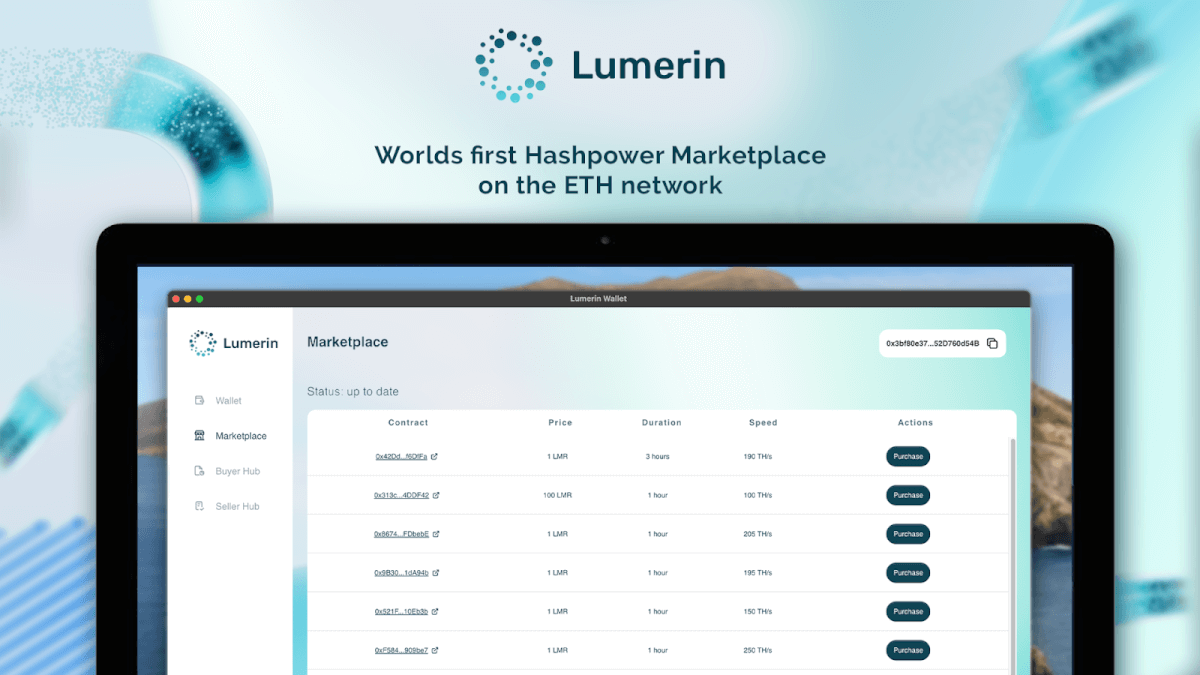

Introducing Lumerin Hashpower Marketplace: Decentralizing Bitcoin Mining Capacity

Lumerin unveils its public testnet, showcasing the world’s first decentralized application for buying and selling Bitcoin mining capacity.

Lumerin, a pioneering Web3 datastream routing protocol, announced the public testnet launch of its Lumerin Hashpower Marketplace, a groundbreaking decentralized application (dApp) that enables the purchase and sale of Bitcoin mining capacity. This initial beta showcases the early capabilities of the marketplace, facilitating participation in Bitcoin mining for both miners and non-miners via Ethereum network smart contracts.

The primary goal of this initial testing phase is to refine the Marketplace and identify potential enhancements in user experience. Therefore, testers, who can earn Bitcoin for their contributions, are advised to exercise caution when participating in the public beta.

The Lumerin Hashpower Marketplace aims to offer miners increased flexibility and control over their operations while unlocking global liquidity and access to Bitcoin mining capacity. Miners can create contracts to buy hashpower, setting contract parameters such as price, speed, and duration. This innovation enables efficient capacity planning and risk-management strategies.

Participants do not need to own mining equipment to engage in the marketplace, as they can buy hash power contracts like professional miners.

The phased launch ensures the integrity and security of the marketplace’s hashpower contracts. Users can initially purchase hashpower through the market and connect to their mining pool account. In addition, beta testers registered on the Lumerin Explorer Program can access the Marketplace and purchase hash power using Ethereum Sepolia Testnet LMR tokens (sLMR).

During the testnet phase, users can exchange Lumerin testnet tokens to purchase real Bitcoin mining hash power provided by the Lumerin team, directing hash power to a mining pool account to earn Bitcoin.

At this preliminary stage, it is highly recommended for testers to go through the instructions for the Lumerin Wallet and Hashpower Marketplace. The guidelines include not just Wallet installation but also network setup. Users can only buy hashpower via the marketplace and link it to their mining pool account.

Beta testers enrolled in the Lumerin Explorer Program can still join by following this link. These testers can now access the Marketplace and acquire hashpower using Ethereum Sepolia Testnet LMR tokens (sLMR).

Ahead of the main net release, Lumerin plans to onboard strategic mining partners to provide hash rate contracts on the platform.

“Conversations about the centralization of Bitcoin mining power have too long obscured the need to distribute control of that mining power through market forces,” said Ryan Condron, co-founder of Lumerin. “With the testnet launch, the Lumerin Hashpower Marketplace will offer a glimpse into what a future of liquid, globally distributed control of Bitcoin mining could look like.”

“Lumerin has had a remarkable journey — from a novel idea for solving the centralization issues in Bitcoin mining to today’s real-world testnet deployment,” said Matthew Roszak, co-founder and chairman of Lumerin partner Bloq. “Lumerin shifts the discussion of Bitcoin hashpower from one of mere geography to one of control and ownership across borders, further fulfilling the promise of a 24/7/365 future of finance.”

Lumerin is a decentralized Web3 data stream routing protocol that allows users to own, transfer, and exchange data through blockchain networks using smart contracts. The Lumerin Hashpower Marketplace aspires to be the first dApp utilizing this technology to transform Bitcoin hash rate into a liquid financial asset, enabling peer-to-peer, decentralized hash rate trading worldwide.