Licensed trading platforms or a white label solution. What is the best choice for your business? – Guest Editorial

Brokerage companies have several options to choose from when it comes to trading platforms. Find out which fits your business the most, says Amnon Goldrat, CEO of ParagonEX Dynamic

By Amnon Goldrat, CEO, ParagonEX Dynamic.

On the 7th of May, fintech developer and trading platform company ParagonEX Dynamic held a live webinar for those interested in starting or growing their trading companies, as well as how to situate their business in the saturated market.

The webinar was a great success, as the company’s top experts presented a comprehensive guide to the audience on how to leverage the trading tools and strategies to get the best possible results. Many questions were asked, and many questions were answered. One of the most important ones was:

“Which one is better – the franchise or the White Label model? What do you recommend more?”

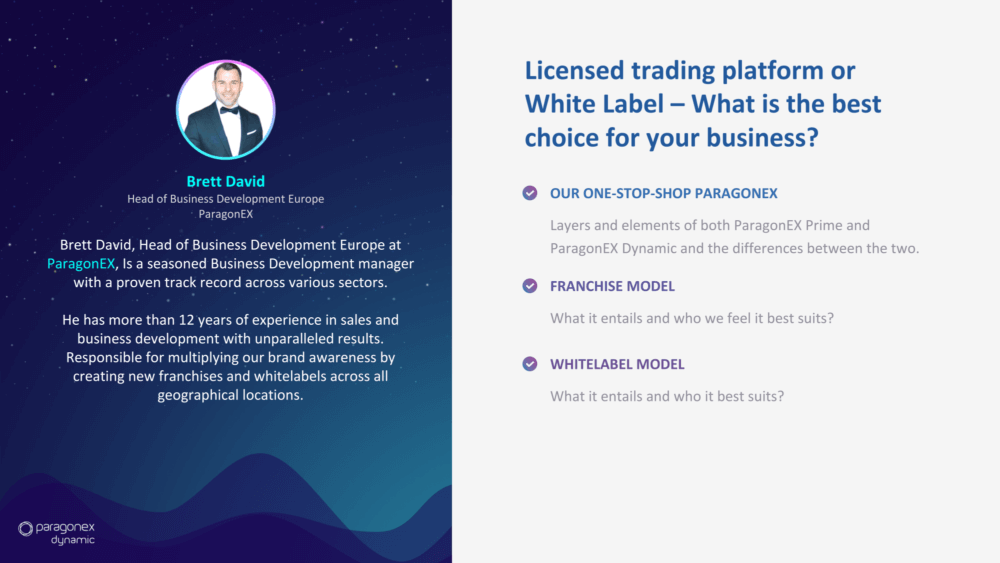

Brett David, Head of Business Development Europe at ParagonEX, gave the audience a detailed explanation, but here is a brief summary.

“No matter if your brokerage business is in the trading field for a long time, or your company is just starting out, there is one thing that every business owner has to provide to his clients – a trading platform, which manages all undergoing operations. This is undisputedly the beating heart of any brokerage company“, said David.

Many young companies believe that buying a powerful server is suitable enough for their business trading platform and some say this is all they need for the “get going” setup. That may be true if you have the required finances at this stage. But there is so much more to add to that, which must be considered, such as providing technical support, security features, in-house CRM system, API integration, payment options, and other nuts and bolts for making your business work and most importantly to be competitive.

Fortunately, there are brokerage solutions that would be cost- efficient for your company.

To be up-to-date, major fintech companies and small brokerage businesses keep their solutions lightweight. Nowadays, enterprises develop their products as SaaS – Software as a Service. This technology is not only “lightweight”, but it saves time, and will not break the bank.

In the fintech industry, we refer to this as the white label trading platform solution (WL).

What is a white label trading platform?

Think of a white label product as the canvas that a manufacturer provides. If a company wants to resell it they can have it custom made specifically for them, determining the size, color, print, and other features. The only thing they should do is to label it with their own company logo as they receive it.

Now, let’s talk about what white label is in terms of trading solutions. These are trading platforms, which already established fintech companies have developed and offer to business owners as a trading solution. Thus, the brokerages acquire a full-fledged software service for their setup.

Using a white label trading platform turns out to be one of the easiest and cost- effective alternatives to step up into the financial business. This is why it is such a widespread option and preferred choice among new-coming trading-oriented companies.

New brokerage businesses may leverage off the know-how of enterprises that provide white label services. The original developers are customer – oriented, therefore know what is best for their client’s business. Thus, you will get the best solution for your company for less money, compared to developing your own platform.

“We are a fintech provider, and as such we strive to bring to the market better and better trading platforms for brokers. This is why, our solutions are fully functional and customizable, and can help the business owners reduce their initial investments and improve ROI”, says Amnon Goldrat, CEO at ParagonEX Dynamic.

Business owners prefer the white label platforms because it can be interpreted as a “quick fix” for their companies, meaning you don’t have to tackle with building your own platform, buying your own server, configurations and customizations, payment settings, or any other technical issues.

The WL platform suppliers provide all of the above services and more. All you need to do is to pay a monthly fee for using their servers as a service for your brand.

After reducing the overall costs by using a white label solution, the brokerages can then focus on business growth, meaning developing their brand and applying marketing strategies.

White label trading platforms pros:

– Quick product/service launch

– Low initial cost

– Own brand development

– Customization and technical configuration

Who is the White Label trading platform for?

The white label solutions are notoriously famous among companies that are already established. However, that does not mean that the WL is only fit for the established companies as with a WL solution it attracts a high volume of both newcomers in the early stages as well as the already mentioned established companies.

Licensed trading platforms

The licensed trading platforms is yet another great choice for the brokerage start-ups. In this case, the major fintech providers offer not only white label platforms but also a full package of integrated services, such as back-office, tutorials, leads generating, marketing and so much more.

Paragonex Prime is one of the well-known enterprises that provides licensed trading platforms. They are part of the TRADE360 Partners program. All TRADE360 services are regulated under strict financial laws.

The company can offer brokers complete and flexible solutions. By acquiring their package your business is set and ready to go in a matter of days. You can start your trading operations, as well as your brand growth right away.

Who is the licensed trading platform for?

This option is more renown to be suitable for complete beginners and intermediate level brokers since the “parent” company will take care of every aspect of your business – from technical support, through payments, to marketing and more.

What is Full Ownership

Trading platforms are infamous for being exceptionally difficult to build, develop and maintain, and not many software companies are eager to take on this task. Not only that, but it is also a well-known fact that this is a very expensive endeavor, and many young brokerage companies are not prepared to pay that price. Simply put, the process of building a full-featured trading platform is restricted to major companies, which are considered fintech development experts.

Although it may all sound bad, this is usually the route, which advanced brokerages take and is part of their business development strategy.

If you have started your business with a WL platform, it can turn out that this may not be the ultimate solution for you further down the line.

As your company grows, so will your customer base. That means, requiring more server services, which will lead to greater rental fees. At some point, you may decide that your next business milestone is developing and obtaining full ownership of a trading platform.

Choosing a trading platform depends on many factors and a long list of decisions, which you need to make. For instance, and very simply put: Are you a big or small company? At what status level is your brokerage (beginner, advanced)? Do you have a strategy for business growth and so on are among the many questions you need to answer first.

Ultimately, it all comes down to finances.

For more information and further questions, please don’t hesitate to contact ParagonEX Dynamic by clicking here.

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.