Prudential Regulation Authority to be legally integrated into Bank of England

Tier 1 prime brokerage desks at London’s dealers that are responsible for 49% of all global FX order flow are regulated by the PRA.

It seems that the days marked by concerns over the ‘twin peaks’ model are so far away, when in fact they are not, and, now, another structurally important change is in store for the UK financial services sector regulation.

Effective March 1, 2017, the Prudential Regulation Authority (PRA) will be brought within the single legal entity of the Bank of England, as the PRA Board will be replaced by the Prudential Regulation Committee (PRC). The changes are happening under the Bank of England and Financial Services Act 2016.

What will change?

- Effective March 1, 2017, the PRA’s most important supervisory and policy decisions will be made by the PRC. The PRC replaces the PRA Board as the governing body of the PRA as part of the Bank of England.

- The PRC will be on the same legal footing as the Monetary Policy Committee and the Financial Policy Committee.

- The PRA’s legal status as a subsidiary company will be terminated.

Why is it important?

Because the PRA is responsible for the regulation of the biggest financial institutions, including Tier 1 banks whose prime brokerage desks are responsible for 49% of all global FX order flow and decide to extend (or not!) liquidity to OTC markets.

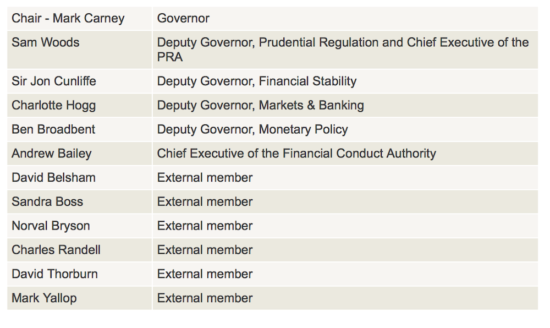

The PRC members

Then and now

When, back in April 2013, the Financial Services Authority (FSA) was replaced with the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA), the PRA got a number of statutory objectives, including the promotion of the safety and soundness of all the firms it supervises. The regulator was required to focus chiefly on the harm that firms can cause to the stability of the UK financial system and to prevent such harm from happening.

After the latest raft of reforms, the statutory objectives of the PRA remain unchanged. The PRA’s operational independence will be preserved, while the changes are aimed at the promotion and the sharing of knowledge, expertise, and analysis throughout “One Bank”.