London is the number 1 place for FX innovators – here is why

In Britain, FX technology innovators can actually pay no corporation tax at all, even when highly profitable. Here are the facts and figures and why London is THE place to be an FX industry technology leader.

In this highly technologically advanced electronic trading industry, brokerages are reliant on either their own in-house development in order to maintain a foothold in the very upper echelons of today’s modern FX business, or on the very sophisticated technological advancements that emanate from specialist technology firms that facilitate liquidity management, platform integration, hosting and high quality of execution.

Nowadays, companies providing third party solutions to brokerages which have become very prominent and whose products and services are an essential part of today’s brokerage structure have formed in three specific locations, those being North America, Britain and Cyprus.

Cyprus has become such a comprehensive and advanced location for retail FX that alongside the 180 brokerages that are registered on the island, platform firms, specialist management consultancies, regulatory reporting companies, ancillary technology vendors, signal providers, educational technology companies and legal specialists have established there, making their contribution to what has really become an entire nation which is home to a very complete FX industry.

This initially began to take shape due to the very favorable conditions which surround doing business in Cyprus, including a well organized business framework, a high quality and skilled workforce and, of course very low corporation tax rates of between 12% and 15%.

What if we were to say that running a business in England could be tax free?

Most certainly, in a jurisdiction which is notorious for high levels of taxation such as the UK, the landscape is geared toward large institutions with vast capital bases as only they can afford to not only maintain their operations in London’s highly expensive Square Mile, or to nestle in the shadow of the global banking giants whose glass towers reach for the sky in Canary Wharf, with multi-billion dollar world leading financial technology and tax bills that run into the billions.

….or not!

Britain is actually one of the least expensive nations in the world within which to operate an FX technology vendor, especially from a taxation perspective.

Not only is London the world’s largest financial center, and has for quite some time been a world leader in financial technology that powers the entire international electronic market infrastructure, therefore being a prime location for firms which develop software for electronic trading, or provide essential ancillary services such as liquidity management, order execution software, platform integration, charting and automation systems, CRM and marketing technology and of course execution technology such as VPS and hosting to reduce latency is of very high importance and enables their businesses very well.

London is home to vast electronic trading companies with proprietary technology, as well as the entire institutional FX sector for the global brokerage industry, plus 49% of the world’s interbank order flow. For this vast financial markets powerhouse, most of the technology is developed in house, in London, therefore ancillary service providers are not only in very good company, but have enormous, advanced and well capitalized potential customers literally on their doorstep.

All a company has to do is commit a certain percentage of its activities and resource toward research and development (R&D), and certainly the majority of FX technology vendors are very R&D focused due to the leading edge and fast moving nature of this business, and no, you do not need to be a giant multinational, as the genius of this is that Britain wants to stimulate leadership, innovation and modernity by empowering small to medium enterprises – exactly those which develop the latest solutions which drive the industry forward.

This initiative sets Britain apart from mainland Europe and emulates North America’s initiative of stimulating modernity and new inventions. Whilst North America’s tax authorities look favorably on the institutional and exchange technology developers of Chicago, Britain is now looking favorably on those developing systems for the retail market.

The scheme is called R&D Tax Credits, and means that in many cases, technology firms in this sector which are based in England could pay absolutely no corporation tax whatsoever.

Although not new (R&D Tax Credits were initially introduced in 2000 for small to medium sized businesses), they have evolved so much that now in a Britain that is about to become independent from the flagging, technologically retrograde mainland European Union mainland, British technology, especially financial technology, is about to experience a rapid increase in its prowess.

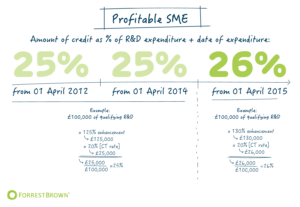

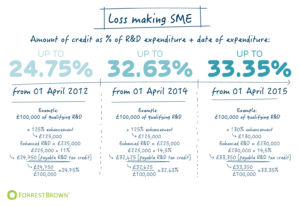

Remarkably, the system sets out that the net benefit after tax of the relief ranges from 7.7% to 32.63% of eligible expenditure depending on whether the claimant is a large or small profitable or loss making company.

Originally aimed only at small to medium sized businesses, the scheme has now opened up to all business within which R&D is a large part of their operational scope.

The system works by allowing small to medium enterprises to deduct an additional 125% of eligible R&D costs from its taxable income (a superdeduction).

If the company has made a loss, then the scheme goes even further and allows the alternative of a cash payment of up to 32.63 per cent of the eligible R&D investment. The rate of the SME R&D tax credit enhancement has increased from 150 per cent when it was first introduced in 2000 to the rate of 225 per cent as at 2013.

Now more favorable than ever as government ups the anti

The R&D Tax Credit is a taxable receipt and it will be paid net of tax to companies with no corporation tax liability. Prior to 1 April 2015 the rate of the RDEC was 10%, so after a corporation tax deduction at 21% the net cash benefit to a large company was 7.9% of its qualifying R&D expenditure.

From 1 April 2015, the RDEC percentage was increased to 11%. So, combined with the reduction in the corporation tax rate to 20%, also from 1 April 2015, the net cash benefit to a large company is now 8.8% of its qualifying R&D expenditure.

The Chancellor of the Exchequer announced in his 2014 Autumn Statement that the super deduction rate for the SME relief regime has been increased from 225% to 230%, on expenditure incurred from 1 April 2015, providing a benefit of 26% of the qualifying expenditure.

The rate at which losses can be surrendered for a payable tax credit under the SME scheme remains at 14.5%, meaning loss making SME’s can receive a cash credit of 33.35 pence (previously 32.63 pence) for every pound spent on qualifying R&D.

A large company is able to claim an additional 30 per cent of its eligible R&D costs from its taxable income as a superdeduction. And with effect for qualifying expenditure incurred after 1 April 2013, the government introduced a new Research and Development Expenditure Credit (RDEC) which operates above the tax line, and until 2016, alongside the existing superdeduction scheme.

The RDEC scheme makes it possible for large companies to claim a payable tax credit at a rate of 10% of qualifying expenditure (rising to 11 per cent of qualifying expenditure incurred from 1 April 2015).

The steady state cost of the whole scheme is approximately £1.3 billion per annum in terms of corporation tax revenues foregone by HM Treasury and by 2013, nearly 100,000 claims had been made and over £9.5 billion of relief has been claimed since the R&D tax credit scheme was launched. More than 28,000 different companies have made claims under the SME scheme, and 7,500 under the large company scheme.

With Silicon Roundabout now home to a large number of astute Millennials who are developing new technology which ranges from trading infrastructure to blockchain database development so that banks can automate ledger functions, this is a very strong system which means that the government is supporting those who wish to move things forward, even during difficult times as startups that are making a loss can actually gain a cash payment.

For a profitable small to medium sized enterprise, an R&D claim would reduce its profits chargeable to corporation tax for the period, by the amount of the additional deduction.

Where the additional R&D deduction is greater than the SME’s profit for the relevant accounting period then this will create a loss for corporation tax purposes. The SME will then have to decide whether to carry back the loss to the previous accounting period (assuming there is a taxable profit), to carry the loss forward and offset against future profits (as and when they arise) and/or to surrender the loss (fully or partially) to HMRC in return for a payable R&D tax credit.

The total R&D tax credit claim benefit to an SME for a particular accounting period could therefore be a total of the corporation tax relief in the year of the claim, the corporation tax relief from the previous accounting period (due to the loss carry back) and the payable R&D tax credit.

For the transitional period between 1 April 2013 and 31 March 2016 a large company can elect to either make an Enhanced Deduction claim (the traditional route) or a claim for R&D Tax Credits (the comparatively new route). Deciding which route is most appropriate will affect what a claim could be worth to the company and once a claim for R&D Tax Credits has been made it is treated as an election and is irrevocable. From 1 April 2016, large companies will only be able to make an R&D Tax Credits claim and will not be able to make Enhanced Deduction claims.

25 years ago, when I began my career in the electronic trading technology industry on the institutional side, programming PBX switches and Cisco Routers for bank trading desks, the landscape comprised of huge conglomerates and large professional services consultancies providing outsourced technology services, at that time the largest were IBM whose Middleware systems dominated the telecoms and connectivity rooms within large banks, and British Telecom’s specialist connectivity and hosting division where I spent two years between 1991 and 1993 (now BT Radianz).

Back then, it had become de rigeur for technologists to leave such firms and become a consultant in their own right, providing software consultancy to large institutions. For 18 years I ran a business which provided software consultancy to the financial sector, focusing on network development, deployable packaged applications and connectivity. During the mid to late 1990s, the British government invoked IR35, which treated contractors and external consultants (which I was classified as) as the same tax status as employees, despite independent consultants having to take the risk of operating their own business, pay employee and employer national insurance contributions and be responsible for their own entities and expenses of operating.

The government had effectively made it very unattractive to run any form of consultancy, and many of such businesses went west by 2000, their owners gave up and closed their businesses down, electing to take up middle and senior management positions on a salaried basis within large companies. This stifled R&D and whilst many companies benefited from gaining some very experienced innovators and developers, the fit for those wishing to do it their way was not always a comfortable one.

Quite clearly, the British government has gone full circle and is once again stimulating the mind of the technological geniuses and in doing so is most certainly THE place to operate if you are a technology provider not only offering services to the retail FX market, but inventing them and leading the way ahead.

Main picture: Silicon Roundabout, Shoreditch, London