Plus500 marks 80% Y/Y drop in net profit in H1 2019

In what appears to be a rather hectic period for the brokerage, it decided to relinquish the South African licence of Plus500SA Pty Ltd.

Online trading company Plus500 Ltd (LON:PLUS) has earlier today posted its results for the first six months of 2019, with the numbers being broadly in line with the Group’s earlier guidance.

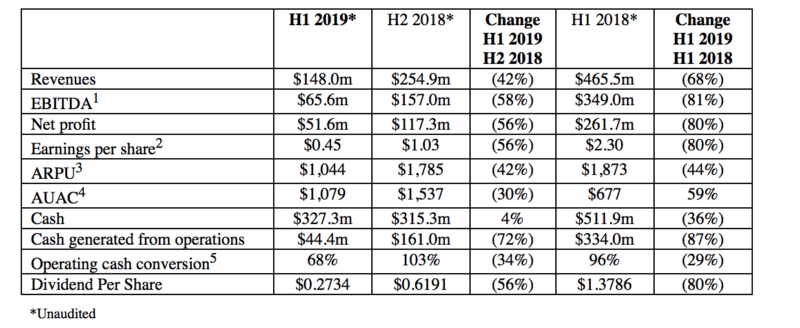

For the six months ended 30 June 2019, net profit was $51.6 million, down 80% from the $261.7 million registered in the equivalent period in 2018. Revenues in the first half of 2019 amounted to $148 million, down 68% from $465.5 million registered in the first half of 2018. The company blamed the drop on the low volatility within the first quarter of 2019.

On the brighter side, the brokerage says that the second quarter of 2019 was its strongest quarter for new and active customer metrics since the introduction of ESMA’s product intervention measures in August 2018, as New Customers numbers in Q2 2019 were 23% ahead of Q1 2019, and Active Customers numbers in Q2 2019 were 11% ahead of Q1 2019.

The Board announced an interim dividend of $0.2734 per share (H1 2018: $1.3786), a total pay-out of $31 million, representing 60% of net profit in the period. The ex-dividend date is 29 August 2019, the record date 30 August 2019 and payment date 28 November 2019.

Further, the Board will today announce a material share buyback programme to purchase up to $50 million of the Company’s shares.

Plus500 provided some updates regarding its global presence. As part of the Group’s lean cost structure, the Board has decided that one South African licence from the Financial Sector Conduct Authority (FSCA) is sufficient in order to deliver the best value to the Group. The activity of the South African licence will continue to be operated via Plus500’s Australian subsidiary, Plus500AU Pty Ltd, which also holds a regulatory licence from the FSCA, in addition to its regulatory licences from the Australian Securities and Investments Commission (ASIC) and the Financial Markets Authority (FMA) in New Zealand. The FSCA licence of Plus500SA Pty Ltd has therefore been relinquished.

Regarding regulation in Australia, Plus500 notes that ASIC received product intervention powers, similar to those possessed by European regulators, which will enable them to more directly address any abuses in the sales and marketing of a broad range of complex financial products. The company continues to assume that ASIC will seek to consult on the future rules around the industry, with potential for the introduction of certain restrictions.