MercerFX, fraud complaints and possible lawsuits: FinanceFeeds investigates

Claims of fraudulent practices by Mercer FX toward their clients have seen the light of day since 2014, but mounting complaints sent to the Financial Markets Authority (FMA) of New Zealand forced the regulator to take action. Summing up all the protests made public by affected clients, the estimated worth of the alleged situation that […]

Claims of fraudulent practices by Mercer FX toward their clients have seen the light of day since 2014, but mounting complaints sent to the Financial Markets Authority (FMA) of New Zealand forced the regulator to take action.

Summing up all the protests made public by affected clients, the estimated worth of the alleged situation that has been perpetrated is to the order of millions of dollars, and as a result, accusations on the internet are now being directed at the company’s CEO Jake Amar and how the management of MAM (managed portfolio) accounts has been conducted.

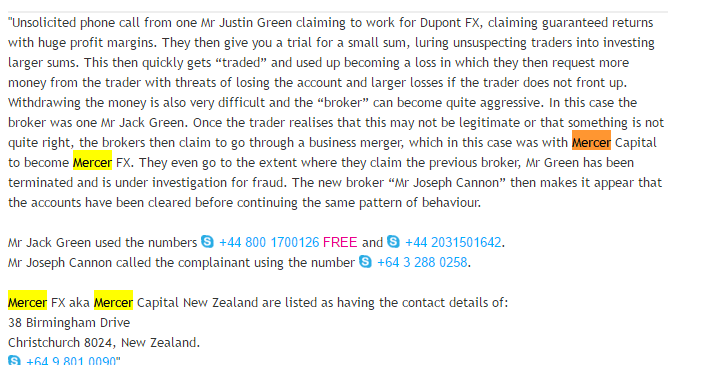

The Department of Internal Affairs in New Zealand recently published on its website a detailed report of how the company operated, recurrently making unsolicited phone calls “claiming guaranteed returns with huge profit margins. They then give you a trial for a small sum, luring unsuspecting traders into investing larger sums.

According to the New Zealand authorities, client monies then quickly get “traded” and used up becoming a loss in which they then request more money from the trader with threats of losing the account and larger losses if the trader does not front up.”

The statement added that withdrawing the money was also very difficult and the “broker” could become quite aggressive. But once the client suspected to be involved in illegitimate business, the broker then claimed that it was going through a business merger or that the previous account manager has been terminated and is under investigation for fraud. However, the same pattern of behavior continued regardless of any new manager.

Despite having voluntarily de-registered the company, Mercer Capital executives made no intention of updating the status publicly, which resulted in the FMA issuing a warning in October 2015:

“The FMA is concerned that the website refers to Mercer Capital New Zealand and Mercer Capital Limited and makes false claims regarding its registration on the Financial Service Providers Register (FSPR). Mercer Capital New Zealand is not registered as a company in New Zealand. Mercer Capital Limited was registered as a company in New Zealand with company number 4861160 but has since been struck off. Neither Mercer Capital New Zealand nor Mercer Capital Limited is registered on the FSPR.”

FinanceFeeds contacted the Mr. Amar in order to investigate this further from his perspective. Mr. Amar explained “The company was sold by its previous owners, of which I was one, in 2015. Since that time I am not part main operations of the company.”

Mr. Amar explained that the company was voluntarily struck off in New Zealand, however he also explained that the new owner, Mathew Ashok Kumar, a Singaporean citizen, took ownership of the entire structure which at the time consisted of Mercer in New Zealand and Cyprus. Mr. Kumar still operates the company today and is the sole owner.

Mr. Amar also pointed out the below YouTube video verifying this claim.

FinanceFeeds reporter Ricardo Esteves contacted one of the latest victims of the situation. Mr. Caleb Nathi opened and funded a managed account in 21 October 2015. Asking for a withdrawal since early March, the reply he got from the firm was similar to what was described in the Internal Affairs’ website:

“Mercer Capital is always looking to improve our systems, servers and trading environment. As such, we are moving our clients to our new faster server environment named Walton.”

During last week, the company’s website mercerfx.com had been blocked to certain users in certain jurisdictions. FinanceFeeds was unable to find out if it was a move by the government or by Mercer Capital, since none of these entities replied to contacts. Other executive names are pegged to the Mercer Capital situation, already finding a place on youtube, and lawsuits are underway.