IS Prime Launches New Multi-Asset Trading and Risk System with Reactive Markets

IS Prime, part of ISAM Capital Markets, has launched a new trading GUI and risk system with Reactive Markets, particularly aimed at its growing client base of FX hedge funds and asset managers.

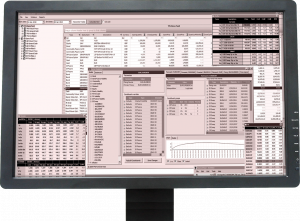

This latest development from the FCA regulated Prime of Prime allows clients to combine their position management, charting, technical analysis, risk management and trading across FX, indices, cryptocurrencies and precious metals. Alongside this, clients are able to access trade analytics including slippage and latency statistics enabling them to trade more efficiently and effectively on IS Prime’s market-leading liquidity.

The partnership with Reactive Markets combines features of IS Prime’s back office portal, Terminus, and gives clients a more streamlined trading experience. Clients can view and manage their risk in a single place, whether using IS Prime’s desktop or mobile app.

Jonathan Brewer, Managing Partner at IS Prime comments, “This is a significant strategic development for IS Prime, enabling us to expand our ever-growing number of FX hedge fund and asset manager clients in addition to providing an enhanced offering for our existing client base of banks, brokers and professional traders. It further cements our position as a global market-leading Prime of Prime.”

Barry Flanigan, Head of Distribution and Liquidity, IS Prime adds, “Reactive Markets offers cutting-edge, cloud-based technology which complements our own proprietary infrastructure. Our partnership with Reactive Markets enables us to provide a seamless user experience and expand into new asset classes. Simple to install, it also enables us to scale client distribution, including new trading via a REST API and analytical tools tailored to our client base. It is a great addition to our offering.”

Phil Morris, Co-Founder, Reactive Markets says, “Reactive Markets is delighted to be partnering with a market leader like IS Prime as we roll out Crossfire, our cloud-based high-performance trader desktop. It’s been a privilege to work with the IS Prime team whose input has been invaluable in helping us build our functionally rich multi-asset trading and analytics UI. We are very excited about what the future holds for this partnership and look forward to continuing to deliver innovative trading technology solutions for IS Prime.”

Formed in 2019, Reactive Markets is an innovative trading technology company that specialises in ultra-low latency price streaming for FX and Digital markets. Reactive Markets has built a cutting edge streaming network that helps banks, brokers and market makers scale with efficient liquidity distribution over API and UI. Trading desks can access all of their FX and cryptocurrency liquidity through a single API and a secure, globally accessible, cloud-hosted trader desktop.

IS Prime offers full-service brokerage and execution via its cutting edge proprietary technology. As a Prime of Prime, IS Prime provides aggregated pricing sourced from Tier one institutions, settled through the group’s bank Prime brokers. ISAM Capital Markets also includes IS Prime Hong Kong (regulated by the SFC) and risk management specialist, IS Risk Analytics.