ahead technology lists the best-matching products as a trader starts to type a symbol or company name.

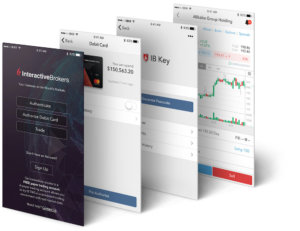

Online trading major Interactive Brokers has released a new version of the IBKR mobile app for Android devices.

The new version of the solution makes it easier to find a product to trade. Smart filtering with type-ahead technology lists the best-matching products as you start to type a symbol or company name, prioritizing those for which you have trading permissions. Tap a product to add it to your screen.

Interactive Brokers has been regularly updating its mobile app. In the preceding version, released in February 2020, the company made a raft of enhancements to the app. For instance, traders can view TipRanks Ratings and Sentimental Analysis by opening Quote Details for a stock and expanding Analyst Reports. Tap Show More, then select TipRanks Analyst Ratings or TipRanks Sentiments.

Also, traders who primarily use Limit and Market orders can speed up the order entry process with Interactive Brokers’ new simplified order ticket. In the Order Ticket tap “Fewer Options” and the app will show you only what those fields and options you need to see. You can view hidden attributes at any time by tapping “Show More Options” at the bottom of the Order Ticket.

The app has also made available Environmental, Social & Governance (ESG) scores on ETFs and Mutual Funds. Traders can now view ESG scores on Funds and ETFs from the ESG section of the Quote Details screen.