Nexo Review: What beginners need to know

The crypto industry offers its users a variety of lucrative investment opportunities. However, investors must select the most appropriate vehicle to benefit from these opportunities.

Nexo is a fast-growing cryptocurrency platform with highly competitive lending and borrowing rates. The platform allows users to put their idle crypto assets to work straight away and have a predictable source of passive income, with up to 18% annual interest.

Established in 2018, Nexo has more than 4 million users worldwide and is one of the largest crypto interest/saving account providers.

Regulation

In order to provide their portfolio of services in compliance with applicable regulations, the Nexo companies hold licenses and registrations in many jurisdictions worldwide.

Nexo is registered with the U.S Financial Crimes Enforcement Network, FINTRAC, ASIC, and holds multiple specific U.S State licenses. You can read more about that here.

How it works

Nexo provides straightforward plans for investors to generate interest from their crypto deposits. Overall, the platform attaches high-interest rates to digital assets, which are often way higher than those provided by banks or other investment platforms.

The specific annual percentage yield (APY) you earn is dependent on your loyalty level and the token chosen. The higher the loyalty level, the higher return, or the lower the borrowing repayment rates, you can enjoy.

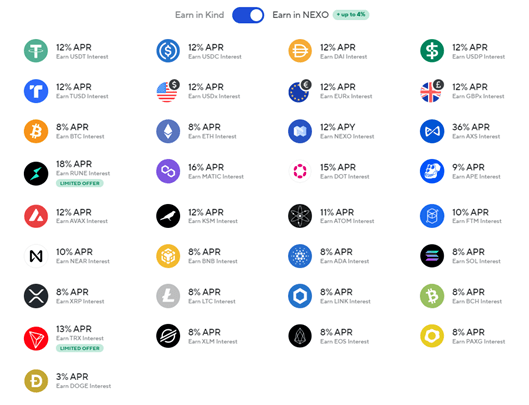

The platform accomplishes this by delivering the “Earn in Kind” feature, which means that users will earn their interest in the same base currency. For example, Ethereum deposits will earn in ETH. The other option is to earn in NEXO’s native token which gives the holder an additional 2% bonus. Here is a look at some of the APYs tires available:

How to earn

Earning on Nexo is super easy. You can sign up for a Nexo account in less than a minute. Then complete your verification, and buy or transfer any of the 41 cryptocurrencies supported on the platform. You’re all set now. You’ll start earning interest the next day after your transfer.

Your Loyalty tier depends on the ratio of NEXO tokens against the balance of other assets in your portfolio. For example, to get the ‘Silver’ tier, at least 1% of your portfolio balance must comprise NEXO tokens. The Gold status requires the client to increase the NEXO stake to 5% or higher.

To receive Nexo’s highest interest rate, 18%, you have to become a Platinum Loyalty tier client by allocating 10% or more of your portfolio balance to NEXO tokens. You also need to opt to earn the interest in NEXO tokens for up to 2% additional interest. Finally, you need to create a 1-month Fixed Term for an extra 1% interest.

Borrowing

Nexo allows you to borrow in cash or stablecoins (rates start at 5.9%) without a credit check. While you don’t have to sell your crypto, you can borrow from $50 to $2 million and can keep borrowing until you hit your credit limit. This feature helps the borrower avoid a potentially taxable event that would emerge if he sold crypto at a profit.

To borrow, it’s the same process as lending crypto. Login to your account, select a supported coin, and click “Top Up” to send the crypto to the required wallet address. You’re all set again.

You can spend the borrowed amount as cash, crypto, or by using the Nexo card. The amount you can borrow is dependent on your actual crypto deposits. In most cases, your credit line will be 50% of your crypto holdings and will fluctuate based on the borrowed coin’s market value.

If the value of your crypto on deposit drops, you’ll receive a sort of ‘margin call’ to top up your account balance in order to maintain your collateral. If you don’t cover your exposure, Nexo will move funds from your savings wallet to your collateral account. Once funds in your savings wallet vanish, the platform will begin to liquidate your collateral to repay the loan.

It’s important to note that Nexo does not offer traditional crypto loans, but rather a crypto line of credit which allows for more flexibility. For instance, Gold and Platinum members who keep their loan-to-value ratio under 20% can borrow for as little as 0%. They also can borrow funds with no credit checks, no origination fees, and have instant access once funds have been deposited. However, it can take up to 24 hours to be approved in some cases.

Lending services

Nexo generates revenue for investors by lending out crypto deposits on its platform to institutional and retail borrowers.

Nexo provides an interest calculator on its homepage to help potential investors determine the amount of returns they can expect on their investments.

One of Nexo’s most recent developments that have produced substantial popularity is enabling users to borrow against their NFTs. At the time of writing, the platform implemented a function that allows customers to utilize their Crypto Punks and Bored Ape Yacht Club NFTs as collateral.

Security

Speaking of the security features of Nexo, the platform takes full responsibility for the crypto assets deposited and traded on its platform.

All crypto deposits are insured before lending them. On the other hand, borrowers must provide collateral before accessing crypto loans offered by this platform. As such, loans issued to retail and institutional borrowers are 100% collateralized.

This practice ensures that funds are always available for repaying interests on crypto deposits, which in turn guarantees the users’ daily payouts.

In a pioneering move for the crypto space, Nexo has engaged leading accounting firm Armanino LLP to offer a real-time audit of the lender’s custodial assets. Armanino is a certified auditor which counts Kraken, Uber, and DoorDash among its clients – to provide attestations over assets and liabilities.

Nexo has insurance policies in place with BitGo, Ledger Vault and Bakkt, among others to ensure crypto assets are secured in case of hacks. Collectively, they carry $775 million in insurance protection for digital assets held on its platform via prestigious syndicates of underwriters.

Nexo Fees

When it comes to fees, our review found that Nexo is very competitive compared to similar providers. Firstly, users don’t pay any fees to register nor will be charged anything to maintain their account.

The only fee that Nexo charges is with respect to cryptocurrency withdrawals. However, users receive each month between 1 and 5 withdrawals to an external wallet free of charge. The actual number of zero-fee withdrawals depends on a user’s loyalty tier and internal transfers are not counted since they are off-chain.

Conclusion

If you’re looking for a top-rated crypto savings account that allows you to earn interest on major digital assets and a range of stablecoins – Nexo is well worth considering.

Put simply, Nexo allows you to earn an APY of up to 18% on your idle crypto assets on a fee-free basis. Additionally, the comprehensive range of security features contributes a great deal to the credibility of this user-friendly platform.