“Mind The Gap!” – The life and times of a man on the move Episode 62

I get Equinix data on which big firms are moving to Singapore for Tier 1 execution, the dedicated exchange that no longer offers its core product, and when there are spreads, and there are spreads!

In this weekly series, I look back on what stood out, what was bemusing, amusing and interesting during my weekly travels, interesting findings within the FX industry and interaction with an ever-shrinking big wide world. This is purely observational and for your enjoyment.

Monday: I know who is executing trades in Singapore and eschewing Hong Kong

This week began with the government vs people tug of war in Hong Kong slowing down somewhat, but a long lasting aftertaste in respect of what to do should the Chinese Communist Party become more and more dominant.

Hong Kong has long been a very international center for all kinds of trade including financial services, largely as a legacy left by the British colonialists who established HSBC and Standard Chartered Bank as absolute pinnacles of colonial banking for the Asia Pacific region including the minting of official reserve bank notes and the connection between Tier 1 banking in Asia and the West.

I spoke to a few institutional non-bank FX firms in Hong Kong on Monday, and the general consensus is that things are currently sustainable but if the communist government becomes too forceful, the western firms will pack up and leave. This is a great shame, as many are mainstays in the diversified multi-asset trading infrastructure that exists in Hong Kong (gold bullion being massive there and a one very important example) and relationships between western institutional firms which are well capitalized and Hong Kong based banks would be reassessed.

This led me onto wanting to get hold of correct up to date information, so I acquired via some extremely close contacts in the banking technology sector in which I spent 18 years of my 29 year career, to check the regional execution statistics processed via Equinix.

My colleague explained “There are a lot of Tier 1 banks which have committed to setting up pricing engines benefiting from MAS (Monetary Authority of Singapore) incentives and as you put it a stable government that encourages investment.”

As a result of this conversation I now have a list of which of the Tier 1 institutions which will be setting up in Singapore if ever needed as well as some additional useful information.

My opinion, ever since I saw the International Bank for Settlements report in 2012 which showed that Singapore had surpassed all other APAC region financial capitals for Tier 1 FX execution and had become the third most important electronic trading center in the world after London and New York.

Thus, today, Singapore is effectively a Tier 1 bank / interbank FX clearing center for the entire APAC region and it’s been like this for some time so I can imagine a lot of Hong Kong banking entities will move there.

Yes, Singapore is a dictatorship, but it is not part of any overruling communist country that could suddenly isolate it from the world. It has a sustainable future and is strictly channelled in that direction. I personally don’t have much affection for Singapore as a place, but its commercial, fintech and Tier 1 prowess are undoubted.

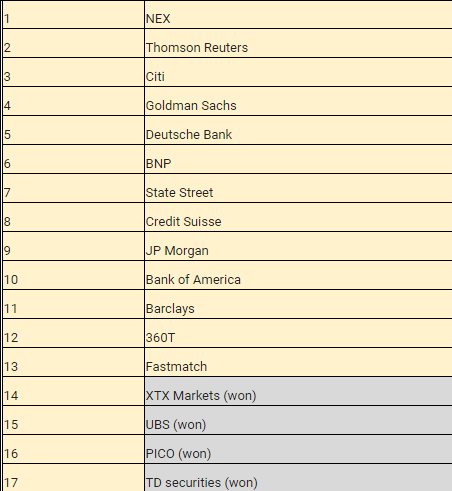

In this report from Equinix, it is clear as to who the main Tier 1 execution venues are in Singapore, and as expected these days, it is a combination of mainstream interbank FX dealers and non-bank market makers, however interestingly the lower end of the table where the word ‘won’ is in brackets, that means new entries are coming from Hong Kong division into Singapore. XTX Markets is the world’s largest FX dealer by market share, so this is a very interesting dynamic.

I will be getting more of this information as time goes on.

Add this to the massive investment in FinTech and the number of financial markets technologists and leaders who have moved to Singapore over the past five years and we can all have a good guess as to what the future there holds.

Wednesday: Cantor Exchange stops offering its core product

I had a brief chat on Wednesday with a relatively junior employee at Cantor Exchange in Chicago who exchanged a series of emails between himself, Cantor Exchange’s binary options division and a client.

Three years ago, in New York, at just one of Cantor Fitzgerald’s palatial offices at 499 Park Avenue in Midtown Manhattan, I met with Cantor Futures Exchange senior executives, most of whom had been esteemed professionals with over 30 years of experience in the institutional exchange-traded futures sector in Chicago and New York.

If we were to say that binary options could be regarded as an institutional product, that would be unheard of outside of the United States, but that is the way it is going here in the Land of the Free.

Far removed from what overseas customers perceive to be the retail binary options sector, Cantor Fitzgerald backs one of two exchanges in the United States with a business focus on binary options. By regulation, binary options on forex and commodities are mandated to be traded on an exchange approved by the U.S. Commodity Futures Trading Commission. [Note: Cantor Fitzgerald’s HQ is at this office, not in Chicago.]

The company has now, however, ceased to offer exchange traded binary options despite the massive efforts it went to in order to establish a dedicated futures exchange for this purpose.

When asked by a potential customer “Do you offer a trading API for automated order placement?”. a very curt email returned stating “We do not offer binary options anymore.”

FinanceFeeds had known for some time that the firm was looking at ceasing offering the product, and that there was so little volume on that exchange that its resource-hungry operating environment was very difficult to justify but the interesting matter here is that the firm has stopped offering its core product yet has not replaced it.

There has been some dialog across Chicago about restarting some of the traditional binary trading methods such as weather futures, which was very popular on the CME in the 1970s, however today’s version would be electronic, yet that is not something that came to fruition.

Cantor Fitzgerald is a huge entity. It has vast resources and is highly respected among the futures fraternities of North America. It is therefore of great anticipation to see what the firm will do with that exchange, or whether it will simply retain its licensing and hold it as an internal asset. It is, after all, the only exchange of its type in the world with a genuine centralized counterparty. NADEX, its peer, differs tremendously in that IG Group is its owner and therefore execution methodology between the two differs tremendously.

Let’s watch this space!

Friday: There are spreads, and there are spreads

I have looked at this matter before, and once again it came to light on Friday.

As everyone who knows me well is well aware, I am a long term advocate of genuine prime brokerage, and of the ability of our prime of prime brokerage industry to be able to aggregate Tier 1 pricing and execute via sophisticated matching engines to banks and non-bank market makers, giving very good top of book pricing and making a remarkable facility available to retail brokerages and clients at a very cheap price.

Never has trading been so efficient, and most of the leaders of the OTC derivatives sector are now the envy of the exchanges, which have in some cases resorted to massive mergers and acquisitions campaigns to buy institutional OTC firms or lobbying regulators to try to force retail trading onto exchanges because they simply cannot compete.

This is all excellent as long as it is done correctly.

Over the past few years, it has been apparent that one particular firm has the art of marketing over substance perfected.

London’s LMAX which purports to operate multiple institutional execution venues for electronic foreign exchange trading and has since inception marketed itself as the world’s only multilateral trading facility (MTF) for electronically traded FX, recently established a b-book retail brokerage, offering 200:1 leverage, in New Zealand from which to directly approach retail clients in mainland China.

Indeed, diversification is vital in this rapidly evolving industry, and in order to offer a range of good quality products to a wider audience than the one that has become completely over-targeted by so many also-rans, however LMAX began its business as a highly-sophisticated provider of Tier 1 liquidity to brokerages and positions itself among prime of prime brokerages, meaning that its target audience is retail brokerages and its product range is marketed as a ‘no last look’ execution based MTF, and an ‘exchange’ from which brokerages can source Tier 1 liquidity.

By operating a retail brokerage with 200:1 leverage and fixed trading terms set by LMAX, the company demonstrates that not only is this a b-book retail brokerage rather than an exchange model that provides directly sourced and aggregated tier 1 liquidity, but it also competes against LMAX’s broker clients, especially given that direct retail order flow is a core business activity of the company.

Why do I go over this once again?

Here is why:

Basically, a retail brokerage which operates a b-book, yet is onboarding brokerages rather than retail clients and then b-booking their trades when the broker thinks that its clients are accessing a combination of tier 1 bank liquidity and non-bank ECNs.

Don’t get me wrong, there is absolutely no harm whatsoever in b-book execution if it is correctly marketed as a retail market making service, and there is nothing wrong with conducting risk management according to a price feed by b-booking trades as many top quality retail FX and CFD firms with public listings and 30 years in operation do.

The difference is that, as an example, IG Group is a retail firm, calls itself a retail firm, and openly onboards retail clients without approaching brokerages to attempt to sell them ‘institutional’ liquidity via their own retail b-book and then compete with their own customers.

Over the past few years, I have attempted to speak to LMAX about this, but no conclusive admissions have been made.

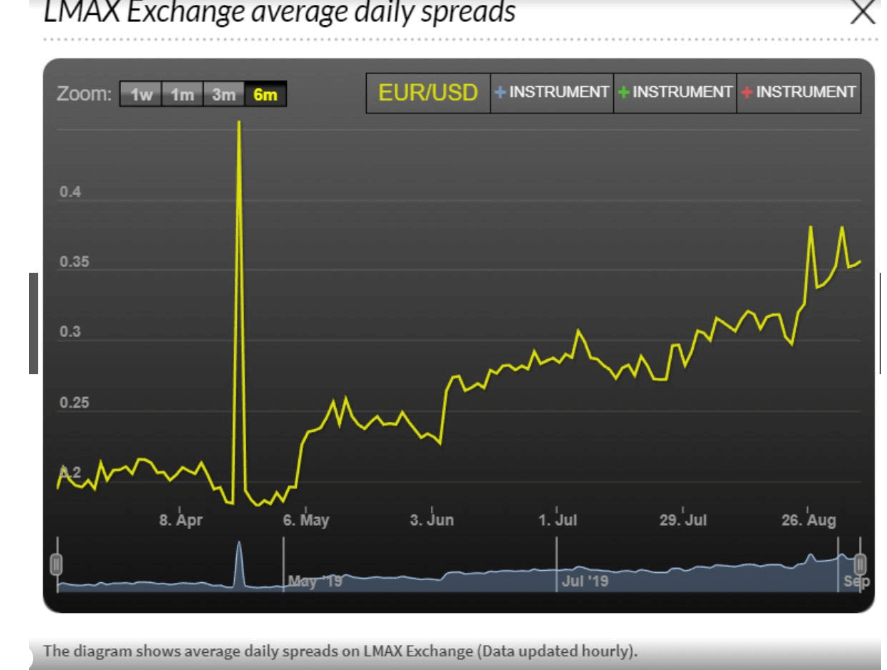

One such approach was based on some information that I obtained from a broker back end that some spreads that are being executed are different to those being advertised on the LMAX website in that there were differences between the raw tick data and averages posted on the website. This was back in 2017.

At the time, LMAX’s response was that the prices resembled the top of book price for 31st August 2017 which was the day in question. “Nothing too surprising in there. We don’t ever “advertise” spreads and certainly never fixed because that’s impossible on a CLOB. If you ever view our “spreads” on website widgets they are LIVE. Our VWAP app in all the app stores shows the TOB price and spread in depth.”

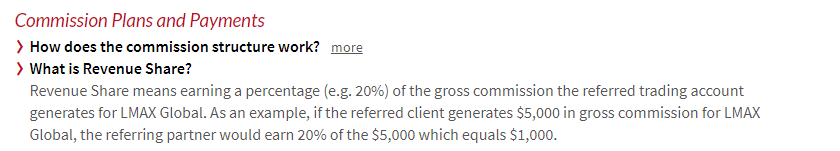

Since then, the firm has openly begun to offer revenue share agreemnents with partners as an additional point of interest.

Mind how you go 🙂

Wishing you all a super week ahead!