Interactive Brokers’ TWS platform offers enhanced Performance Profile

The broker has added more data points to the Performance Profile, such as Break Even and Margin Impact.

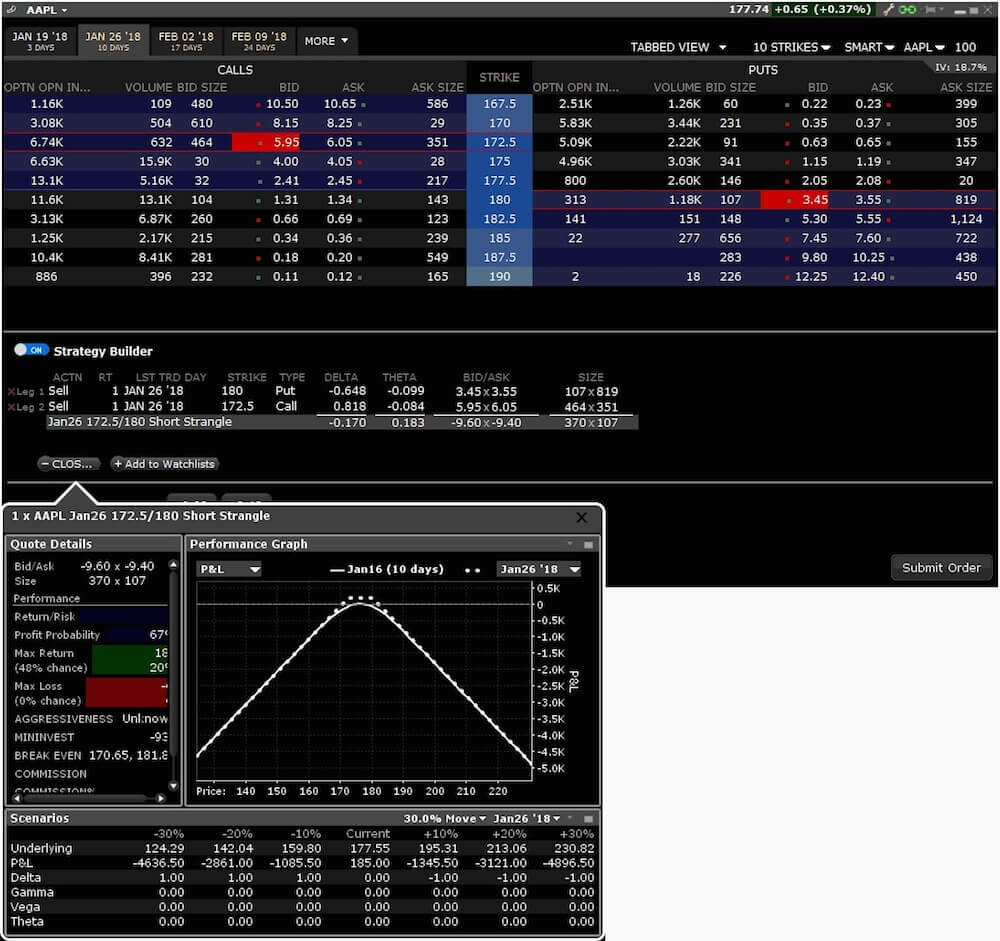

TWS, the platform developed by electronic trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) now offers its users an enhanced Performance Profile.

The latest (beta) build of the platform allows traders to access the Performance Profile from within Strategy Builder. It will reload as legs are added/removed from the strategy or ratios are changed. The Strategy Builder can be enabled at the bottom of the Option Chain tool by toggling it to “ON”. Let’s note that traders can also access Strategy Builder from within the OptionTrader tool using the Strategy Builder tab.

The broker has also added additional data points to the Performance Profile, including:

- Min Invest: The minimum amount required to invest in the strategy. Debits show as positive value; credits show as negative values.

- Break Even: This is the price/value of the underlying required for the strategy (or leg) to break even at expiration. Strategies with more than two legs may have multiple “break even” points.

- Margin Impact: Shows the potential impact on your maintenance margin of buying 1 contract.

- Commission (and Commission%): The potential commission based on the Minimum Investment amount.

These data points can be seen in the Quote Details section of the profile.

Other recent improvements to TWS include the addition of real-time last tick data for all products that support this feature in the the Time & Sales windows, which includes stocks and futures worldwide. Let’s note that all other products will continue to show real-time Time & Sales derived from the aggregated real-time volume. If traders prefer to use real-time aggregated/averaging of trades (approximately every 3-4 seconds) instead of tick-by-tick data for all products, they should go to Global Configuration > Information Tools > Time & Sales > Settings, and check “Always use real-time volume to approximate Time and Sales data.”

The IB API beta in conjunction with TWS version 969+ also supports this feature through the new reqTickbyTickData function which provides real-time data for up to five (5) US securities.

These enhancements have been taken to the next level in the latest beta version of the platform. This version will see the Multi-Contract mode in Time & Sales to also support real-time last tick data for certain products.