Silver price hits a nine-year high and inflation is only partly to blame: an OctaFX analysis

Silver reserves and production have not kept up with the increased demand for green energy. In just 20 years, reserves could be completely depleted, leading to skyrocketing silver prices.

- The global economy’s focus on transition to clean energy is creating an additional demand for silver, which is used in solar panels and EVs, that will only grow in the future.

- According to Silver Institute research, 2023 will be the year of the biggest-in-decades deficit in the physical silver market.

- The easing of monetary policy by world central banks and the inflation slowdown support the fundamental growth of silver prices.

Gold and silver often go hand in hand when discussing precious metals. Both metals have been objects of desire for thousands of years, and each has been found on every continent of the world.

Just like gold, silver is used in jewellery. However, its demand in industry, where it is used six times more often than gold, creates a strong interest among investors. Nevertheless, there is relatively little information available on silver, which makes potential investors more vulnerable to losses.

OctaFX experts expect that silver reserves will continue to decline in 2023, leading to a potential increase in its value. Silver prices could reach a nine-year high of $30, highlighting its strong potential for well-informed investors.

Decarbonization and electrification will lead to a major increase in demand

Much of the silver value is determined by its industrial demand and supply fundamentals. It is estimated that approximately 60% of silver is used for industrial purposes such as electronics manufacturing, solar cell production, automotive industry, and soldering, while only 40% is available for investment in the form of jewellery, silver coins, and bars. Industrial demand is growing due to the electrification of automobiles, 5G deployment, and governments’ commitment to using renewable energy sources, such as solar panels.

The demand for renewable energy is a key driver of growth. Silver is an essential component of solar power generation panels, with approximately 100 million ounces consumed annually. According to the IEA 2022 renewables report, electricity from wind and solar photovoltaics (PV) will more than double in the next five years, providing almost 20% of global power generation in 2027. This is expected to lead to a significant increase in the amount of silver consumed in the coming years. According to projections from BMO Capital Markets, the annual consumption of silver in the solar industry could grow by 85%—to 185 million ounces—within a decade.

Silver’s excellent electrical conductivity makes it an indispensable component in the automotive industry, especially in electric vehicles (EV), which contain twice as much silver as petrol cars. Furthermore, charging stations for EVs will require a substantial amount of silver as well.

By-product silver production is expected to be the key trend of the next decade

Most of the silver supply is generated as a by-product of base metals mining, with zinc, lead, and copper mining accounting for 59% of silver production. Specialised silver mines are costly, as they are very large projects, and their number is therefore declining. The supply of silver as a by-product of non-precious metals production is expected to rise in the coming years.

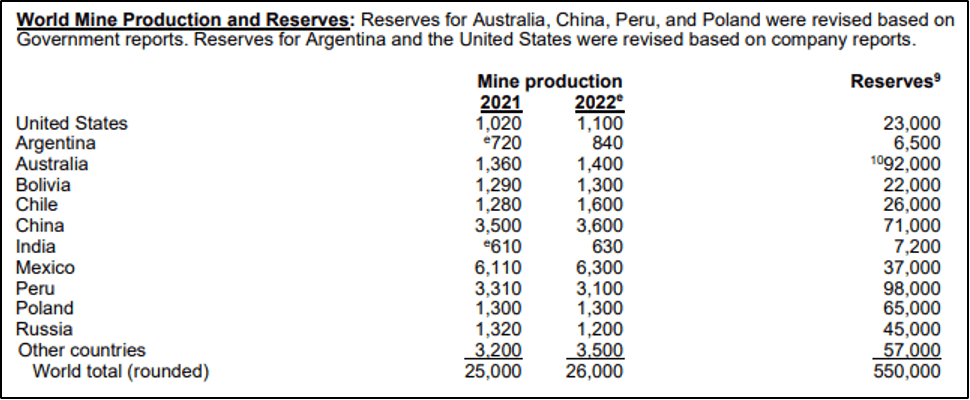

Mexico, China, and Peru are still the largest silver producers in the world, with Peru leading in silver reserves. However, Peru’s reserves are declining, while China’s are increasing. The growth in production has not kept up with the significantly increasing demand. Extrapolating the data on reserves and production suggests that the reserves may be completely depleted in 20 years or sooner, given the average life of a silver mine being 10 years.

Market momentum kept silver prices low in 2022 and drove them up in 2023

Looking at the silver price dynamics over the last 5 years, it becomes clear that a new bullish trend in this market began around mid-2020. Since then, the silver price has lost some of its growth, dropping to $22. The main constraint was the strong dollar, which in turn reacted to the tightening of the Fed’s monetary policy. The correlation is quite strong—together with the end of the inflationary shock and the change of the dovish tone, the silver price found support at $18 and has been consistently bullish since August 2022.

Inflation expectations are positively correlated with precious metals and are a leading indicator, especially when combined with the EURUSD effect. In the current environment of declining inflation and lower interest rates coupled with additional stimulus amid the banking crisis, investors believe in the beginning of a new business cycle. This will reduce the strength of the dollar and provide significant support to silver, possibly boosting its price to $30 in 2023.