BoE: Bank of England Could Lower Rates Next Week

ATFX UK Chief Market Strategist Alejandro Zambrano examines the markets and charts the currency movements in the run up to the Bank of England Rate Meeting next week, looking at a strong performance of GBP pairs

Written by Alejandro Zambrano, Chief Market Strategist at ATFX UK.

With eight days to the January 30 Bank of England rate meeting, the rate markets are anticipating the central bank to ease the interest rate from 0.75% to 0.50% with a likelihood of 61%.

Weak GDP growth and comments from the head of the bank, Mr. Mark Carney, and other Bank of England members is the reason why the probability of rates turning lower has risen in the last few weeks.

Just four weeks ago, the likelihood of a rate cut was at a low 5%. In this article, we will outline the reasons for the change in mood, and also what currencies pairs to watch, as the British Pound is poised to move lower on a rate cut.

Why could the Bank of England Cut Interest Rate in January?

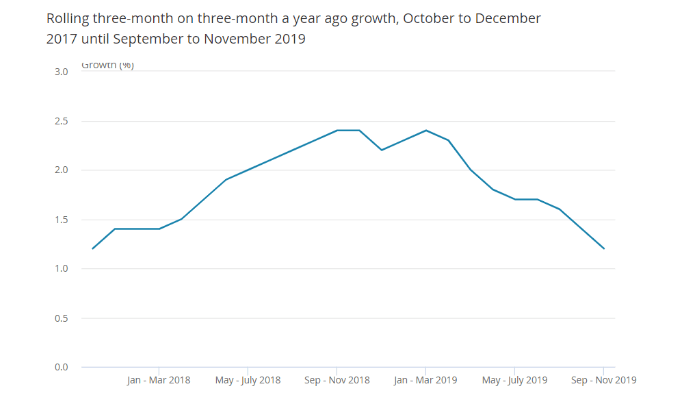

On January 13, UK GDP data for November showed that the economy contracted by 0.3% in November, an outcome that was lower than the zero-growth anticipated by economists. The biggest drag was Manufacturing that contracted by 1.7%, while construction rose by 1.9%. But more importantly, the largest sector of the economy, the service sector, has seen dwindling growth, as seen in the chart below.

Service Sector Rolling three-month Growth

Source: ONS

Leading indicators are also not suggesting the economy will bounce back soon. The manufacturing and construction sectors should continue to contract.

The Markit Services PMI managed to climb above the 50 levels vs. an anticipated outcome of 49.2. However, it is not enough to suggest that the service sector is turning higher. The Construction PMI index dropped to 44.4 and lower than the 45.9 anticipated, a reading below 50 indicates that the industry is contracting. Manufacturing PMI is also struggling.

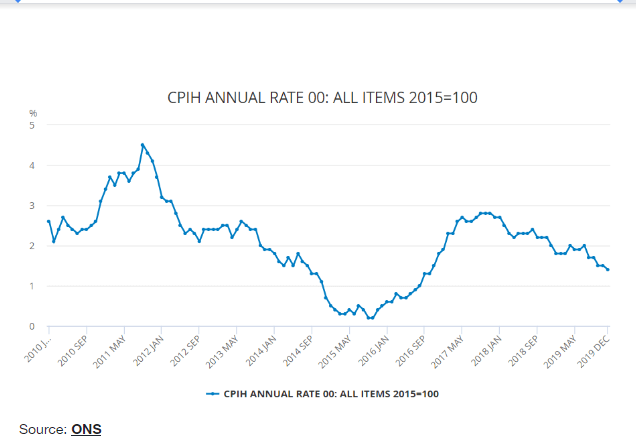

UK Inflation Dropping Sharply

Annual head inflation has also turned sharply lower. By December 2017 inflation was at 3.1%, while at the latest reading, it was at 1.4% and much lower than the Bank of England’s two percent target.

Core inflation is also trending sharply lower. In the December report inflation dropped sharply to 1.4% vs. the 1.7% projected, and much lower than the 2.7% level seen in September 2017.

Overall, soft economic activity and with no signs of bouncing, and fast slowing inflation rates looks to force the hand of the Bank of England, and Mark Carney.

UK Headline Inflation

Not all in the economy is bad, and the unemployment rate is at a low of 3.8%, and wage growth is at a healthy rate of 3.2%. However, comments by BoE members: Silvana Tenreyro and Gertjan Vlieghe, are suggesting that the central bank is moving closer to cut rates.

In the December rate meeting, two members voted to cut rates, while 7 opted to keep rates unchanged.

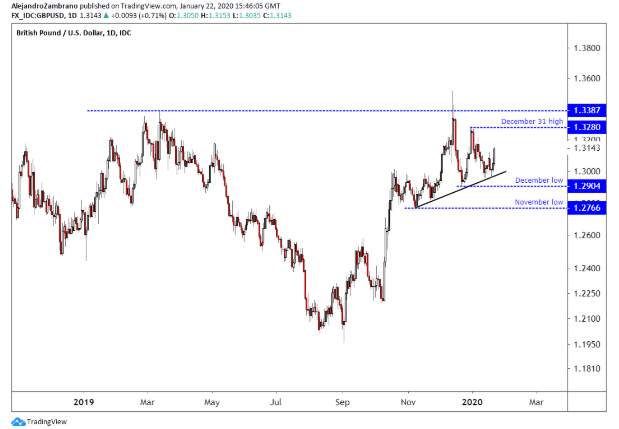

GBPUSD Remains Bullish Above the December Low

The GBP to USD exchange rate trend remains upwards above the December low of 1.2904, and as long as the price trades above this level the price might be able to reach the December 31 high of 1.3280. If the Bank of England cuts rates the price might slide below the December low and reach the November low of 1.2766.

GBPUSD Daily Chart

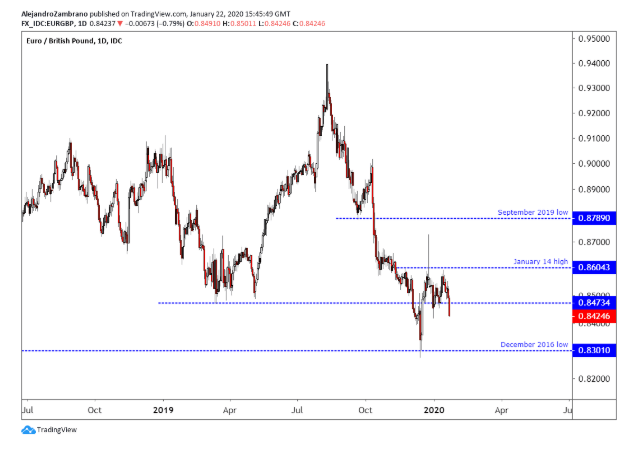

EUR to GBP

The EURGBP exchange rate has declined over the last few days, and that means that the British Pound has strengthened.

If the Bank of England, BoE, indeed reduces rates then that might send the EUR to GBP rate higher. But the price will need to take out the January 14 high of 0.8604 to have a long-lasting effect on the pair, until that happens the price might revisit its December 2016 low of 0.8301.

EURGBP Chart

This market update has been produced by a third party (Red Castle Ideas LTD), for general information purposes only, and is not indicative of future results. AT Global Markets UK Ltd (ATFX UK) takes no responsibility for its accuracy or completeness. Any opinions expressed do not reflect those of ATFX UK. This information does not take into account your personal circumstances or objectives, and should therefore not be interpreted as financial, investment or other advice, or relied upon as such. You should seek independent advice before making investment decisions. Reproduction of this information, in whole or in part, is not permitted. Please note: If you are a Professional client, you are not eligible for negative balance protection and you could lose more than your initial deposit.

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.