Spotware releases new version of cTrader Web

Traders can now hide accounts from their main accounts list, zoom in and out using the Ctrl key and scrolling with their mouse wheel, while also being able to draw arrow lines.

Fintech expert Spotware Systems today unveiled a set of enhancements available in the latest version of cTrader Web.

cTrader Web 3.5 adds some highly requested features, aimed to optimise users’ experience while trading on the platform and enhance their analyses. In particular, traders can now hide accounts from their main accounts list, zoom in and out using the Ctrl key and scrolling with their mouse wheel, while also being able to draw arrow lines.

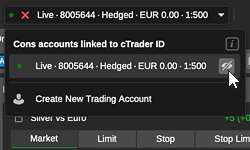

In the latest version of the platform, traders can hide any accounts they do not use from their main accounts list. The accounts will still remain active but will not be visible under the accounts list, with the option for users to see them should they wish at any point.

In the latest version of the platform, traders can hide any accounts they do not use from their main accounts list. The accounts will still remain active but will not be visible under the accounts list, with the option for users to see them should they wish at any point.

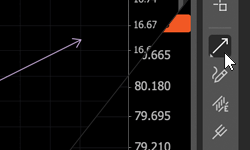

Also, the Lines tool section has been equipped with the Arrow Line, which users can now utilise and draw on their charts. This new Line type provides traders with an extra tool when forming their analyses. The Arrow Line can be found in the Lines tool, right below the Ray one.

Also, the Lines tool section has been equipped with the Arrow Line, which users can now utilise and draw on their charts. This new Line type provides traders with an extra tool when forming their analyses. The Arrow Line can be found in the Lines tool, right below the Ray one.

Finally, in order to optimise the functionality of the charts and opt for a more user-friendly approach, traders can now zoom in and out of charts using the Ctrl key and scrolling their mouse wheel up and down accordingly.

As FinanceFeeds has reported, the preceding version of the platform (cTrader Web 3.4) added Pencil Tool, which allows traders to draw shapes and objects of their choosing on charts in any chart mode by means of a pen cursor. Used to free-form draw on, or annotate a chart, the Pencil Tool is not bound to a specific shape like most other drawing tools, and allows one to make notes directly on the chart when setting up a trade, which proves useful for reviewal purposes.

The platform has also introduced new Line Study Tools which offer traders extra convenience and a personalized aspect to the toolset. Among the provided options, new additions include: Color Picker with opacity settings and Line Thickness Selector.