Middle Eastern expansion and exchange connectivity on the cards as cTrader launches Islamic Account

Spotware Systems is preparing to take its cTrader platform into the Middle Eastern markets, as well as strengthen its position in other regions by launching support for Islamic accounts.

As far as compliance with Sharia law is concerned, the payment or receipt of interests are considered usury and unjust. Debt is also disapproved of, making investments in highly leveraged companies unacceptable, and funds cannot pay fixed or guaranteed return on capital. Instead of borrowing and lending, Islamic finance relies on sharing the ownership of the assets and therefore risk and profit/loss.

Spotware Systems has therefore has introduced a swap-free account type which is an attribute of a trading account and does not require the broker to create individual groups specifically for Islamic traders where they could impose higher spreads or commissions simply to recuperate speculative Swap charges incurred themselves and make up for missed revenues.

The functionality has been designed to meet all of the requirements of Shariah Law and the principles articulated for Islamic finance, which is a rapidly growing sector which Spotware Systems’ cTrader has thus far foregone.

Speaking today to James Glyde, Business Development Manager at Spotware Systems, FinanceFeeds discussed the methods by which cTrader may gain popularity in the Middle East, as well as among diaspora Islamic communities globally.

An interesting matter that has been a topical discussion within the industry recently is the possibility of retail FX brokerages connecting retail platforms to electronic derivatives venues.

Exchange traded futures, listed on some of the world’s largest derivatives venues in Chicago are now rapidly becoming the preserve of the retail client, and due to the lower leverages and higher deposit amounts of traders that hold futures portfolios, this is attractive, especially during times of high volatility and low margins for brokerages in the retail sector.

One of the aspects that has made this less viable is the high cost of exchange membership fees which average around $500,000, and the additional clearing fees associated with exchanges that host commercial clients.

By offering the Islamic account, cTrader is now positioned to offer exchange-traded currency futures on lower cost fledgling exchanges that have risen up to become very popular venues for retail traders, especially in the Middle East and Indian Subcontinent.

Mr. Glyde indicated that is a distinct possibility that cTrader may be connected to the Dubai Gold and Commodities Exchange (DGCX) in the near future, an exchange which handles Australian Dollar/US Dollar, Canadian Dollar/US Dollar, Swiss Franc/US Dollar, Euro, British pound, Japanese Yen and Indian Rupee futures, the Indian Rupee contract representing 31% of all exchange-traded Indian Rupee order flow worldwide.

As of 2014, sharia compliant financial institutions represented approximately 1% of total world assets. By 2009, there were over 300 banks and 250 mutual funds around the world complying with Islamic principles and as of 2014 total assets of around $2 trillion were sharia-compliant.

According to Ernst & Young, although Islamic financial services still makes up only a fraction of the banking assets of Muslims, it has been growing faster than banking assets as a whole, growing at an annual rate of 17.6% between 2009 and 2013, and is projected to grow by an average of 19.7% a year to 2018.

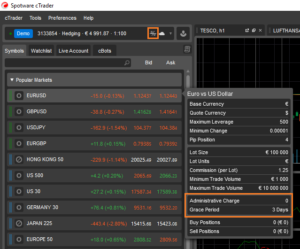

For brokers who are concerned with the risk of overnight swaps arbitrage an option to charge, Spotware Systems confirms that a fixed daily administration fee exists after a predefined grace period. This is a completely flexible and optional setting for brokers who wish to use it, meaning it only exists to protect brokers in accordance to their business operations. All fees are fully disclosed to users via the cTrader platforms highly detailed and informative UI.

Mr. Glyde concluded “Thanks to the detailed feedback of our clients and their local representatives for the Middle Eastern region this functionality is already in line with the majority of our client’s policies, meaning they will be rolling out Swap Free cTrader accounts in no time.”