Polkadot product survives beating in crypto asset management

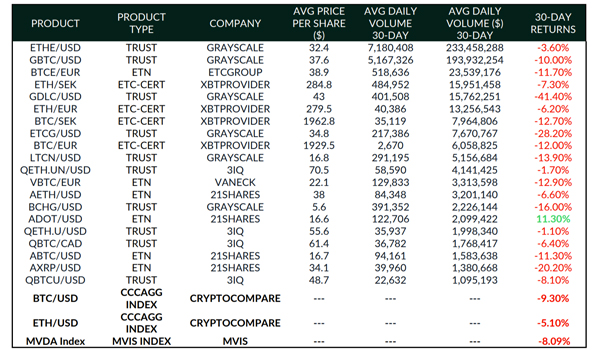

21Shares’ ADOT single-asset Polkadot product was the only product to see positive returns (11%) among the largest products by volume.

CryptoCompare has published its September edition of Digital Asset Management Review, a month that saw the price of Bitcoin and Ethereum fell 9.1% and 14.7%, respectively, up to 9/24 on regulatory concerns from the U.S. SEC and China’s full-on ban on crypto trading.

Digital asset investment products followed sentiment, but CryptoCompare estimates there is room for upside going into the last quarter of 2021 on the back of a rise in volumes in September coupled with positive weekly inflows for the first time in 3 months.

The highlights for the September edition include:

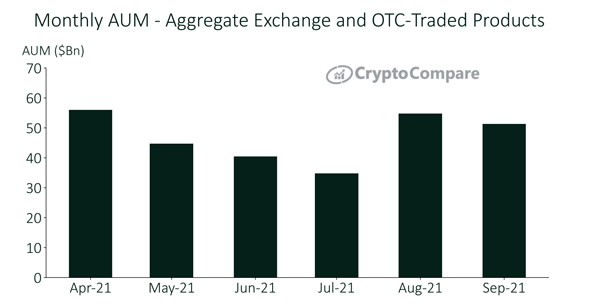

– Bitcoin AUM fell 7.8% in September to $35.1bn – its lowest share this year (67.9% of current total AUM).

– Ethereum-based products reached their highest market share of AUM at 25.9% – movement that suggests investors are seeking alternatives to Bitcoin for cryptocurrency exposure.

– Grayscale’s Ethereum Trust (ETHE) was the most traded digital asset product in September – with average daily volumes increasing 29.0% to $250mn (42.4% market share) – dethroning Grayscale’s Bitcoin Trust (GBTC) for the first time ever.

– Net flows turned positive in September after 3 months of net outflows.

– ETNs were the only product type to experience an increase in AUM in September, growing 7.2% to $3.7bn.

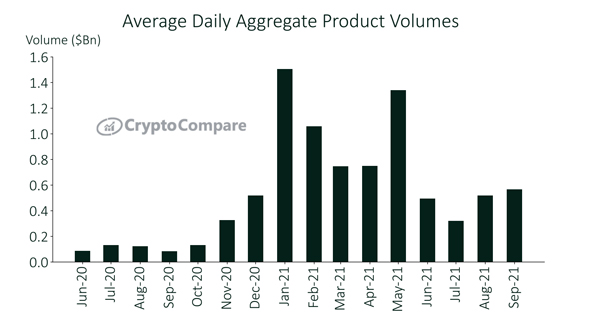

Aggregate daily volumes increased by an average of 4.1% from August to September, with average daily volumes standing at $566mn. Since August 2021, total AUM across all digital asset investment products has decreased 6.3% to $51.3bn.

Grayscale’s Bitcoin trust product (GBTC) lost its majority market share of trust product volume in August at 40.1%, with ADV for GBTC and Grayscale’s ETHE standing at $201mm (down 8.6%) and $225.3mn (up 29.9%) respectively.

Both BTC and ETH-based products experienced losses over the last 30 days, ranging from -15% to -6% for BTC products and -8% to -1% for ETH products.

21Shares’ ADOT single-asset Polkadot product was the only product to see positive returns (11%) among the largest products by volume. Grayscale’s GDLC basket product experienced a loss of 41% over the period.

The August edition of the of Digital Asset Management Review pointed to a sharp rebound, with prices of Bitcoin and Ethereum rising 49.7% and 57.4% respectively.

Total AUM across all digital asset investment products hadincreased 57.3% to $54.8 billion since July 2021, with average daily aggregate product volumes rising 46.6% to $544 million.

The rebound had been triggered by the implementation of the Ethereum London Hard Fork on 5 August, according to CryptoCompare, which found average daily trading volumes increasing by 46.6% across all exchanges and OTC-traded investment product markets.