US April retail sales could deepen the losses – Guest Analysis

ATFX (AE)’s Ramy Abouzaid believes that the upcoming figures might be ignored – to a certain degree – by the financial markets – given the optimistic outlook backed by re-openings of major economies.

By Ramy Abouzaid, ATFX (AE) Head of Market Research

With mandatory shutdowns all over the states, the data for retail sales going out on Friday will surely reflect the effect of COVID-19 on the US economy. Even with the re-opening process in some states, the measurements taken to contain the spread – such as social distancing – will further limit a fast rebound in sales while a high unemployment rate would sharply depress retail sales components.

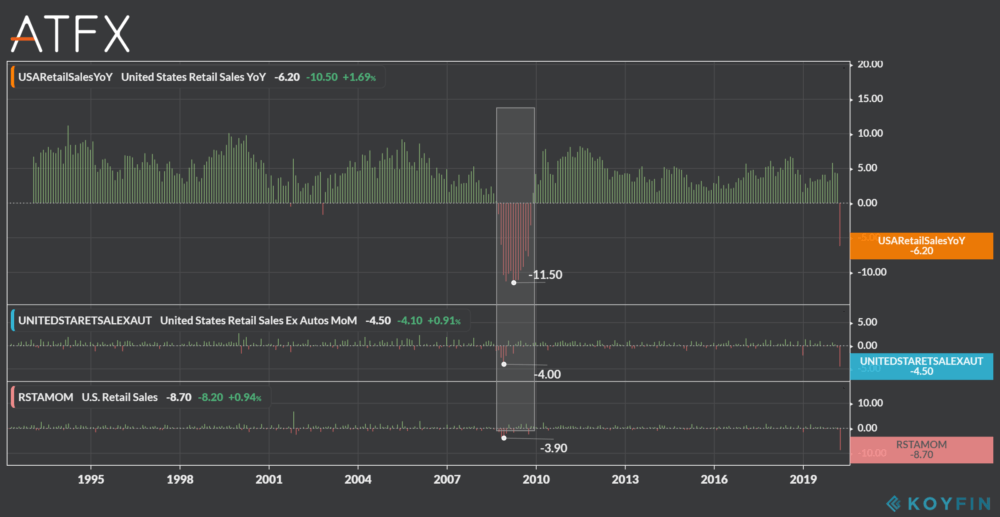

A quick look on March figures, many analysts believed that the numbers were bad, but it could’ve been worse. While being the worst monthly figure on record with a fall of 8.7%, it’s rational to believe that restaurants and bars, for example, should’ve witnessed a fall greater than the 26,5% recorded, while gasoline station sales fell by 17.2%, again it’s rational to see worse figures. Clothing sales were the worst with a fall of 50.5%, while furniture sales went down by 26.8%.

What might have helped March’s report – if we can actually say that – was two main factors; panic buying and shutdowns taking place in the second half of the month. We see that food sales went up to 25.6%, while health spending rose to 4.3%, Nevertheless both factors It did not change the negative nature of April’s figures.

Over the month of April, lockdowns were across the country and millions of workers lost their jobs – Total nonfarm payroll employment fell by 20.5 million in April, and the unemployment rate rose to 14.7% – we believe that the figures will be drastically worse, while retail shoppers limiting their spending.

April’s Retail Sales report will likely show weaker figures. We are expecting to see a drop by 13.5%, after a decline of 8,7% in March. Gasoline component expected to witness a decline of 22% in April, while it fell to -10.5% for the month of March, and -3.4% in February, while construction spending would face a drop of 12%. It is also important to mention that vehicle sales fell to an 8.6 million from 11.4 million in March and 16.8 million in February.

We still believe that the upcoming figures might be ignored – to a certain degree – by the financial markets – given the optimistic outlook backed by re-openings of major economies, such as Europe and the US. It seems that the most likely scenario, accepted by the markets, that businesses will re-open and the millions laid-off workers would return to their jobs.

Sentiments in the markets did alternate the truth many times, but with the current scenario, we cannot bet on that. A new wave of the virus outbreak could happen again when shops re-open, this would bring us back to ground zero and could lead to a longer recovery period even with the government and Federal Reserve support.

The V-shape recovery in retail sales seems like a “too good to be true” scenario, and going back to normality seems like a challenge even after COVID-19, even with respecting the measurements taken to contain the Covid-19 spread and social distancing we believe a full recovery could take many months to happen.

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.