Market Dynamics and Precious Metal Trends: A Comprehensive Analysis

Exploring the intricate patterns of S&P 500’s fractal charts and current shifts in market sentiment, alongside crucial updates on commodities like Gold, Silver, and Oil. What do these trends forecast for investors?

And once again we show the fractial chart of the S&P500, compared with the movements of 1929. The rule still applies: the chart works as long as it works and there is no confirmation that this time it has to happen again. On the contrary: in 90% of cases, fractial charts no longer correlate from an unknown moment. Nevertheless, the high correlation of +0.92 is astonishing…

The short-term sentiment on Wall Street has recently been very negative and suggests that the recovery will continue…

In the search for a possible trigger, we recognize that hedge funds are holding long positions like they haven’t done for many years… too bullish?

Or maybe AI stocks have consolidated recently, but their valuation compared to the overall market has reached new highs…

We still have a ‘real’ concern with the yen’s movements. According to the latest COT data, the short positions in futures were expanded once again…. However, today was a typical key reversal day (new low, but on the same day a recovery above the previous day’s price… cause for hope???

The Gold price has long since broken away from its correlation with the Yen and is showing its own strength. Just 10 years ago, the Yen was considered the ‘academic’ Gold – for those ‘studied’ investors who saw no sense in Gold…

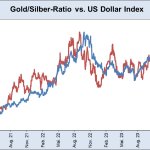

The US dollar index has a high correlation with the Gold/Silver ratio. This rises in economically positive times – and falls in bad economic times (Gold=security while Silver becomes more and more an industrial metal)…

The movements of Copper, which usually rises during good economic times, are striking. This week the ISM Index will be released… let’s see if it confirms Copper’s move…

However, Copper’s own strength is impressive and has been active since February…

…and can also be seen in comparison to the index of all base metals…

Who is responsible for this? Let’s take a look at the charts from a colleague this time: China is buying far more Copper than usual at this time of year… For what? The economy is not doing so well…

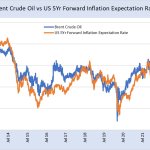

The Oil price is moving in line with inflation expectations…

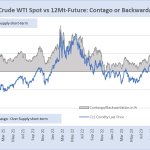

By contrast, futures continue to show backwardation, i.e. a tightening of short-term supplies. This means that the Oil price is unlikely to fall for the time being…

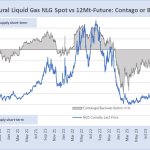

The opposite can be seen in the LNG market: the large oversupply (contango) continues and gives a possible recovery of the Gas price hardly a chance…

The consolidation in Silver could soon come to an end and the Silver bugs could become more active again…

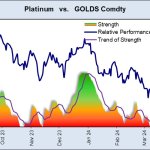

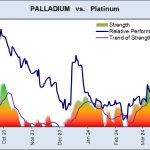

We continue to follow the platinum and Palladium market closely. The disappointing EV sales should give a boost to fossil-fueled vehicles again – and thus to catalysts and demand for the two metals… There is also potential to catch up with Gold and Silver… The Platinum market is not yet showing any strength of its own…

Nor is Palladium: the upward trend in March only had a short life…

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.