Newest version of cTrader platform offers more chart features

The list of enhancements in cTrader 3.3 includes easy chart symbol changes, as well as Range and Renko bars with a step from 1 to 100 pips that are now available for time-independent volatility-based price charting.

Fintech expert Spotware has earlier unveiled some of the enhancements set to come with the release of the latest version of the cTrader platform.

Following the landmark launch of the cTrader 3.0, the platform went through the stabilization stage in the following updates and is now set to release new features. The upcoming update to version 3.3 provides more usability by extending its chart tools, and introduces the ability to manage sessions on all devices thereby bolstering the security of the platform.

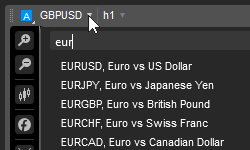

- Easy Chart Symbol Changes

cTrader has now a new efficient way to switch the symbol of an open chart while retaining a timeframe and other chart settings.

cTrader has now a new efficient way to switch the symbol of an open chart while retaining a timeframe and other chart settings.

- Range and Renko Bars

The platform introduces the Range and Renko bars with a step from 1 to 100 pips that are now available for time-independent volatility-based price charting.

- Linked Charts

Traders are given the ability to link trading symbol to the color and set this color for multiple charts with different settings to group them. This allows switching between symbols while retaining specific chart settings, with no need to configure a chart all over again for every newly selected symbol.

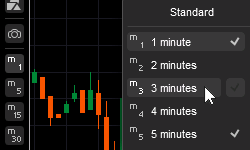

- Favorite Timeframes

Traders’ favorite frames for all tick-, time-, and volatility-based chart types are now available directly in the chart. They can check the corresponding items when selecting a timeframe to create quick-access buttons, as well as switch between their favorites with Up and Down keyboard arrows.

Traders’ favorite frames for all tick-, time-, and volatility-based chart types are now available directly in the chart. They can check the corresponding items when selecting a timeframe to create quick-access buttons, as well as switch between their favorites with Up and Down keyboard arrows.

- Manage Sessions on All Devices

As cTrader is a multi-device application, a possibility to manage sessions on different platforms and devices has been added in order to enhance privacy and security of the trading activities.

In May this year, Spotware rolled out cTrader 3.0 – a long-awaited major upgrade of the popular trading platform. It marked an important milestone for cTrader since it is a merger of two separate applications, cTrader and cAlgo. cTrader and cAlgo have now become modules of cTrader 3.0 and have been renamed to cTrader Trade and cTrader Automate.

The merged application also laid the ground for incorporating cTrader Copy, the planned successor of cMirror service, into cTrader. Eventually, traders will be able to perform manual trading, copy trading, mirror trading and trading performance analysis in a single application.

A raft of new features were included in that upgrade like a wider range of predefined tick charts, the brand new cTrader Analyze application for analyzing trading performance, many usability changes as well as an enhanced cAlgo.API. The list of cAlgo.API enhancements includes support for Stop Limit orders, trailing stop losses, fractional volumes and Stop trigger methods.