New FX product: MetaTrader 4 EAs completely manageable and deployable from a smartphone

Retail traders continually seeking close proximity to vital servers and venues, instant and on-the-go deployment of EAs and automated solutions as well as a sharp method of replication across MT4 virtual servers from any location, along with brokers looking to provide a unique value proposition to ever-discerning customers can now do so with SkyDesks latest innovation

Trading retail FX via increasingly advanced front end systems is a major factor within the requirements of today’s customers.

Gone are the days of multiple screens, and downloadable desktop solutions are rapidly becoming passe.

The rise of specialist system development companies that enhance the trading environment for retail traders is now a vital component within the retail trading ecosystem insofar as brokers adopting new generation technology which has been designed by specialists are able to maintain their foothold in the very upper echelons of technological leadership, meaning that they create a value proposition compared to similar competition, and also simplify the trading experience for on-the-go customers.

Nowadays, a need to be able to replicate every activity from smartphone to desktop and vice versa, as well as ensure that any automated trading software and proximity to execution servers is maintained at all times.

Today, FinanceFeeds spoke to Sheldon Gardner, President of North American company SkyDesks, that provides a MetaTrader 4-based WebTrader for autotrading EAs and signals, as well as a VPS which can be integrated into the MetaTrader 4 platform and provided a simple, ergonomically refined method of reducing latency and keeping the cost down for retail traders wishing to achieve the closest possible experience to that of a co-location effort by an institutional firm.

Mr. Gardner completed his Masters degree in Electrical, Electronics and Communications Engineering, graduating from Brooklyn Polytechnic Institute some fifty six years ago, and despite the long and illustrious history of institutional electronic trading which dates back to the 1970s, and the multi-faceted retail ecosystem which it spawned some twenty years later, very few, if any, professionals in this business have the roots of their career dating back over six decades.

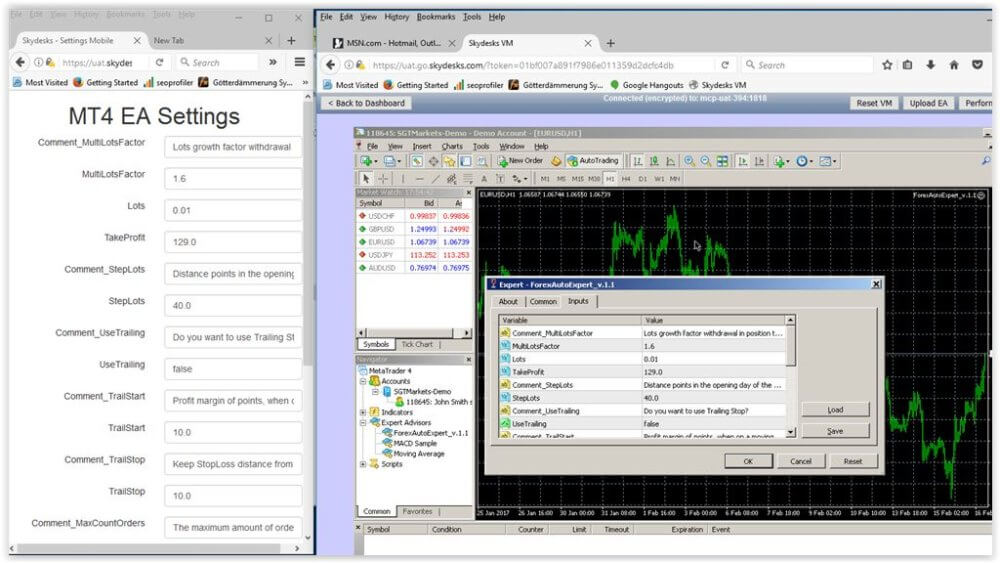

The new system that has been released today by SkyDesks allows traders to control their virtual servers and expert advisers from a smartphone in order to open a subscription on the server of the broker with which they trade.

Demonstrating the system to FinanceFeeds today, Mr. Gardner explained “As a retail end user, you can install the VPN and virtual machine from a smartphone. It is quite simply a question of providing a username and password, and then the server is pointed to the broker. Once the trader clicks on the MetaTrader 4 log in, the account is created and logged in.”

“Once the trader has logged in, it takes a few seconds to actually build the LINUX virtual server, and then a panel comes up with an EA control panel which displays the MetaTrader 4 EA. The EA displayed is specific to the user’s preferences and has to be set up in advance by us as it is a pre programmed component” said Mr. Gardner.

“When the user returns to his desktop, and clicks refresh, the EA automatically populates on the desktop version of MetaTrader 4, having replicated across via the virtual server from the smartphone, and the EA is then switched on” he said.

“Traders can then log onto their desktop computer, click to enter the virtual server, and see that the MetaTrader 4 platform is running on the broker’s server which hosts the MetaTrader 4 for the client” he said.

“We designed the EA properties section to be identical to the properties on both desktop and smartphone applications, as we realize that many traders these days want to control their entire system whilst on the move. The EA control panel on the PC is replicating what is on the VPS into the smartphone” explained Mr. Gardner.

“If you have an EA running on MetaTrader 4 platform, you can enter the properties section and then enter a value in the Take Profit or Lot Size sections for example, however now this can actually be done from the smartphone application and replicate across to the virtual MetaTrader 4 platform” said Mr. Gardner.

“We are using WebRTC which facilitates the communication between all machines. This is a new generation web protocol that allows them to talk to each other. The smartphone will now change something on the PC if I enter a value on the virtual server application on the smartphone” he said.

“For example, if we take the Lot Size value, I can change it to 1.00 in the smartphone application and then and can take profit at a larger level. If for example I set it to 140 pips instead of 129, now I am ready and have made these changes on the smartphone, and can save these changes by clicking once on the Save button, and it will now update in the MetaTrader 4 desktop via virtual server. Now if I go back into this and open up the panel, I can look at the same panel in the desktop version and the properties will updated.”

In times at which traders are continually seeking the trading experience of the institutional desks with close proximity to important venues and servers, as well as being concerned with the ergonomics of once-cumbersome trading platforms that must include deep integrations of feeds, information and the ability to connect virtually to automated trading solutions and reduce latency, this is another representation of a step in the right, innovative direction.