New version of CQG Desktop platform enables filtering by any column in QSS

Version 4.4 of the platform also adds exchange as a column in QSS and SpreadSheet Trader.

Provider of high-performance trading, market data, and technical analysis tools CQG has just rolled out a new version of the CQG Desktop platform.

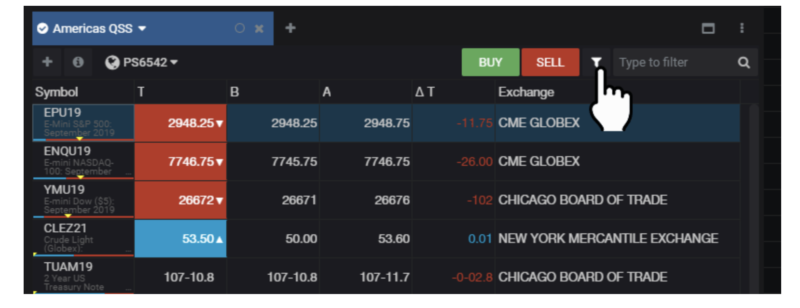

The latest version (4.4) of the solution enables filtering by any column in Quote SpreadSheet (QSS). To access this feature, click on the filter icon in the toolbar in the upper right of the QSS window. It will reveal a filter bar below the column headers. Then click on the filter icon in the column you want to filter, then select a condition from the dropdown.

The updated platform also adds exchange as a column in QSS and SpreadSheet Trader, and adds ISIN number to CSPEC.

Regarding trading, in the newest version of the platform, child orders in a bracket can now have separate duration from the parent order.

Regarding charting, the updated platform improves chart zoom using the mouse wheel. Also, when trading sidebar is open, placing a horizontal line will change price selection for trading. The platform has also enabled traders to change fractional study parameters.

In the preceding version (4.3) of the platform, a quick filter on QSS and Spreadsheet Trader was added. There were also a raft of general enhancements too, as tab overflow has been improved. The font rendering on non-retina displays has also been enhanced. Further, the platform has updated some widget names and icons.

Version 4.2 of the solution offered improvements for fans of technical analysis, as parabolic study was added to charts. Trend and ray pointer tools were also introduced. In terms of general enhancements, another fractional price format – solidus, was added.