RBNZ Cut Interest Rate To All Time Low

Reserve Bank of New Zealand cut interest rate to 2.00%, Kiwi surprisingly rallied more than 150 pips!

By Wayne Ko, Head of Research & Education at Fullerton Markets

RBNZ followed the footsteps of RBA and BOE, slashed its interest rate to an all time low of 2.00%. The cut was prompted by a persistently low inflation, currently at 0.4%, way off RBNZ’s target range of 1% to 3%. The Kiwi had held up well above 0.71, even after 2 rate cuts this year. With a strong currency, RBNZ is finding it tough to hit their inflation target.

NZD/USD jumped more than 150 pips immediately after the interest rate announcement. The 25 basis point cut was not enough for some investors, who were expecting a 50 basis point cut. However, RBNZ Governor Graeme Wheeler said in his statement, “further easing will be required to ensure that future inflation settles near the middle of the target range”. A strong signal was sent by the use of “will be” instead of “may be” in Wheeler’s statement. The market eventually adjusted to the prospect of further rate cut. NZD/USD fell back below 0.72, back to the level prior to the rate cut.

Fed’s delay in raising its rate has become a challenge to central banks that are battling low inflation. Just after a promising Non-Farm Payrolls, last Friday’s retail sales data is a disappointment. Casting shadow and doubts on the possibility of a rate hike this year. This week, investors will be looking at US CPI data and FOMC Meeting Minutes for guidance.

With the poor retail sales, the Core CPI is unlikely to out-perform the market expectation of 0.2%. If the FOMC Meeting Minutes indicate Fed is still open to a rate hike this year, it should provide some support for the greenback. Failure to do so, market may price out rate hike this year or even push back expectation to second half of 2017.

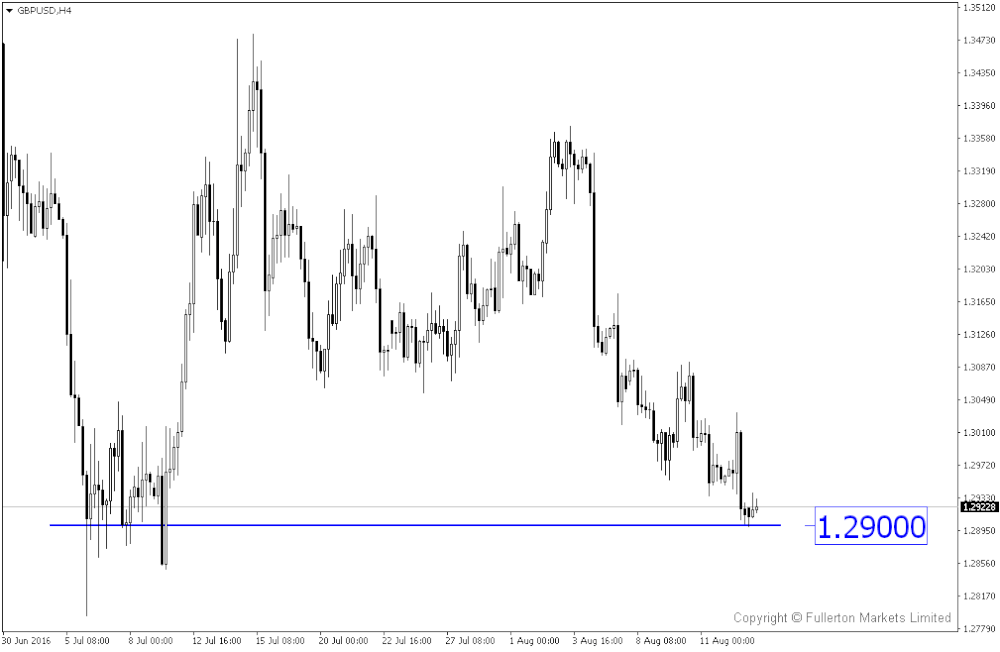

After a slew of bad data, the sterling has become the worst performer against the greenback. The pound has weakened 3% against the dollar since BOE cut its interest rate early this month. The short-term bulls may be looking for some positive data in the upcoming CPI, employment and retails sales to take some quick profits off the current key support of GBP/USD around 1.29.

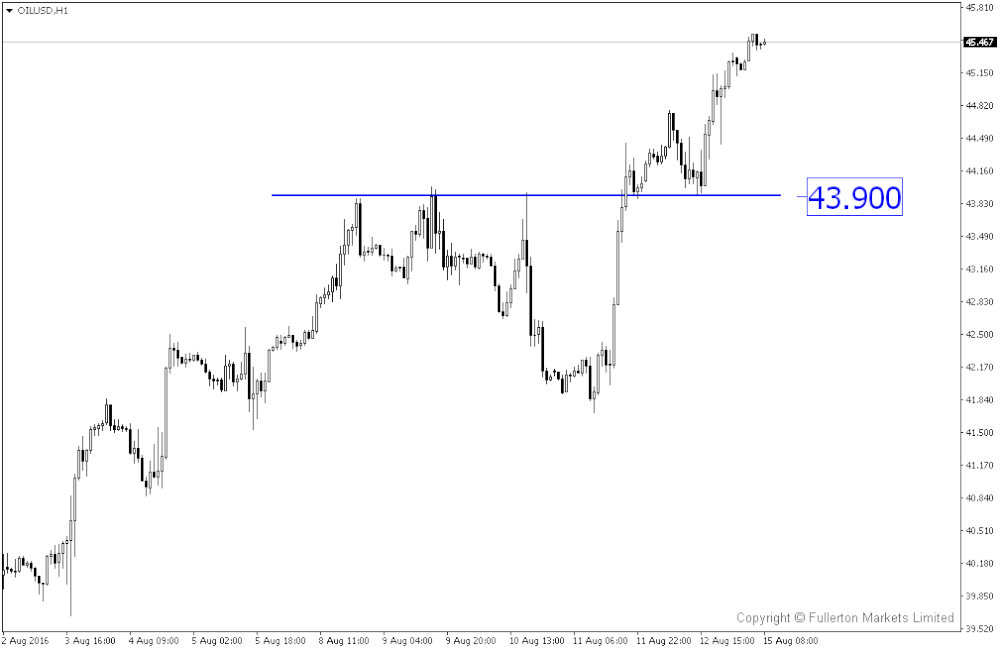

Oil price has seen a decent recovery after bouncing off the 4-month low. As mentioned in our last week’s report, the chart has shown signs of a technical reversal. WTI is now heading towards $46 a barrel. The recent rally is sparked by Saudi Arabia expressing willingness to discuss stabilising the oil price at informal OPEC discussions next month.

Based on our past observations, such rally is unlikely to sustain unless there is concrete decisions being made. We feel the market may continue to be hopeful of positive outcome in the near term.

Our Picks

GBP/USD – Slightly bullish. We expect the key support of 1.29 to hold, unless this week’s UK CPI, employment and/or retail sales show signs of further deterioration.

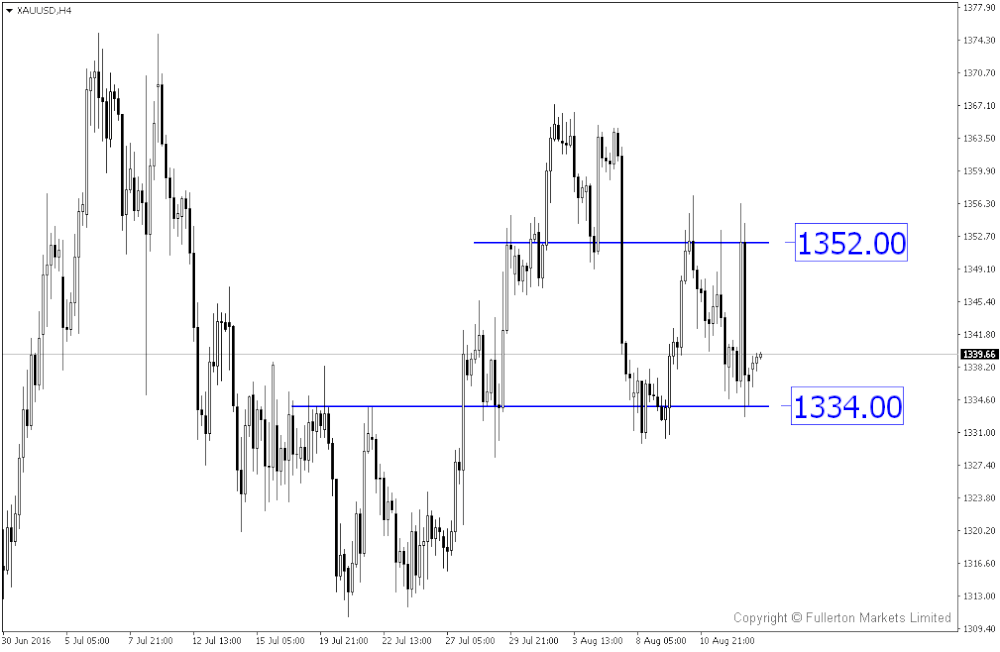

XAU/USD (Gold) – Slightly bullish. Gold is trapped in a range. We believe rate hike expectation has been scaled back and expect the price to continue to move within 1334 and 1352 in the near term.

OIL/USD (WTI Oil) – Slightly bullish. The reversal signal highlighted last week has come to realisation. The uptrend is likely to continue near term. Possible to buy at dips.

Top News This Week (GMT+8 time zone)

UK: CPI y/y. Tuesday 16th August, 4.30pm. We expect figures to come in at 0.4% (previous figure was 0.5%).

US: CPI m/m. Tuesday 16th August, 8.30pm. We expect figures to come in at 0.1% (previous figure was 0.2%).

UK: Retail Sales. Thursday 18th August, 4.30pm. We expect figures to come in at -0.1% (previous figure was -0.9%).