OANDA Prototypes asks clients for feedback on new features

It comes as no surprise that the company which back in the days launched Hackathons is now trying to harness collective tech wisdom again.

True to its reputation of an innovator, OANDA has recently launched a new website, called OANDA Prototypes, whose main aim is to receive important feedback on new features and functionalities.

The website‘s content is neatly organized in a list of the new features that OANDA’s User Experience Design and Development teams are currently working on. Each new feature is accompanied by a brief description, as well as a “View” button that opens a window allowing to explore the solution in more detail.

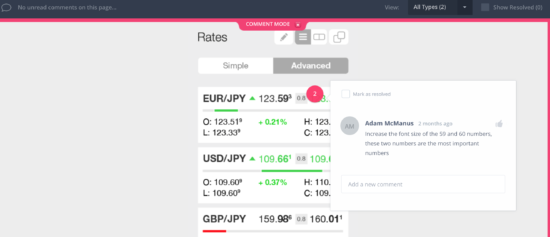

Feedback can be provided in Comment Mode – in terms of practice, this means that by clicking anywhere in the picture, one can leave his/her remarks.

The website also offers download links to fxTrade Mobile Beta Downloads. Everyone is welcome to become a beta tester.

It comes as no surprise that OANDA enables traders to demo features before their official launch – the company has been known for its efforts to harness collective wisdom. You must have heard of its Hackathons, events where teams of developers, designers, product managers and other employees interested collaborated to complete a project. OANDA Prototypes resembles this approach, as it enables a wider audience to become an integral part of the designing and development process at the company.

Some users have complained, however, of the lack of interactivity provided by OANDA Prototypes, meaning that there is no option to make suggestions and propose new ideas (like Spotware did back in the days, creating Spotware’s UserVoice where traders posted suggestions regarding cAlgo and cTrader). OANDA Prototypes indeed does not provide such a forum-like functionality. But let’s not forget that OANDA does have a forum.