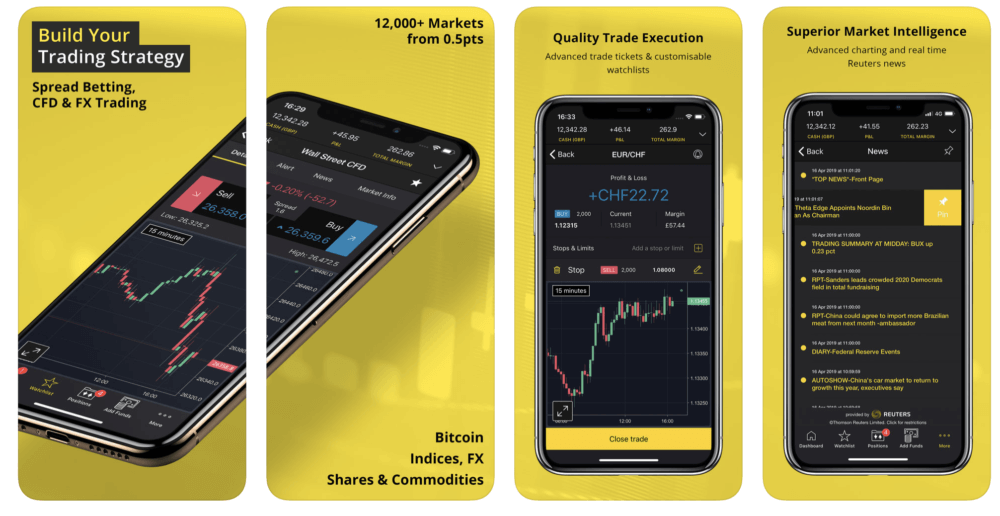

Latest version of City Index mobile app includes new TradingView charting

The City Index mobile app for iOS-based devices has been updated to include new TradingView charting, complete with more than 60 technical indicators.

Online trading services provider City Index has just released a new version of its mobile app for iOS-based devices.

The solution has been updated to include new TradingView charting, complete with more than 60 technical indicators, over 10 chart types, as well as a Compare function.

The app provides access to trading markets for owners of spread betting or CFD trading accounts. The lineup of trading instruments includes:

- Indices from the UK 100, Wall Street, Germany 30 and Australia 200;

- Over 4500 global company stocks from the UK, U.S, Europe, Asia and Australasia;

- Commodities including oil, gas, food and more;

- Metals including gold, silver, copper and more;

- Options;

- Bitcoin;

- Bonds;

- Interest rate.

The app also enables its users to trade 84 global FX pairs using City Index’s spread betting, CFD Trading or Spot FX on MT4 platforms with spreads from 0.5 points.

The City Index iPhone app allows users to trade, amend existing orders and place guaranteed stop loss orders (spread bet and CFD account only), as well as to check the latest prices and market movements. Traders can also open and close positions with a new faster, simpler trading ticket.

In addition, traders can research prices using real-time charts and multiple technical indicators, review trade and order history, as well as view statements, balances and edit account information.