Saxo Bank’s Benny Johansen: “OpenAPI in banking – Why now?”

Saxo Bank senior executive Benny Johansen goes into great detail on open trading platforms. “Until recently we have not seen the same need for open collaborative systems and standards in the area of financial trading interfaces”, he says

By Benny B Johansen, Senior Director & Head of OpenAPI, Saxo Bank

Exactly one year after the launch of OpenAPI, I am once again in Asia to speak at a number of industry events hosted by Saxo Bank, this time in Shanghai, Singapore and Sydney. While last year was all about the launch of Saxo Banks OpenAPI, my chosen is how OpenAPI’s are a only one aspect of the wider Open Banking paradigm.

Being a software architect and having worked for over twelve years in Saxo Bank, which pioneered the White Label model within financial services, I don’t really find API’s and Open Banking standards very “disruptive” or surprising. In fact, what I find most interesting is, “what took us to long”.

Over twenty years ago, I was fortunate enough to be the architect and project manager for the development of a standard and software framework for the exchange of hearing related information. The work was commissioned by three Danish and a Swiss hearing instrument manufacturer, and it was tremendously successful!

Just a year after the launch of the standard, it was adopted by about 30% of the world’s hearing aid producers, and two years later more than 50% of all digital hearing aids were fitted with software adhering to the standard. Today the standard is managed and developed by “HIMSA” and according to their website the adoption has increased to 90% (see here)

This was back in 1993, and the effort to standardize was not even government mandated, rather it was a completely voluntary undertaking. So why then is it, that only now the topic of open standards and Open APIs is starting to gain traction in the financial services industry?

On reflection I think perhaps it is because only now are we starting to realize that open apis and ways to collaborate are no longer a “nice to have”; They are becoming a “must have”.

The push towards an open standard in the hearing world was actually caused by the introduction of the new digital hearing aids.

While the older analog hearing aids could be adjusted by turning a couple of dials with a screwdriver, the new digital hearing aids had to be connected to a computer. If an audiologist were to sell me a GN Resound hearing aid, she would start the GN Resound software and input all measurements taken about my hearing. She would then use a special cable to connect the digital hearing aid to the computer, let the fitting program calculate the best settings, make various adjustments, and then press a button on the computer to send the optimized settings to my hearing aids.

Great,.. except, if I then asked to try the new model from another provider, the audiologist would then have to repeat all of the input of my measurements again, start another program, connect the other device to another hardware box with another set of cables and so on.

Adding to this complexity was the fact that that the medical and fitting data related to a clinics patients would be spread between the many different programs, developed by each of the hearing aid manufacturers.

What the industry found was that although the new digital hearing instruments were better, many audiologists were reluctant to sell them, because they simply did not want the inconvenience of a desk cluttered with different programming boxes and cables; nor have to deal with problems related to the incompatibility of fitting-software, or the duplicate inputting of data.

This resistance significantly limited the market adoption of the new digital devices, and therefore, in order for the industry to progress, companies, who were otherwise competitors, agreed to collaborate and agreed on a shared set of standards.

Until recently we have not seen the same need for open collaborative systems and standards in the area of financial trading interfaces. Previously, it would be “nice” if a user could choose between multiple applications for trading on his account, and it would be useful if he could grant a robo-advisor of choice access to his portfolio and have it analyse or perhaps even automatically rebalance his portfolio. However, it was not necessary for the large players to make this available, as it was imperative for the big hearing aid manufacturers to ensure that it was practical for dispensers to sell the new digital hearing aids.

But that is about to change. Today there is a lot of talk about Fintech and how it is disrupting the industry and existing business. In reality a bigger change is the move from a ‘service’ economy to an ‘experience’ economy. The biggest issue for established financial institutions today is not that fintechs bring innovation to the market, but it is that many of the financial services as they are delivered today, are just that, financial services. And services are being commoditized at a very rapid pace.

The move towards commoditization and thus lower margins was nicely explained in the book “The Experience Economy” (Joseph Pine & James Gilmore), first published in 1999, and later updated and republished in 2013. One of the first examples provided is illustrated below:

As the drawing shows, the price for the coffee beans used to produce a cup of coffee is only about 2 cents, or only about 1% of the value that a coffee drinker is willing to part with in a standard cafeteria (USD 2) or at a specialist coffee shop (5 USD).

Over time coffee beans have been reduced from being a somewhat unique product, sold to end customers, to a standardized, commoditized product, sold only to a few large distributors of ground coffee. While the good (ground coffee) is further up the value chain, it too has been largely standardized and commoditized and hence is subject to significant price pressure. The price increase from 0.30 to 2.0 USD represents the increased perceived value of the service of providing a hot cup of coffee, but even this is now considered to be an undifferentiated commodity, and thus subject to significant price pressure.

The parallel in our industry today is the expectation that can perform an online trade (and thus any trade) at very low costs.

The antidote to this is to enhance the core service offering with something extra and turn it into an experience. In our coffee example this “extra” is often the way the coffee is being brewed, the premium surroundings and the way it is being served. In our own industry, fortunately, there are also many ways, in which we can enrich the core service offering of being able to trade an equity, a currency cross or a futures contract.

One rapidly growing area is the introduction of personalized portfolio management. This used to be an offering only available to very high net worth individuals, but thanks to technological advancements, the offering can now be delivered to a much larger client base, in the form of what is today commonly known as “robo-advisory”. Another area is the trend towards making information more actionable, be it a news article, twitter feed sentiment, or the emergence of a chart pattern. By integrating such information with the trading environment a trader is better equipped to take appropriate action in a timely fashion. A third area, of course is the move towards ubiquity, trade anything, anytime, anywhere (and on any device).

As offering trading services alone is now being commoditized, the winners of tomorrow will be those who, in addition to providing a basic trading service, can also provide personalized, targeted and innovative solutions. Those who cannot, will see increased competition and significant revenue erosion.

The Experience Economy requires Open Architectures

It is almost impossible for a single company to provide all of the systems and all of the capabilities necessary to satisfy a discerning customers expectations. Consider the infrastructure of a typical financial services company.

Over time, the company will have invested significantly (strategic, financial, technological and human resources) in just being able to provide a core brokerage service. This is natural, since without market connectivity and trading infrastructure, the company would have no service at all. This leaves less resources to focus on what matters in the ‘experience economy’, the user interfaces, the user experience and the personalized targeted offering.

When this becomes apparent a traditional financial services company may try to “bolt on” new offerings, but this approach will rarely be successful. Often the existing, aging, infrastructure is simply not flexible enough, and moreover very few companies will be able to resolve the dichotomy between “large, reliable, expensive infrastructure” and “nimble, agile, and innovative user experience development”.

The only lasting solution is an open architecture, which allows separation between infrastructure and user experience, and for this to be effective we need standards and OpenAPI’s.

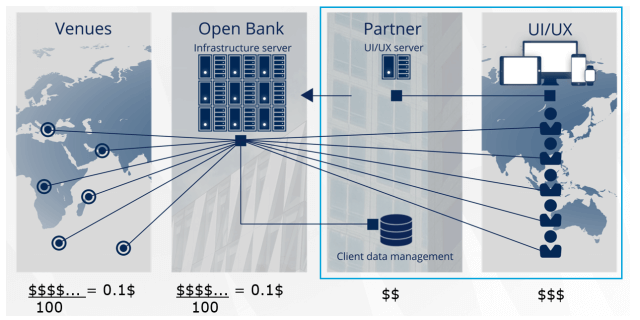

Compare the traditional system architecture (shown above) with a modern architecture, designed for collaboration:

When the infrastructure is API-enabled and the software is designed from multitenancy from the outset it is possible to share the infrastructure costs over a large number of partners. It is then possible to extend the service offering with additional connectivity, more products, and higher performance, while reducing the per user cost. Through partnering is also possible to wrap this service into many types of customized, regionalized, targeted customer experiences.

At Saxo Bank we have been offering such solutions to our white label clients and introducing brokers since the early 2000’s. We continue to believe that the best, most memorable and valued client experiences are enabled via Open API’s and created in collaboration.

With initiatives like PSD2 and the British Treasury’s Open Banking Standard initiative it seems that the industry is finally starting to embrace the same vision (although we may still be talking more “stick” than “carrot” here). Technically it could have happened much earlier, but like my experience from the hearing industry, the most important driver for change is necessity. With the continued downwards price pressure on standard financial services, the industry is now being forced to innovate and offer clients more.

This simply requires collaboration, which in turn requires open systems. For this reason open banking systems are finally becoming a must have, rather than a nice to have, for any serious institution, who wants to also remain relevant in the next decade.