PrimeXM trading volumes drop 18pct in December 2021

PrimeXM has reported weaker trading volumes for December 2021, in line with other institutional and retail platforms that saw the activity of their clients dropped compared to a month earlier.

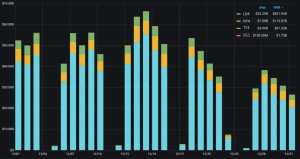

The provider of FX bridge aggregation and institutional hosting solutions today revealed an average daily volume (ADV) of $45.65 billion, down 18 percent month-on-month from $55.92 billion reported back in November. The highest trading volume of the month was recorded on December 15 with $66.34 billion in daily turnover.

Having hit the $1.23 trillion milestone the previous month, total turnover at PrimeXM took a step back in December, coming in at $1.05 trillion, or 15 percent less than it was in November.

A notable drop in PrimeXM’s operational metrics was seen across its Gold instrument, though it retained its top spot as the most traded asset. While the yellow metal accounted for 30 percent or $367 billion of November’s overall traded volume, XAUUSD spot volumes dropped by over 34 percent to $272.5 billion.

FinanceFeeds webinar: Expert panel to discuss market data for multi-asset brokerages

EURUSD turnover was the 2nd most traded instrument with $136 billion which was a significant drop from the previous month’s $188 billion.

The US30, otherwise known as the DJ30 derivative contract, took the third position (11.4% of all volume) with $128 billion in monthly turnover.

The total number of trades rose by nearly 24 percent over a yearly basis, coming in at 31.1 million transactions compared to just 25.17 million in December 2020.

Other business highlights show that London LD4 remains the strongest across PrimeXM’s four major data center locations, with 81 percent of trades exchanged hands there, more than $852 billion in notional value.

Another $115 billion has passed through NY4, while the data center in TY3 has processed $81 billion. PrimeXM’s newly established SG1 data center has seen more than $1.75 billion in trading activities in its fourth month since inception.

PrimeXM revealed last month that its hosted servers were targeted using ransomware. According to the company, less than 3% of hosted clients experienced difficulties on their trading operations, but its team of engineers managed to quickly restore the servers to their usual performance and correct any issues caused by the ransomware attack.