Saxo Bank prepares SaxoTraderGO Mobile app improvements

The first set of enhancements will be released in January and concerns improvements to the navigation and search.

Online trading and multi-asset specialist Saxo Bank is planning to bolster the functionalities of its SaxoTraderGO Mobile application. The bank said today that traders can look forward to a number of design and usability enhancements to the SaxoTraderGO Mobile platform over the coming months, with the first enhancements set to be released in January. These will concern the navigation and search functionalities.

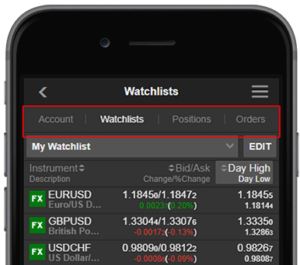

The improvements to navigation will offer quick navigation between the most used sections of the platform:

The improvements to navigation will offer quick navigation between the most used sections of the platform:

- Watchlist;

- Positions;

- Orders;

- Account.

The search enhancements will result in the “Search” function delivering recently viewed instruments alongside a search input field for quick and easy access.

In the meantime, Saxo continues to enhance the SaxoTraderGO trading platform. In October, the bank announced the launch of a new, comprehensive account functionality on SaxoTraderGO for its global client base. The new account section provides Saxo’s clients with a number of graphical overviews to illustrate how their account value, profit/loss, returns and bookings have changed over a selected time period. It also provides graphical representation of a client’s current and historic portfolio allocations as well as exposures to different asset classes and currencies. Clients can further choose to view an in-depth analysis of their P/L, bookings and cost by trading instrument, specific segment or sector.

Also in October, the bank informed its clients that new chart tools would be made available. These include Linear Regression Lines which represent a new statistical chart annotation tool used to predict future values from past values. In graphical terms, this is a straight line that best fits the prices between a starting price point and an ending price point.

Since the launch of SaxoTraderGO in May 2015, Saxo has kept adding new instruments and functionalities to its multi-asset and multi-device platform. Clients can now trade over 35,000 instruments across different asset classes and have access to tools and features aimed at facilitating greater transparency, control and price improvement on every trade.