Should we be concerned with low volatility in FX?

FinanceFeeds has always called for a multi-asset approach within the FX industry and, fortunately, that has been the trend among the leading brokers

Volatility has become one of the most discussed topics across the FX industry as we witness new and palpable dynamics with the expansion of stock offerings and the introduction of crypto trading.

Those changes were quite visible in 2020 as the pandemic drove many new investors to open accounts with brokers to gain exposure to the extreme volatility, especially in March and April, particularly in stocks, cryptos, and oil as foreign exchange instruments suddenly lost their appeal.

FXOpen’s head of sales Natalia Zakharova has recently shared the broker’s client onboarding experience during the year 2020 as the industry witnessed a structural change in market dynamics, with retail traders showing their power in times of pandemic and gamification.

And although retail trading volumes have skyrocketed last year on account of lockdowns and stimulus checks, new investors seem particularly eager to get exposure to cryptos and stocks.

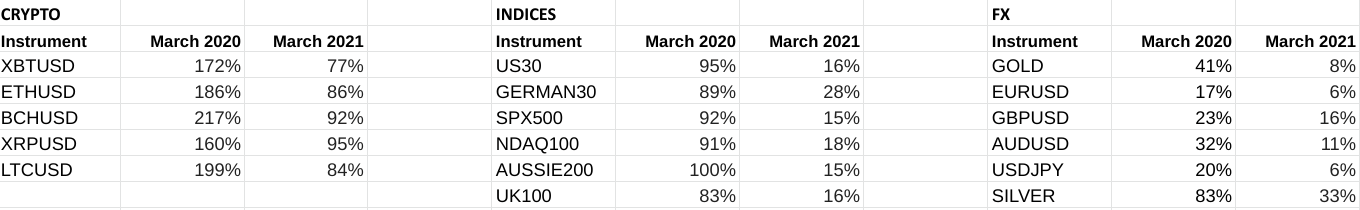

CMC Markets Connect has provided us with volatility figures for in each asset class in March 2020 and March 2021. The difference is brutal, but not surprising.

FinanceFeeds has always called for a multi-asset approach within the FX industry and, fortunately, that has been the trend among the leading brokers.

Offering a variety of asset classes is not only for the benefit of the client as we can ascertain from the figures shown above.

“The overall interest towards trading is definitely growing” – Natalia Zakharova, Head of Sales at FXOpen.

Traders tend to search for volatility so they can get exposure to fast and extended movements in the markets. So, should brokers be concerned about a less volatile FX market?

“I do not think that fx brokers should be too concerned about it. Most of them have been in this business for a while now and are used to drastic changes”, said Natalia Zakharova, Head of Sales at FXOpen.

“First Dodd-Frank act, then execution requirements were introduced. After that, leverage restrictions came along and now the volatility is down. Brokers learned to survive, adapt and operate on a thin margin. Most of them now offer CFDs on cryptos and stocks.

“While the interest towards FX is stagnating, the overall interest towards trading is definitely growing – so brokers have all the opportunities to make up for limited volatility in FX”, she explained.

“FX brokers understand the importance of being patient” – David Madden, Market Analyst at Equiti Capital.

From a market analyst perspective, “volatility comes and goes and just because the swings seen in the FX market have been low recently, that doesn’t mean we won’t see high volatility again”, said David Madden, Market Analyst at Equiti Capital.

“FX brokers should just bide their time and perhaps look to update their service or trading platform, while volatility is low because at some point there will be an increase in market moves. FX brokers understand the importance of being patient.”

Past performance is no guarantee of future results” is generally treated as a warning label. In this case, we can rest assured we have no idea what will be the future of the FX market and its volatility.

In the meantime, patience and a multi-asset offering can do wonders. Still, it seems the FX industry is consolidating behind the scenes.

“Industry is getting to an over-saturation point” – Natallia Hunik, Chief Revenue Officer at Advanced Markets

“Lack of volatility has certainly been an ongoing issue for FX brokerages, particularly in 2019. The first half of 2020 saw a bit of a shake-up due to the pandemic but that spike was short-lived and hasn’t materialized into a long-term trend”, said Natallia Hunik, Chief Revenue Officer at Advanced Markets.

“In an attempt to take advantage of volatility, wherever it may lie, FX brokers have been trying to catch the crypto and stock trading waves by adding these instruments into their portfolios, typically in the form of cash derivatives.

“But a bigger question remains about the future of FX businesses. The industry is getting to an over-saturation point and so it’s likely that we will see a pattern of consolidation (it has been already happening but because most of this is not public information, this M&A activity doesn’t get wider press coverage).

“Stricter regulations in the most established jurisdictions have pushed many brokers offshore where they can be more competitive and extend better (leverage) conditions to their clients. While it’s a practical short term move, it’s hard to sustain a business offshore in the long term as you are deprived of tapping into the traditional finance ecosystem and have limited options in terms of an exit strategy”, Ms. Hunik concluded.

As the leading jurisdictions tighten their requirements, new asset classes emerge, FX volatility drops, and the ecosystem consolidates, what will the FX industry do? Adapt, as always.