Plus500 buys more of its own shares

The brokerage purchased 17,000 of its own shares in accordance with its share buyback program announced in October 2018.

Just a day after online trading services provider Plus500 Ltd (LON:PLUS) announced the purchase of 10,000 of its own shares, the company reports another transaction in its own shares.

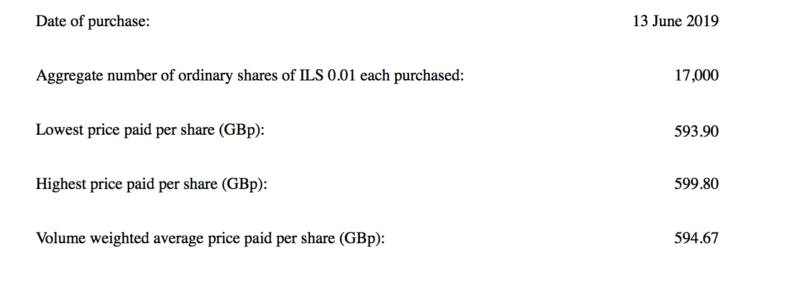

As per today’s report, Plus500 purchased 17,000 of its ordinary shares of ILS 0.01 each through Liberum Capital Limited on June 13, 2019. The transactions are in accordance with the terms of the share buyback programme announced on October 23, 2018.

Plus500 will hold the repurchased shares in treasury. Following the purchase of these shares, the remaining number of ordinary shares in issue will be 113,309,768 (excluding treasury shares), and the company will hold 1,578,609 ordinary shares in treasury. Therefore, the total voting rights in Plus500 will be 113,309,768.

Back in October 2018, when Plus500 provided a Q3 trading update, the company said its Board had approved a program to buy back an initial amount of up to $10 million of the company’s shares in accordance with the authority granted at the company’s AGM. With effect from October 23, 2018, the company has appointed Liberum Capital Limited to manage an irrevocable, non-discretionary share buy-back program to repurchase on its behalf, and within certain parameters.