Standard Chartered HK releases mobile account opening service

The clients of the bank can open a banking account anytime, anywhere via SC Mobile.

Standard Chartered HK has earlier today announced that, in order to make banking easier and more convenient, the bank has enhanced its digital capabilities via the launch of a mobile account opening service. The service enables clients to open a banking account anytime, anywhere via SC Mobile. In about eight minutes, clients can complete the application without having to visit a Standard Chartered physical branch.

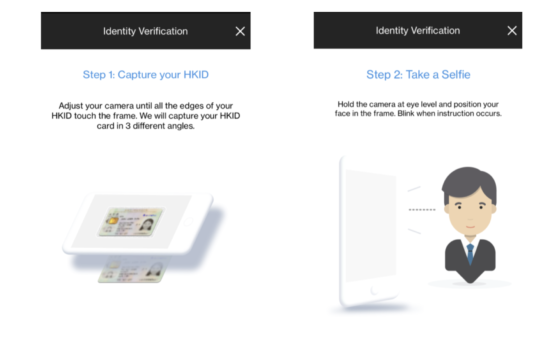

The mobile account opening service digitises the process of identity verification. It includes two steps. First, clients have to scan their Hong Kong Permanent Identity Card (HKID) from three different angles to validate the security features of the HKID card. Then, the client is requested to take a live selfie for facial recognition to confirm the client is indeed the HKID card holder. While taking the selfie, the client needs to follow the instructions to blink twice to validate that it is not a photo. The client has the option of having voice navigation throughout the entire process.

After identity verification is completed, the clients need to input their personal data and choice of banking plans, ATM card design etc. to complete the application. The clients’ HKID, selfie and the inputted data will be encrypted and will not be stored on their mobile phone to ensure no data leakage.

The service provides easy access to the Faster Payment System (FPS) and other banking services. Clients will receive an SMS and an email notification about their account opening status after up t two working days. Once their account is opened, clients can login to online banking or SC Mobile to conduct transactions such as SC Pay via Faster Payment Service (FPS), transfers, mobile payments and more. Clients will receive their ATM card by post within five to ten working days. Upon receipt, they can set their ATM password via online banking to activate their card.

Let’s note that Standard Chartered is among the applicants for Hong Kong virtual banking licenses. Virtual banks are set to operate in the form of locally-incorporated entities with no physical branches. A key objective of virtual banks in Hong Kong is to promote financial inclusion by leveraging on the banks’ IT platforms that would lower the incremental cost of taking in additional customers.