With Market Volatility, Why are People So Bullish on Cardano?

It’s always hard to predict the future. And in the case of predicting a token’s price, it’s much more difficult. There are so many variables that weigh in, from the overall market performance, regulatory decisions, mainstream press, and even the irrational crowd mentality that can bump or bust a stock/token price for no discernible reason.

Cardano has been in the news of late because of its downturn in the ADA token price since the high mark of September 2021 at $3.03; up from a humble $0.18 at the beginning of 2021; and since then dropping (at the time of writing) to $0.87. This has been a rough ride for Cardano since their peak—though a fivefold increase over a year is not bad at all.

With these jumps and dips on such a popular platform, it’s natural to wonder just what is causing the volatility, why Cardano support is higher than ever, and what this means for the future of its ecosystem. Let’s dive in and find out just what is happening with Cardano.

Pricing Madness

Before we look at ADA’s wild ride, let’s review what exactly Cardano is. The platform has become a juggernaut of blockchain Dapps, with an incredible amount of diversity represented. The Cardano developer team focuses on three key elements: sustainability, scalability, and transparency—all while maintaining very strong decentralization. The Proof of Stake consensus created by the platform uses nearly 3,000 distributed staking pools in order to create blocks and verify each transaction.

Given the amount of growth seen, why would the platform’s ADA token drop in price? Well, there are several key factors. The blockchain industry as a whole has cooled a bit during that time, and additional competition from other developing platforms has led to the various ecosystems fighting for the same investors. Also, US regulations have caused additional uncertainty in the crypto world, causing eToro to drop ADA and Tron’s TRX for users in the US. This naturally led to some nervousness among investors who are unsure of what this means for crypto in the US market, whether this regulation will ripple into other regions, and if further restrictions are ahead. A key sign of this is that the “whales” who hold a minimum of 100k ADA dropped from holding around 37% of the ADA supply to only holding 18%.

Bullish Support

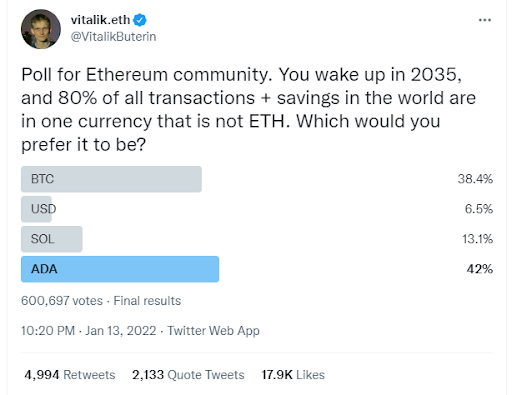

Given all the turmoil ADA has faced, one would think this is making things difficult for Cardano. However, this doesn’t seem to be the case. In the strongest form of support, Cardano users came out in droves when Vitalik Buterin sent out a Twitter Poll in January. The question asked the Ethereum community what currency (other than ETH) they would like to see dominate in 2035, and 42% said ADA. With Bitcoin taking second at 38%, and the USD taking another 6.5%, this left a paltry 13% for SOL. This level of support was a big statement for the Cardano community.

Source: Twitter

Why was this support so strong? Again, there are several reasons. The most obvious reason is that the Cardano community is alive and thriving. There are around 900 Dapps in the ecosystem, with more added constantly. They cover the range of decentralized use cases, from finance to games to security, and there are many high quality, well reviewed Dapps on the platform. Part of the reason the percent of whales holding ADA dropped may simply be because the community is growing and diversifying. The number of 10-100k ADA holders has been growing rapidly, buying up the token as an investment and a key utility within Cardano.

The “secret ingredient” to the support, and the calming of instability fears, may have been the development of Ardana, an on-chain asset-backed stablecoin protocol and decentralized exchange stable asset liquidity pool built on Cardano. Using overcollateralization for its stablecoin with on-chain Cardano native assets, the platform facilitates borrowing. Its DEX was designed to operate using incredibly high capital efficiency trading between stablecoins and identical assets with low risk income for liquidity providers from fees. Ardana will have the only stablecoin DEX on Cardano, which creates the least expensive method for stablecoin/stablecoin trading. With its low risk dUSD, Ardana has the only collateralized, decentralized, soft-pegged stablecoin on Cardano. Helping investors further, deposited ADA can be simultaneously staked with a staking pool.

This much needed stability may very well calm the Cardano pricing fluctuations, and there is already a shift to more faith in Cardano with a recent jump of over 130% in TVL for the ecosystem’s DeFi apps. This shows a growing community actively putting investments to work.

Looking Forward

We’ve looked at the ADA price fluctuation, and we’ve looked at the growing support of the community. As a potential investor, how does all this stack up? It seems that the support is outweighing the pricing slide, because various forecasting sites are showing rises in their 2030 forecasts. The price expectations vary wildly, with some estimating in the $4-5 range while others are more bullish at $21-32 by 2030. However, the trend of recovery and healthy growth is consistent, showing that these analyst firms are coming to the same conclusions. Only time can truly tell, but if Cardano continues its growth as a thriving community, and Dapps like Ardana continue to provide the stability critical to any ecosystem, we may well see ADA jump back up to its September 2021 glory—and never look back.