“Mind The Gap!” – The life and times of a man on the move Episode 49

There is no place for FX in the 1970s, the Northern Enlightenment of Fintech and a fond farewell to Grant Foley

In this weekly series, I look back on what stood out, what was bemusing, amusing and interesting during my weekly travels, interesting findings within the FX industry and interaction with an ever-shrinking big wide world. This is purely observational and for your enjoyment.

Monday: Hello 1970s

It is always surprising how surroundings can differ tremendously in just one hour.

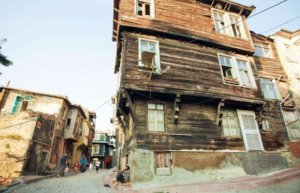

On Monday, I spent a few hours in the Turkish town of Dalaman, on the Aegean coast, as a layover en route to the West of England.

Dalaman, a small town in the Mugla province of Turkey, is home to only 24,000 people, yet receives over 4 million of Turkey’s total 28 million Western tourists each year.

That is an astonishing figure, and with a guaranteed and continuous business of that scale, it would be fair to expect that the town, and indeed the nation of Turkey, would be home to a flourishing and vibrant economy peppered with urbane sophistication. It even has its own airport, which is being expanded from its current 110,000 seats by a further 45,000 seats this year to accommodate the traffic as tourism gets even bigger there.

Yet it is far from that.

A trip to Dalaman, and a short stay in a local supposedly 5 star hotel during a layover is enough time to gain a perception that the 1970s is a decade which never ended, and that modernity, structure and business ethic are three tenets that have been overlooked completely.

From the erratic electrical system in my hotel room to the proliferation of locally-built 40 year old Renault 12 station wagons being driven by farmers and taxi drivers who appear to be in a race with each other, there is no evidence of modernity at all.

Indeed, the aspirational among us would note that some of these relics from the dark days of the French three-day working week have been upgraded to Renault 9 which, I can see anyone reading this who is under thirty years old wondering what that is.

Checking in at a hotel requires cash only, which can be withdrawn from a machine housed in dusty concrete and surrounded by people sitting on plastic chairs, as debit cards and electronic payments are anathema in Dalaman.

Aside from the UK government-issued and quite justified personal security concerns and lack of press or personal freedom, there are far more troubling aspects blighting what is effectively an impoverished, illiberal non-westernized nation.

In short, this is absolutely not the sort of place where any form of electronic trading business could be imaginable.

However, that is far from the case, as Turkey has a very significant retail FX trading sector with over 25 brokerages with their own infrastructure, and one that is specific to its own domestic market audience, very few of whom own a smartphone or have access to a fast internet connection.

Back in the 2000s, many unregulated FX brokerages operating a pure B-book execution model attempted to onboard customers in Turkey and did so with aplomb, however the Capital Markets Board of Turkey (CMB) had serious concerns that these Middle Eastern B-book shops were simply taking deposits and running away with them, so in 2010, the Turkish authorities prevented all external firms from accessing the Turkish FX market, stipulating that not only would an FX broker have to be physically present in Turkey and regulated by the CMB, but would also have to possess its own banking license and have its technological topography based within Turkey on the brokerage site.

Whilst this appears a very good rule, and is similar to that imposed by the NFA on North American brokerages, it represents a dichotomy between the expectation from the authorities toward brokerages to operate a highly sophisticated commercial structure, in a nation with absolutely no infrastructure at all.

To make matters more difficult, two years ago the CMB announced without warning that the maximum leverage on forex accounts will be cut to 1:10 and that the minimum deposit was raised to TRY 50,000 (about $13,500) in a nation in which the average annual salary is only $7,000 and poverty is widespread.

Not only did this greatly affect employees in the Turkish FX industry, which numbered approximately 6,500 people before the leverage restrictions, however the regulator’s actions also created negative effects on traders who now have to pay higher spreads as a result of lower trading volumes and liquidity. This was definitely counterproductive to the goal of protecting FX traders, of which there are 36,000 in Turkey, as they have begun to be driven offshore and outside the protection of their home country, back to the unregulated firms that did so much harm 15 years ago.

In April this year, Polish brokerage XTB announced its intention to exit the Turkish market, via the liquidation of its subsidiary X Trade Brokers Menkul Değerler.

XTB stated earlier that it expects that the CMB initiative will significantly reduce overall activity in Turkish retail forex trading. It also said that these drastic changes to the regulatory structure have contributed to a considerable decline in the number of customers and consequently to a significant reduction in the activity of XTB Group in Turkey.

Quite simply, the restriction of financial service to within national boundaries works well in developed and sophisticated nations such as the United States, however in Turkey, it is not possible to operate a highly technologically advanced electronic trading business within the borders of a completely unsophisticated and totalitarian environment.

Thus, it is possible that the educated Turkish population of the larger cities may look toward non-Turkish brokerages once again. Let’s hope.

As I headed to Dalaman Airport after a very interesting experience punctuated by terrible service, amazing and very cheap food and a reminder of the artifacts of my childhood over 40 years ago which are still in every day use in Turkey, I noticed the tremendous amount of heavily tattooed, worse-for-wear British tourists returning from 300 euro package tours, all lined up at the airport.

It occurred to me to call Parliament to advise them to hold a General Election whilst all of Jeremy Corbyn’s voters are in Dalaman!

Wednesday: Sheffield Wednesday!

By total contrast to my short stay in Dalaman, Wednesday morning’s sun rose over the Yorkshire city of Sheffield as my day began.

Sheffield is, along with Manchester, leading the UK’s northern revitalization and, over the last 20 years during which I have regularly visited Sheffield, its continued modernization and attraction of highly educated young people has continued to be of note.

These days, Sheffield is a top choice for university students looking to obtain a scientific, medical or engineering degree from a recognized, red-brick educational establishment and offers a lifestyle which covers everything from one of the best music and culture scenes outside London, to a vast array of good quality restaurants and evening venues, to the city’s location in the magnificent scenery of the Peak District.

Range Rovers and horse boxes are as commonplace in today’s Sheffield as PhD qualifications in metallurgy.

Establishing FX brokerages and multi-asset trading firms in Sheffield (and Manchester) would be a good move indeed.

It is the UK, hence FCA regulation and Britain’s world-leading financial infrastructure, which ranges from Equinix hosting and domestic connectivity to London’s major venues in the Square Mile along with expertise like nowhere else, would provide a methodology no different to a plate glass brokerage in the City of London.

Sheffield University has a high retention rate of graduates who love the city to the extent that they stay as post-graduates instead of taking their highly valuable degree to London, hence these are potentially excellent employees and future leaders of the industry.

Sheffield University and Manchester Metropolitan University have fraternities and societies which operate FinTech development events across both cities on a regular basis, encouraging academics to take their part in the development of the new generation of banking systems and trading topography. Where is this in Cyprus or Malta? Regions with over 200 licensed FX brokers between them.

The UK is home to approximately 8,000 miles of dedicated fiber optic cables which emerge from the seas around the UK at locations such as Crooklets Beach and Sennen Cove in Cornwall, and Highbridge in Somerset.

These cables carry data not only across the UK but to its continental neighbors, and whilst the European Central Bank is correct in suggesting that the majority of Europe’s critical infrastructure for trading FX, as well as shares and derivatives, is clustered in a 30-mile radius around the City of London, and that regardless of the UK’s future, some of the industry’s biggest data center operators, which host banks and high-frequency traders’ IT equipment, have announced capacity increases this year to cope with rising demand from investors in both Asia and the US, the real reason is not just infrastructural, it is really around why that level of infrastructure exists only in Britain and not elsewhere in Europe.

Sheffield is absolutely part of the domestic access radius to this level of financial markets related development that powers the entire world’s money.

This, in a region of the UK with no FX brokerages yet the world’s most advanced financial infrastructure says something very interesting. It says that any project that comes to fruition in Manchester or Sheffield will be the brainchild of computer science graduates, mathematicians and financial technologists, not affiliate marketers and white label lessees.

I have said before that anyone trying to get a simple bank account or an investment from an external partner for a MT4 based FX brokerage will be met with two cold shoulders, however major Tier 1 institutions are thinking nothing of investing large capital amounts into new challenger banks such as Dozens in London, hence we can see which way the retail financial sector is set to go.

The new generation want apps such as Pipster, or Revolut. They are wise to the modus operandi of the affiliate marketers and CPA-style fly by nights who do not understand our industry properly.

Just one example of the existing burgeoning Fintech modernity in Sheffield was established in 2012 as Ffrees, which is one of a new breed of small, fast-growing UK startups which is offering an entirely different approach to the retail banks. By the end of 2012 it had 35,000 UK customers and was adding around 1,000 new ones each week.

Founder Alex Letts said at the time, just after receiving a VC investment from an angel investor in Sheffield: “Ffrees is not a bank but an account that also helps customers to save. We don’t rely on their wealth for our revenues, there are no unexpected fees and we don’t try to sell them products. We don’t offer overdrafts and we don’t run credit checks.

“A vital part of our ethos is saving and effective money management – we aim to take customers away from the debt mentality and encourage them to control their finances through tools such as our online ‘jam jars’ and the Ffrees Money Manager, which is free and helps to pay bills, avoid debt and control spending.”

No churn-and-burn me-too affiliate lead based white labels here, and that was 7 years ago.

Customers will respond to an FCA licensed brokerage in Sheffield, incorporated in Britain, with its own technology and good ethics, rather than a white label with a Marshall Islands tag on the website and pressure sales from heavily accented lead churners.

Another important advantage is that London’s Square Mile is just a two hour train journey from Sheffield on the new Virgin Cross Country Pendolino trains with high speed internet connectivity. This is a major advantage when considering that liquidity and technology partnerships are very much a relationship business in this industry.

It is also entirely possible to rent an office in Sheffield for the same price as one in Cyprus. A three bedroom house costs £250,000 rather than the £1.5 million it would cost in London.

So, eyup lad, when are we heading to the green grass of Yorkshire?

Friday: Grant Foley, I wish you well!

On Friday, the end of an era gave way to the beginning of a new one as CMC Markets Chief Financial Officer Grant Foley handed over the calculator and spreadsheets to Euan Marshall, who will act on an interim basis.

Grant Foley, a highly affable gentleman whose open-door, welcoming approach and calm enthusiasm I always respected, joined CMC Markets some six years ago, and has held both COO and CFO positions, overseeing the company’s public listing on the London Stock Exchange in February 2016.

We announced in April that Mr Foley had decided to step down from the board, and at the time of announcement an official date was provided and adhered to.

From discussing the Next Generation trading platform with Mr Foley at CMC Markets global headquarters in London’s Houndsditch, to hearing his eloquent and considered opinion on how good quality, publicly listed companies with their own trading infrastructure can continue to evolve and sustain their business which is well worth the investment in R&D, I always enjoyed Mr Foley’s company and perspectives.

CMC Markets, a 30 year established mainstay of the British CFD and FX industry, is a tremendously more highly advanced commercial entity now than it was 6 years ago, its expansion in China, its new $100 million next generation trading platform – a highly sophisticated proprietary enterprise system – and its move toward institutional provisioning being punctuating points in Mr Foley’s tenure.

It is great to see the company in this modern, sophisticated condition representing the finest of British retail firms. Grant Foley, I wish you a very good and prosperous future, and can concur that you can look back on the last six years with distinction.

Wishing you all a great week ahead!