Premier FX cannot be rescued, Joint Administrators report

A report by the Joint Administrators of Premier FX Limited indicates suspected criminal activity at the company and no chances of rescuing the business.

More than two months after the UK Financial Conduct Authority (FCA) confirmed the appointment of Dina Devalia and Peter Hart of PFK Geoffrey Martin & Co. as Joint Administrators in respect of Premier FX Limited, the Companies House service has finally managed to process and make public a document that provides some details around the work of the Administrators.

The 88-page Statement of Proposal, prepared by the Joint Administrators of Premier FX Limited, sheds light on the rather complex situation that the FCA and the Joint Administrators have to deal with.

The document provides details on the situation before the administrators’ appointment. Peter Rexstrew was the sole director and shareholder at the time of his death in June 2018. Following his death, his two children – Katy Grogan and Charley Rexstrew, were appointed directors of the company on June 18, 2018.

Shortly after that, on July 27, 2018, all employees were “verbally made redundant”.

On August 13, 2018, on the application of the FCA, the High Court appointed Peter Hart and Dina Devalia of PKF Geoffrey Martin & Co as Joint Administrators of the company. The FCA took action to apply to the Court for the Administration Order as the company appeared to be unable to pay its debts and was cash flow insolvent.

In addition, the FCA are very concerned that there was criminal activity taking place at the company in relation to missing funds and the FCA are investigating the business undertaken by the company.

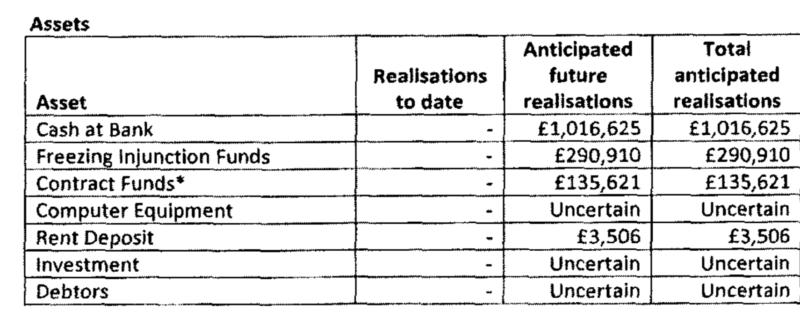

The Joint Administrators believe that the company cannot be rescued as a going concern, given the extent of the liabilities and the lack of funds to meet outstanding customer obligations to enable trading to continue. The administrators believe that a better result would be achieved for creditors if the company were wound up without being first placed into administration.

The Joint Administrators have a statutory obligation to file a report with the Insolvency Service regarding the conduct of the Directors that held office in the three years prior to the Administration. The content of this report is confidential.

The funds were not held in segregated client accounts. The company operated beyond its regulated activity, being simply money remittance. This is the reason why the Financial Services Compensation Scheme (FSCS) has announced it will not protect money held with the company.

The Joint Administrators have processed around 244 claims received by customers of the company to date.