“Mind The Gap!” – The life and times of a man on the move Episode 66

Engage your retail traders with quality trading data, an update on the multi-asset MetaTrader solution and I become exasperated at regulatory blindness and bias as the FCA backs the bad guys

In this weekly series, I look back on what stood out, what was bemusing, amusing and interesting during my weekly travels, interesting findings within the FX industry and interaction with an ever-shrinking big wide world. This is purely observational and for your enjoyment.

Monday: Engage your retail traders!

It has been almost exactly a year in the making, however this Monday marked the completion of FinanceFeeds service to retail traders, as FXTraderHub.com began its fully automated journey toward providing innovative news and analytics to retail FX and CFD traders globally.

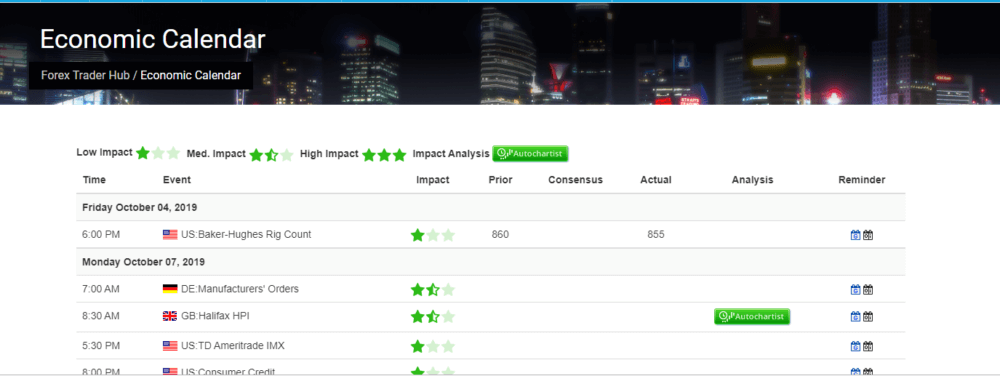

The site is now in its correct guise and has been officially launched, with a view to being able to provide retail traders with automated actionable content from various high quality sources of news, analytics and charting in the FX industry, and includes an Economic Calendar.

The site, which aims to help brokers advertise their products and services to retail customers, has been the result of extensive development and testing, as a resource designed to resolve some very important matters faced by retail FX brokerages, whilst providing valuable resources for retail traders.

We are here to help you grow your business ethically, give good information, reduce costs and be efficient.

There are currently over 30,000 retail traders actively engaged in FXTraderHub who use it as a major resource. A lot of our development time has been in ensuring we engage the right audience, which makes it a very good advertising proposition for retail brokers.

FinanceFeeds was established with a specific direction in mind, that being to bring together the various components of the electronic trading industry, providing detailed information on continual events and developments within platform development firms, liquidity providers, institutional prime brokerages and the brokerages themselves, thus ensuring a quality B2B information resource which gives professionals in the FX and multi-asset trading sector full transparency into important matters that help form their business decisions, as well as to take our part in forging important business relationships via private events internationally.

This, therefore, is our position as a mainstay within B2B relations, however during recent times, I have personally taken note of the commercial challenges faced by quality, regulated retail brokerages when it comes to approaching and acquiring new clients, this being an extremely costly, resource hungry and increasingly difficult necessity.

One of the main issues that appears omnipresent is the traditional method by which databases of potential clients is administered, which has in many cases resulted in tremendous ineffectiveness in approaching a relevant target audience and the consequential business cost that this has generated.

Associations with affiliate marketers, the recycling of age-old databases that have been circulated between several very similar white label brokerages and extensive media buying on generic, non FX specific sites has resulted in a 1% conversion rate, and each new live customer costing in excess of $1500 on average, only to have a lifetime value of less than three months.

The new site aggregates automated actionable content from industry-specific websites that provide quality market information and immediate and forthcoming news events that traders rely on during their day and pushes it proactively to a current database of over 30,000 active traders which we use a custom crawler to maintain and ensure that no dormant clients are being approached.

As professionals in the industry that supports the entire component structure of the electronic trading business, making efficient methods of brokers being matched with the most relevant customers for a reasonable price is vital, hence FXTraderHub.com was born.

The readership consists of active retail traders internationally who currently have live brokerage accounts with regulated firms, who will receive notifications of between 20 and 30 news events per day, all of which is of relevant interest to retail traders rather than to industry professionals.

Brokers have the opportunity to, at a very reasonable fixed price, advertise and direct clients to their account registration page by having brokerage advertisements on FXTraderHub.com which eliminates the conflict of interest between affiliate sites, brokers and traders, and maximizes the opportunity to grow your business, and helping the good quality firms in this industry grow their business and overcome ever-changing circumstances such as advertising restrictions, dry databases and affiliate marketing traps is absolutely the mantra of FinanceFeeds as a responsible resource which is here for you.

To advertise on FXTraderHub.com please contact [email protected]

Wednesday: MetaTrader’s multi-asset leap forward

In these times of low margins, revolving door-style customer acquisition and difficulty for many brokers to differentiate one MetaTrader product range from that of another MetaTrader broker, it has been clear for a few years now that retail brokerages have reached a point at which they will have to engage a different client base and offer a multi asset solution.

The main aspect that has deterred many firms from doing this in the past is that small to medium-sized retail brokerages with a third party infrastructure leasing arrangement with a company such as MetaTrader have been daunted by the potential cost of becoming, for example, an exchange clearing member on the CBOE in Chicago, and then being concerned about not having the fiscal might to be able to wade into metaphorical battle with the giants of Chicago and their professional trading platforms such as Trading Technologies, whose client is a totally different type with a different set of parameters.

One thing we all know, however, is that futures and derivatives trading is totally sustainable and is not the subject of lead churning and low lifetime values, with low commissions and low deposits. It’s actually quite the opposite.

Given that many of the traditional futures exchanges are now making a definitive move toward attempting to attract retail clients, now is the time for retail FX firms to get innovative and go down the multi asset route without having to uproot their entire modus operandi.

This Wednesday, here in London, I met with long term Chicago-based colleague and futures industry stalwart Joe O’Mara, who has been spending significant time between London, Chicago and parts of Europe, building the world’s first genuine multi-asset solution for MetaTrader brokerages, which after two years in development is about to go live and become available for all FX brokerages.

It’s the quiet ones that are often the dark horses, especially among firms that cater toward the financially conservative British retail electronic trading sector.

In developed regions with world-leading financial markets economies such as Britain, very few non-domestic companies are anywhere to be seen with regard to market share, and the London-based CFD and spread betting giants dominate, knowing their customer well, garnering loyalty and ensuring a 30 year presence with a largely British customer base.

British investors may well be conservative and prudent, but they are very technologically analytical and expect to be provided with proprietary trading systems that are developed, supported and continually evolved in the way that only London’s world-leading FinTech sector can provide.

Multi-asset trading environments, offering connectivity to massive asset bases is a pre-requisite in order to engage British investors, who are usually well-read, strategic and pragmatic.

Thus, there is now a fully accessible multi-asset solution for retail brokers which allow the trading of spot OTC derivatives on the same platform as multi-asset exchange listed futures and equities.

This not only elevates the potential client base of brokerages, as it accesses the equities and futures traders on exchanges, many of whom reside in first tier regions such as the United States, Singapore, Hong Kong, Australia and Switzerland but also generates a highly sustainable environment for brokers in which long-term traders with less leverage and larger capital margins operate, bringing them into the realms of the portfolio holders rather than CPA/lead conversion short term business.

The result of a joint development between newly established entity Markets Direct, Danish professional trading platform development company NetDania and Chicago-based high-performance trade routing, global market data, and advanced technical analysis company CQG, itself massively entrenched within the exchange traded derivatives sector in its Illinois heartlands, the new solution has now gone to market.

FinanceFeeds was the first to view the new trading environment during a private meeting in Sydney, Australia at the end of last year, having been told “The new B2B multi-asset solution offer financial institutions maybe the most complete solution available in order to attract and retain clients.”

“The combination of commission free stock trading on 3,500 US stocks and ETFs, futures, FX and CFD trading along with CQG’s outstanding global connectivity and order routing technology which connects to NetDania’s mobile trading app and NetDania’s desktop app, incl. trading from Microsoft Excel (the world’s largest algorithmic platform provide a full end to end solution for multi-asset connectivity for brokers.”

The system has a built in App Analytics allowing financial institutions to do targeted marketing, thereby increasing retention and conversion rates and superior HTML5 website package with charts, rates, news and calendar Trading Central Analyses which fully integrates with MetaTrader 4 and 5, and the entire package can be fully branded in the name of the financial institution, which makes this cross margin multi-asset solution very attractive for brokers and banks. I expect that several of our customers will adapt the solution.

The advent of the interest by exchanges in bringing retail business on board was initially demonstrated by a series of mergers and acquisitions, led by exchange companies which purchased OTC derivatives companies to quickly gain access to that sector, rather than develop their own inroads, as demonstrated by various discussions held by FinanceFeeds within the listed derivatives sector in Chicago as many firms begin to target the higher end retail customers.

It is worth of note that at the time during which Deutsche Boerse bought 360T and Hotspot was acquired by BATS Global Markets, ICE in Chicago was preparing its offer to buy FastMatch for between $150 million and $250 million, as further testimony to the will of the giant exchanges to mop up the minnows of the OTC world.

FinanceFeeds spoke recently to Euronext’s CEO and CFO with regard to the finer points involved in its acquisition of FastMatch, which also highlighted a synergy in this direction.

The marriage of OTC retail brokerages and listed derivatives giants is most certainly a good method of making progress, not just for the derivatives exchanges wanting to access a retail market, but also for retail brokerages to sustain a good quality business plan for the future.

Looking good, Joe. I wish you along with CQG and Netdania all the very best with it, as this is something our industry needs.

Friday: How to make £500 debt into a £7500 one by doing nothing… and unbelievably it’s legal!!

We all know that there are legalised loan sharks operating in civilized Western countries (yes there are loan sharks all over the world, but the ones in less developed nations will likely kneecap you if you default) however this Friday, during my lunchtime walk to a convenience store, I noticed something which really pushes the boundaries of decency.

There was a plate glass, modern and very inviting looking advertisement on a bus shelter, in an equally attractive street near Canary Wharf, which showed an image of a smiling, carefree expression on a young lady’s face. I do not remember the name of the company responsible for the advertisement because the product and its terms almost made my teeth itch!

It offered cash loans, with pretty much no credit check and very little in terms of eligibility criteria, of between £500 and £1000, repayable on your next pay day. Now yes, we know that the ‘polished underworld’ of payday loans is vulgar and perhaps it is mind boggling as to why and how it is even legal, this advertisement had a small reference to the terms of the deal at the bottom, stating… are you sitting down? …… 1500% APR!!

That means, that if you borrow £500 from this completely odious institution, and then, as I am sure happens to many recipients of payday loans, you do not repay it on the date specified, then 1500% annual percentage rate interest applies. That is an exponential of £7500 if it goes unpaid, meaning that even if you make an arrangement to make a tiny repayment each month, the remaining balance will continue to increase at the speed of a galloping stallion, far outweighing any repayments.

It is therefore a very dangerous poverty trap and yet the FCA lauds these ‘services’ and allows them licenses to not only provide these loans to retail customers but also to give advice on suitable financial products by meeting them face to face in high street stores!

Meanwhile, the FCA is busy trying to curtail Britain’s long established FX and CFD industry, which is made up of large, publicly listed companies with very good quality platforms, whose executives and staff are of the highest caliber and are constantly striving to make life better for traders.

CMC Markets invested over 100 million pounds four years ago in developing its new Next Generation trading platform which is quite simply an incredible piece of comprehensive technological trading topography.

Regulators around the world are busy attempting to clip the wings of good quality companies, and force retail clients, especially those starting out their trading journey, to dubious island-based firms, which is contrary to purpose.

Meanwhile, the payday loans rip off artists are allowed to advertise blatantly, have total FCA licensed remit to behave like an industrial revolution-era street vagabond, and cause untold havoc to people who will simply gain nothing and lose everything by using these services.

I live in Central London, which is a global capital and bears very little resemblance, socially, economically, culturally or in terms of lifestyle to any other part of the UK, so as a result, this type of ruse is quite rare in London. You only have to drive 100 miles away, however, to find hoards of them across the high streets of small towns, often nestling next door to gambling shops which are also legal!

Come on, regulators, you are looking down a tunnel vision microscope at very much the wrong people.

Wishing you all a super week ahead!