Standard Chartered HK set to reopen three branches closed amid coronavirus outbreak

Three of Standard Chartered Hong Kong’s branches which were closed due to the coronavirus outbreak are set to resume operations on March 9, 2020.

Standard Chartered Bank (Hong Kong) Limited aims to start reopening branches that were closed due to Covid-19. The bank has announced that three of its branches which have been temporarily closed due to developments in the coronavirus situation will resume operations on March 9, 2020 (Monday).

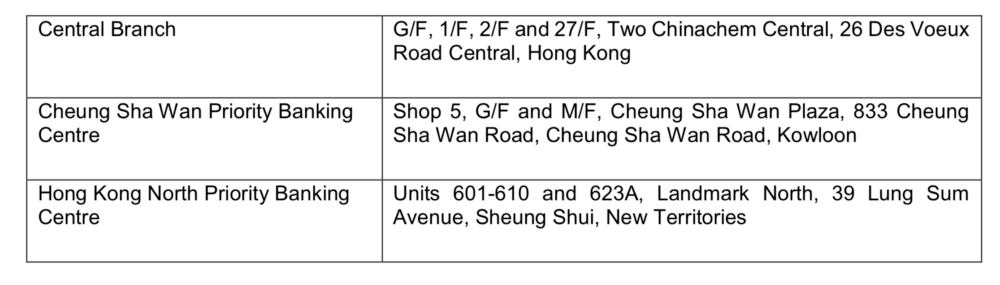

The branches that will reopen are:

Let’s note that 15 branches remain closed until further notice.

As FinanceFeeds has reported, in early February Standard Chartered Hong Kong said that, with consideration to ensuring the health and safety of clients and employees and maintaining the availability of its banking services, it would be suspending banking services at a number of its branches.

The bank has enhanced its cleaning and hygiene measures including deep cleaning and regular sanitisation of common areas and frequently touched facilities such as door handles and handrails. The bank has also reminded all employees to maintain personal hygiene and wear face masks.

As at noon on March 6, 2020, Hong Kong public hospitals reported to the Department of Health the admission of 38 patients (23 male and 15 female, aged 21 months to 88 years) in the past 24 hours who met the reporting criteria of COVID-19. Appropriate tests have been arranged for the patients.

There are 100 patients under isolation currently. So far, 51 patients with the COVID-19 infection have been discharged upon recovery, according to the official update issued on March 6th.