Fullerton Markets CEO Launches Second Thai Book

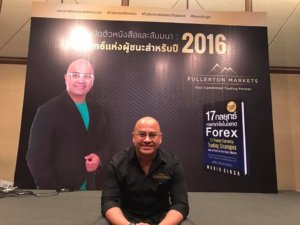

Fullerton Markets today announced the release of CEO Mario Singh’s second Thai book in Bangkok.

Hailed as the “Ultimate Guide to Forex Trading” in industry circles, Mario’s book “17 Proven Currency Trading Strategies” is loaded with practical advice and solid strategies to help traders of all levels.

The book also contains a “Trader’s Profile” which is an interesting test to ascertain a trader’s personality and the best strategies to employ for maximum profit. As an example, a person who is identified as a “Swing Trader” would employ the “Trend Rider” and “Power Ranger” strategies for maximum gain.

The Thai book was launched at the Book Expo Thailand 2016, held at Queen Sirikit Convention Centre in Bangkok.

Flying in for the launch activities, Mario commented: “I am truly humbled by the support and encouragement from all our friends and partners in Thailand. I didn’t expect such a huge turnout, especially since Thailand is going through a mourning period for King Bhumibol. I truly hope that this book will add massive value to all traders in Thailand.”

The book launch activities in Bangkok included a panel discussion and a full day seminar where Mario covered strategies and an overview of both the global and the Thai economy for 2016.

The book is endorsed by many industry titans, including Kathy Lien, Managing Director of BK Asset Management and Dr Mark Mobius, Executive Chairman of billion dollar hedge fund Templeton Emerging Markets Group.