Interactive Brokers’ TWS platform enables traders to use cash quantity for stock order entry

The latest platform build allows traders to specify the cash amount they would like to spend or receive for their stock orders using the Cash Quantity feature.

Electronic trading major Interactive Brokers continues to enhance the capabilities of its TWS trading platform. The latest (beta) build of the solution offers a set of improvements, including enabling traders to use cash quantity for stock order entry.

Traders can now specify the cash amount they would like to spend or receive for their stock orders using the Cash Quantity feature. When the traders specify a cash value for their order, that value in conjunction with the instrument price drives the number of shares purchased or sold. If the price moves, the number of shares is adjusted to accommodate the entered cash value.

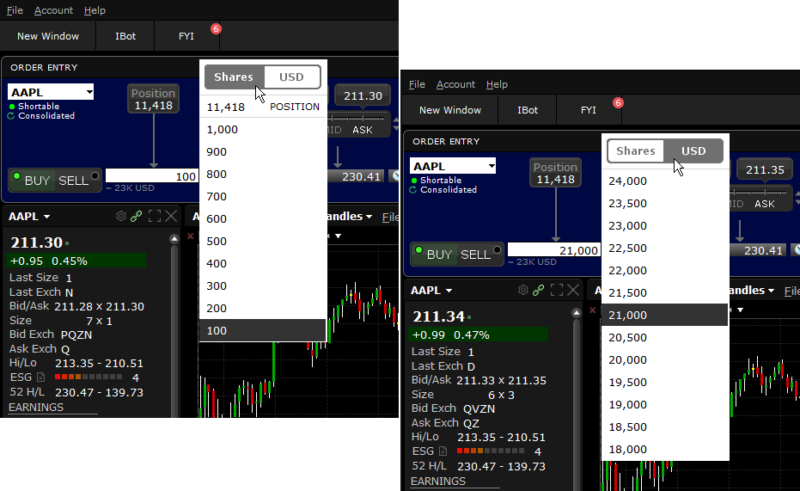

To use Cash Quantity for a stock order, click in the Quantity field and toggle the size calculation method from Shares to USD (or the currency of the instrument). Enter or select a cash value and see the approximate share equivalent directly below. Shares are approximated as the final share amount is not known until the order fills.

The Cash Quantity feature is available for stocks orders in all currencies, and is supported for almost all order types and IB Algos.

Let’s mention that the latest (beta) build of the platform offers continuous sorting for portfolio columns. This feature automatically re-sorts positions in a Portfolio when an event occurs in one’s account that changes values in one’s portfolio, resulting in the need to re-apply the sort order. For instance, if a trader elects to sort a Portfolio continuously by Position (either ascending or descending), when the trader buys or sells an asset, the sort is automatically reapplied to the trader’s portfolio to keep the selected sort order up-to-date.