Ripple may benefit from new Supreme Court makeup in XRP lawsuit

“The major questions doctrine holds that courts generally should not defer to agency statutory interpretations that concern questions of “vast economic or political significance.”

As the public awaits the court’s upcoming ruling on what may be the SEC’s final attempt to keep the Hinman-related documents away from Ripple, the public looks for clues as to how the case will play out.

One key influencer within the XRP community is John Deaton, the attorney who successfully acquired Amicus Curiae status for the XRP Holders in the SEC v. Ripple case and is currently representing over 67,000 of them.

“Major questions doctrine” weakens SEC’s statutory interpretations

John Deaton, who was a Twitter following of more than 200,000 users, has recently referred to attorney-influencer James K. Filan to remind the public that one should be thinking about the bigger picture when looking at the precedent-setting case that is SEC v. Ripple.

Deaton wrote the tweet in the context of the recent Supreme Court ruling restricting the U.S. Environmental Protection Agency’s (EPA) power to regulate carbon emissions.

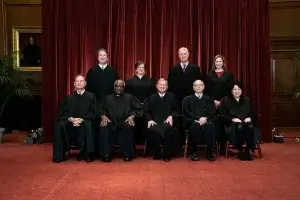

The current makeup of the SCOTUS, which has also recently overturned Roe v. Wade, may be more prone to weaken the power of government agencies. This could be a threat to the SEC as the financial watchdog continues its regulation-by-enforcement practice. In case of an appeal, the current environment in the United States may be favorable to the defendants.

On 30 December 2020, one week after the filing of SEC v. Ripple, James K. Filan wrote: “When it comes to SEC v. Ripple, and all the different federal agencies trying to regulate crypto, start thinking about the bigger picture, like Chevron deference, the major questions doctrine and our new Supreme Court makeup.

“The major questions doctrine holds that courts generally should not defer to agency statutory interpretations that concern questions of “vast economic or political significance.” Why should just one agency get to decide questions of “vast economic or political significance?”, he continued.

“With the rapid evolution of crypto, why should one agency, wether SEC, FINCEN or DOJ get to set the rules instead of having specific Congressional guidance? Especially when they come to different conclusions. We can’t look at individual cases without more specific guidance. Crypto, like Ripple, is treated differently depending on the country. Yet how this case is decided is of worldwide economic and political importance. We can’t have one-off decisions. We need guidance if the U.S. is going to compete in this space.”

The question now is if crypto will be deemed as a question of vast economic or political significance to fit the “major questions doctrine” argument.