Intercontinental Exchange reports rise in net income in Q2 2020

Net income in the second quarter of 2020 amounted to $523 million, up from $472 million a year earlier.

Operator of global exchanges and clearing houses and provider of data and listings services Intercontinental Exchange Inc (NYSE:ICE) today published its financial report for the second quarter of 2020.

For the quarter ended June 30, 2020, consolidated net income attributable to ICE was $523 million, up from $472 million in the equivalent period a year earlier. Net income for the first half of 2020 was $1.173 billion, marking a rise from the result of $956 million registered a year earlier.

Second quarter consolidated net revenues were $1.4 billion, up 8% year-over-year.

Consolidated operating income for the second quarter was $744 million and the operating margin was 53%. On an adjusted basis, consolidated operating income for the second quarter was $820 million and the adjusted operating margin was 59%.

Second quarter data and listings revenues were $685 million, including data revenues of $574 million and listings revenues of $111 million. On a constant currency basis, segment revenues were up 3% with data revenues up 4% year-over-year.

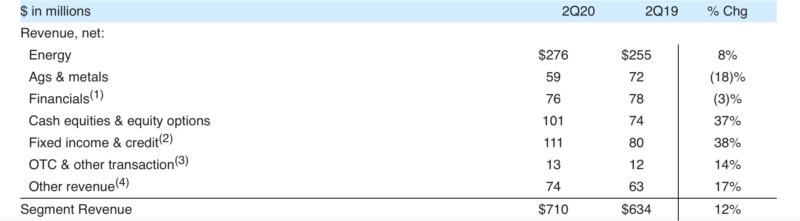

Second quarter trading and clearing net revenues were $710 million, up 12% from one year ago. Trading and clearing operating expenses were $282 million and adjusted operating expenses were $256 million in the second quarter.

ICE forecasts its third quarter 2020 data revenues to be in a range of $575 million to $580 million.

ICE’s third quarter 2020 GAAP operating expenses are expected to be in a range of $651 million to $661 million and adjusted operating expenses are expected to be in a range of $580 million to $590 million.