Plus500 registers 487% jump in revenues in Q1 2020

The steep increase in revenues has been achieved as a result of significantly increased volatility across global financial markets, which has in turn driven higher levels of customer trading activity.

Online trading company Plus500 Ltd (LON:PLUS) today issued a trading update for the three months to end-March 2020, revealing a steep rise in revenues.

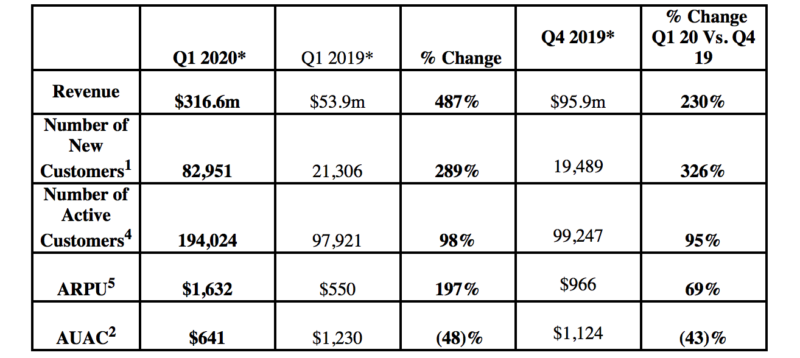

In the three months ended March 31, 2020, the Group’s revenue was $316.6 million, marking an increase of 487% compared to the same period last year. Plus500 attributed the steep increase in revenues to significant volatility across global financial markets, which has in turn driven higher levels of customer trading activity coupled with an increased rate of new customer acquisition.

The number of active customers increased to 194,024 during the period, a rise of 98% versus the first quarter of 2019. New customer acquisition improved 289% compared to the equivalent period a year earlier.

Adding to the positive news, the company saw a decrease of 48% in average user acquisition costs (AUAC) to $641 compared to the same period last year and a 43% fall compared to the prior quarter, boosting EBITDA margins.

EBITDA in the first quarter of 2020 was approximately $231.6 million, a 1,863% increase on the same period in 2019, with EBITDA margins expanding to circa 73% in the first quarter of 2020 compared to 22% in the corresponding period in 2019.

Cash balances as at March 31, 2020 were approximately $515.6 million (31 December 2019: $292.9m), reflecting very strong cash conversion during the quarter.

The Board reiterates Plus500’s shareholder returns’ policy to return at least 60% of net profits to shareholders (distributed through a combination of dividends and share buybacks, with at least 50% being made by way of dividends). This policy applies to net profits on a half-yearly basis. The Board will continue to assess the availability of any excess capital and prioritise its use.

In the first quarter of 2020, Plus500 repurchased an aggregate of 1,955,237 Ordinary Shares for a total consideration of $22.2 million, at an average share price of £8.90; this comprised 749,854 Ordinary Shares repurchased for a total consideration of $8.8 million, at an average share price of £9.06, as part of its $50m share buyback program that ended on February 3, 2020 and 1,205,383 Ordinary Shares repurchased for a total consideration of $13.4 million, at an average share price of £8.79, as part of its $30m share buyback program that commenced on February 12, 2020.

The final dividend for the year ended December 31, 2019 of $40.8 million, representing $0.3767 per share, which went ex-dividend on February 27, 2020, is payable on July 13, 2020.

Regarding performance in the second quarter of 2020, Plus500 says that the first days of Q2 2020 have seen continued heightened levels of volatility. However, the brokerage says it is difficult to forecast whether this will persist.

As a result of the exceptional Q1 performance, revenue and profitability for the full year are expected to be substantially ahead of current consensus expectations. This is in line with earlier issued forecasts.