Libertex from A to Z: how to make the most of Europe’s premier trading platform

Libertex Group was founded all the way back in 1997 when it became one of the first online Forex brokers in what was then a fledgeling niche market

A lot has changed in the nearly a quarter of a century that’s passed, in the company and the industry as a whole. The Forex market has grown exponentially to over $6 trillion in daily turnover, and the size and reach of various other markets and instruments have also increased tremendously.

While Libertex hasn’t forgotten its roots in traditional currencies, it has well and truly changed with the times. In response to this rising demand on all fronts, Indication Investments Ltd, a regulated entity under the Libertex brand with headquarters in Limassol, Cyprus, now offers CFDs in everything from global equities and commodities to ETFs and cryptocurrencies.

As a CySEC-regulated broker, Libertex supports trading for many instruments or asset classes, so there’s something for everyone. It’s no surprise that its client base is growing at a record pace as more and more traders and investors choose this Tottenham Hotspur and Valencia CF Official Partner as their own partner in the financial markets. But once you’ve signed up for a service, it’s crucial you make the most of it, right? With that in mind, we’ve created this useful guide to show you how to maximise your Libertex experience, regardless of your trading habits.

Getting started

The Libertex sign-up and account registration process are extremely fast and efficient. All you have to do is visit the website or download their app (available on both iOS and Android) and enter the bare minimum of personal details, such as your e-mail address and a password, to complete the registration process. Bear in mind that if you register with the CySEC-regulated broker Libertex, anti-money laundering regulations require that you upload documents to prove your identity and residency. This is also a pretty quick procedure, and Libertex’s support staff are super responsive. After that, you’re ready to deposit funds and start trading. Withdrawals are lightning-fast, and there are no hidden fees to pay. All information about the withdrawal process and its fees can be found in Libertex’s support section.

Education and training

One of the best things about Libertex — and a feature that really sets it aside from the crowd — is its Trading Academy. This educational resource is open to all clients, providing them with all the basics they need to put their best foot forward when they start trading. From technical analysis to strategy development and how to value companies, the Libertex Academy has everything you need to get ahead as a trader or investor. This extensive library of easy-to-understand tutorials will make sure you have the best chance to prepare yourself for real trading. Libertex also provides all new users with a €50,000 demo account, so you can dry run all your trading approaches without the usual financial risk.

Going live

Once you’ve created an account and got some training under your belt, you’re ready to start for real. Whether you decide to focus on investing or become an active trader is up to you, but whatever you choose, Libertex will have something to meet your needs. For the traditional-minded trader, Libertex has equities, commodities and Forex, while the more adventurous might be interested in the broker’s offering of indices, ETFs and even cryptocurrencies. Depositing funds couldn’t be easier as Libertex accepts all major credit and debit cards as well as PayPal and direct wire transfer.

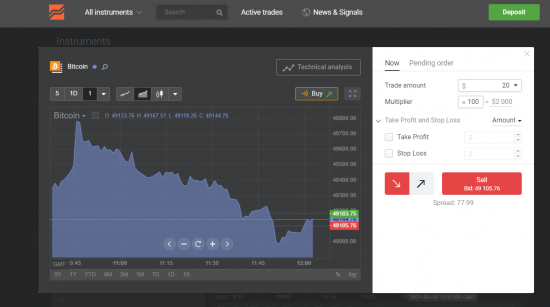

The Libertex platform is ultra-user-friendly and displays all the various instruments in one easy-to-manage interface. To make analysis even simpler, Libertex provides in-app charts with embedded signals, so you can make an informed trading decision in seconds.

As you can see, chart time frames can be adjusted quickly and easily without even leaving the main screen. You can even open a position (short or long) by simply clicking the red ‘Sell’ or green ‘Buy’ button above the chart.

The convenience doesn’t stop there. Once you’ve decided to buy or sell a given asset and clicked the corresponding button, the trade window will appear. There, you can edit every parameter imaginable to fully customise your trade. Beyond the trade amount, you can also specify your desired multiplier amount, view the up-to-date spread, and even set Stop Loss and Take Profit levels all in one place:

These screenshots were taken from the desktop version of the platform, but the mobile app is just as functional and comes optimised for both Android and iOS. In fact, the company’s mobile service is so good that it’s won multiple awards, most recently taking home Best Trading Platform at both the European CEO Awards 2020 and World Finance Magazine’s Forex Awards 2020.

Boost your status

Another unique feature of Libertex is its status-based programme that provides users with additional benefits based on their loyalty to the company. Status levels range from Silver to VIP+ and provide their holders with everything from commission discounts to faster withdrawals and even bespoke premium treatment.

Your status is determined by factors such as your account balance and is valid for a period of one month. If you still meet the criteria for your current status at the end of the month, it will be renewed once more. To really get the most out of trading with Libertex, status can prove the difference. Clients generally find that Platinum offers the optimum compromise between affordability and benefits, but even Gold comes with its advantages.

It might take a while to reach the upper echelons, but the fact that status is calculated on your lifetime deposit (i.e., total funds deposited) means that once you reach a given level, it’s relatively easy to hold on to it. Full details of the requirements and perks can be found here.

Be sure to follow Libertex on all the major social media platforms, or check the brokerage’s on-site newsfeed to stay tuned for the latest updates!